An investigative unit to handle fraud in Savings and Credit Co-operative Societies (Saccos) has finally been formed following President Uhuru's order.

Uhuru ordered the formation of the unit in July 2019.

The Sacco Societies Fraud Investigation Unit (SSFIU) akin to Banking Investigative Fraud Unit (BIFU) formalized today following a memorandum of understanding between the Sacco Societies Regulatory Authority (Sasra) and the Directorate of Criminal Investigations (DCI).

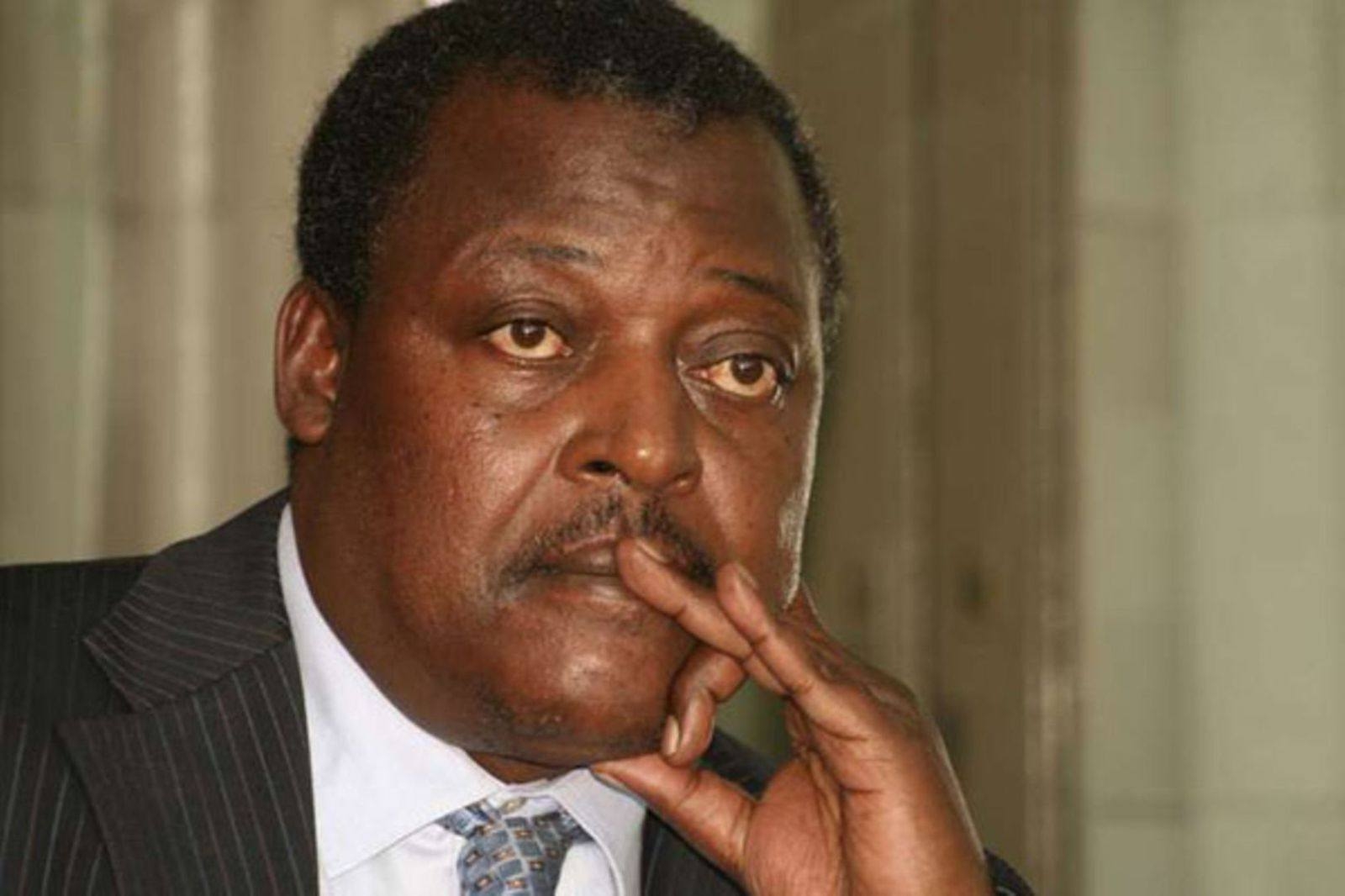

Speaking during the MOU signing ceremony, Sasra chairman John Munuve said the formation has come at an opportune time to complete the cog of the supervisory framework of Saccos in Kenya, which was initially largely reliant on prudential supervision.

''The unit is and will remain critical in complementing the prudential supervision conventionally undertaken by Sasra’s technical staff, by taking up identified cases of fraudulent conduct during prudential supervision and investigating the same,'' Munuve said.

In instances, where criminal culpability is proven, and with concurrence to the relevant prosecution agencies, Munuve said that the Unit shall take lead in ensuring that the culprits are prosecuted and brought to justice.

“A time has come when the safety of members’ savings and deposits in Saccos must be guaranteed and always assured. This is the only way to motivate citizens to consider using Saccos as an alternative investment destination,'' Munuve said.

