The high cost of fertilise in Kenya is likely to affect coffee production, producers have warned.

This they say might further reduce Kenya’s share in the international market.

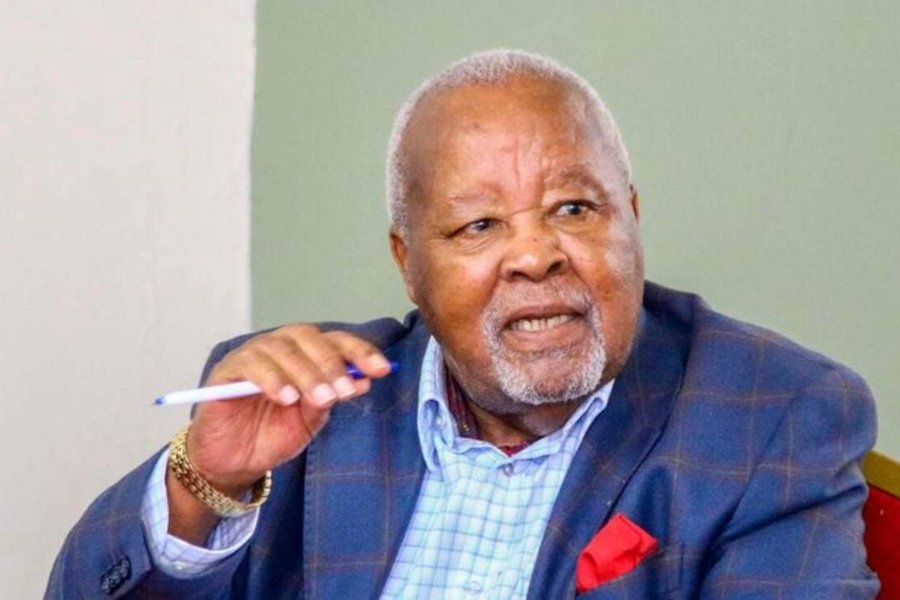

Peter Gikonyo Kenya Coffee Producers Association (KCPA) chairman said, the price of inputs and delayed rains that has led to delayed flowering will in the long run affect the high quality of the beans synonymous with Kenyan coffee.

He said farmers are unable even to to pay the amount required in the fertiliser subsidy programme due to tough economic times.

Gikonyo spoke on Monday during an advocacy meeting by coffee producers in East and Central Africa under a five year reclaim sustainability project.

In January, the Ministry of Agriculture launched a Sh1 billion fertiliser subsidy programme where farmers will pay 60 per cent of the total cost and the Government waives the balance.

A 50 kg bag of fertiliser is retailing at Sh6,000.

Boniface Mulandi, Reclaim Sustainability project manager said the five-year program is targets key commodities such as tea, coffee, food products, gold and cotton textile.

“The programme seeks to contribute to an inclusive and sustainable value chains and trade in an innovative way, in which the interests, voices and rights of farmers, workers and citizens are represented and heard in decision making," he said

This he said will lead to for sustainable use of natural resources, decent work, fair value distribution, and sustainable consumption.

Karugu Macharia from the Kenya Coffee Platform (KCP) said farmers have enjoyed good prices in the recent years, but production is still low.

He said despite the projection coffee production would reach over 300,000 metric tonnes by the year 2000, this has not be attained.

The country has registered a 70 per cent production decline from 130,000 metric tonnes in 1987/88 to around 40,000 metric tonnes in 2020/21 coffee year.

“We have witnessed a continuous decline of the production since 1988 to date. But, farmers have enjoyed impressive prices over the years" he said.

He said, there has been stiff competition from Uganda and Ethiopia which are registering 300,000 metric tonnes and 500,000 metric tonnes respectively annually.

Macharia said Tanzania is also likely to overtake Kenya in terms of production in coming years

![[PHOTOS] Three dead, 15 injured in Mombasa Rd crash](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2Fa5ff4cf9-c4a2-4fd2-b64c-6cabbbf63010.jpeg&w=3840&q=100)