Economies in sub-Saharan Africa grew at a record pace before covid-19 pandemic, however, the growth has not been equally distributed, leaving income gaps unfilled.

The IMF in its economic outlook report says it is less clear if the gains in economic growth have been shared equally across regions.

At least until 2010, African countries had made progress in reducing regional income inequality, the differences in output per capita across regions of a country.

This was in marked contrast with other parts of the world, where inequality either increased or convergence was slower, the international lender says.

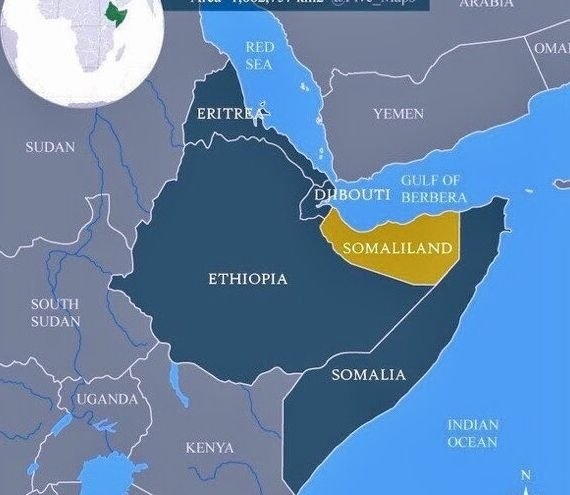

Ethiopia and Rwanda, for example, saw some of the fastest expansions in the world with an average of more than 7.5 per cent per year over the past two decades.

According to USAID, In Kenya, until the onset of the covid-19 pandemic, the country was one of the fastest growing economies in Africa with an annual average growth of 5.9 per cent between 2010 and 2018.

With a GDP of $95 billion(Sh11.4 trillion) USAID notes that the country reached lower-middle income status, and has successfully established a diverse and dynamic economy.

However, it continues to face significant challenges to sustainable and inclusive economic growth, which have been exacerbated by COVID-19’s economic disruptions, alongside long-running challenges including corruption and economic inequality.

This has so far occasioned a situation where two-thirds of Kenyans live in poverty, making less than Sh400 per day and have since Kenya’s independence.

As a result, the majority of Kenyans, particularly women and girls, can be considered vulnerable.

This attributes to the gap between the rich and poor, with approximately 70 per cent of Kenyan families vulnerable due to poor nutrition, food insecurity, and preventable diseases.

“Many Kenyans suffer from economic inequality while a minority elite continues to exploit their labor, resources, and opportunities,” USAID says.

In the past few decades, regional inequality had been reduced on the back of a stable macroeconomic environment, trade openness, strong institutions and well-targeted investments.

“Inequality tends to increase in countries with high, persistent inflation by eroding the purchasing power of consumers, reducing government spending in real terms and discouraging private investment,” IMF says.

On the other hand, easier access to global markets is also said to support convergence by increasing the value of a country’s resources like raw materials, which are more available in lagging regions.

It also brings more workers into urban centers, which could in turn lead to a decline in income per capita in more urbanised regions.

Strong institutions and political stability are also crucial for bridging the inequality gap across nations as weak institutions would impede the capacity of governments to provide services.

In cases where civil wars emerge, public infrastructure could be destroyed raising the likelihood of regions being left behind.

Well-targeted investments, which occur outside the capital cities are most likely to have an impact by creating jobs and promoting economic activity in lagging regions. This could converge the inequality gap.

The lender largely accredits improvements in basic infrastructure to have helped the developing countries converge faster to national levels in taming the inequality gap.

“However, not all developing regions saw improvement. Fragile and conflict-affected states made little-to-no progress in reducing regional inequality,” the lender says.

“And even in countries that experienced decades of growth, progress stalled after 2010, with regional inequalities having likely widened during post-pandemic.”

Access to clean water, electricity, and cellphone services is two to four times lower in these developing regions compared to leading ones because public expenditure per capita is much lower.

Similarly, the share of residents that have completed primary and secondary education is two to three times lower in the developing regions.

Furthermore, the lender notes that in countries where access to public services is generally low, and distribution very unequal, the gap is even larger.

In Burkina Faso, for instance, access to electricity is nearly 20 times higher than in leading regions.

To readdress the filling of inequality gap across the regions in order to counter the income gaps, the lender calls on policymakers to step up with reactive policies.

These include a redistributive fiscal policy with a clear investment strategy to assist the lagging developing nations.

It further urges policymakers and nations to enforce macroeconomic stability by taming inflation and reducing the cost of living to foster inclusive growth.

Build institutions that will ensure political instability and equitable public service delivery. The lender concludes with its urge to policymakers.

Governments also need to invest in building local administrative capacity to collect and analyze data.

This is to gauge development as only 12 sub-Saharan African countries are on record to be publishing their public budget allocations at the sub-national level.

Having this kind of data more readily available would provide a more accurate picture of disparities across regions, helping policymakers to better target policies.