He noted that the proactive actions will be crucial in stopping the loss of members’ funds, instead of waiting to pursue the culprits after the losses.

In March last year, DCI seconded three highly trained and skilled financial fraud officers to SASRA to lay the groundwork for the formation of the Unit.

The SSFIU has already started working with highly trained officers from both the DCI and SASRA and has already started receiving and investigating information from individuals and organisations to prosecute Sacco Society officials, staff and other players implicated in financial and cyber-related fraud.

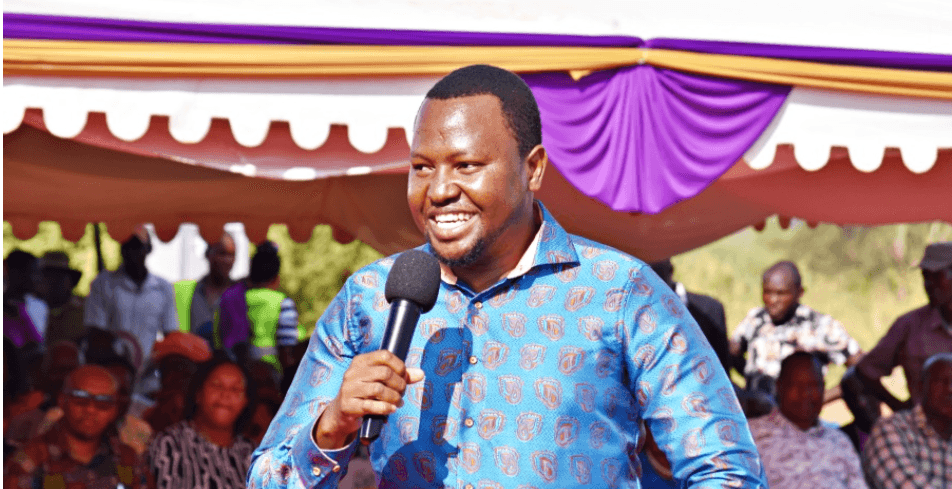

According to DCI representative, John Gachomo, it is important to stress that in today’s economy, financial transactions are heavily conducted using technology and other digital services.

''I do want to call out stakeholders within the Sacco subsector to fully embrace the newly created Unit as a lever to the transformation of the Sacco movement in Kenya,'' Gachomo said.

Saccos have established themselves as formidable players in the financial sector, deepening wealth creation, investment, and savings besides offering financial services to unbanked Kenyans.

This has made it necessary to improve oversight and ensure that the savings of members are protected.

The unit will be domiciled at Sasra and is expected to detect and prevent fraud as part of improved corporate governance in the Sacco sector in line with SASRA’s Strategic Plan for 2018-2022.