Kenya has been forced to go back to the debt market to borrow funds to buy back part of the inaugural Eurobond issued in 2014.

Subsequently the country will pay accrued interest and postpone repayment of part of the $2 billion loan that was largely used to finance infrastructure, including the Standard Gauge Railway (SGR) during the Kenyatta regime.

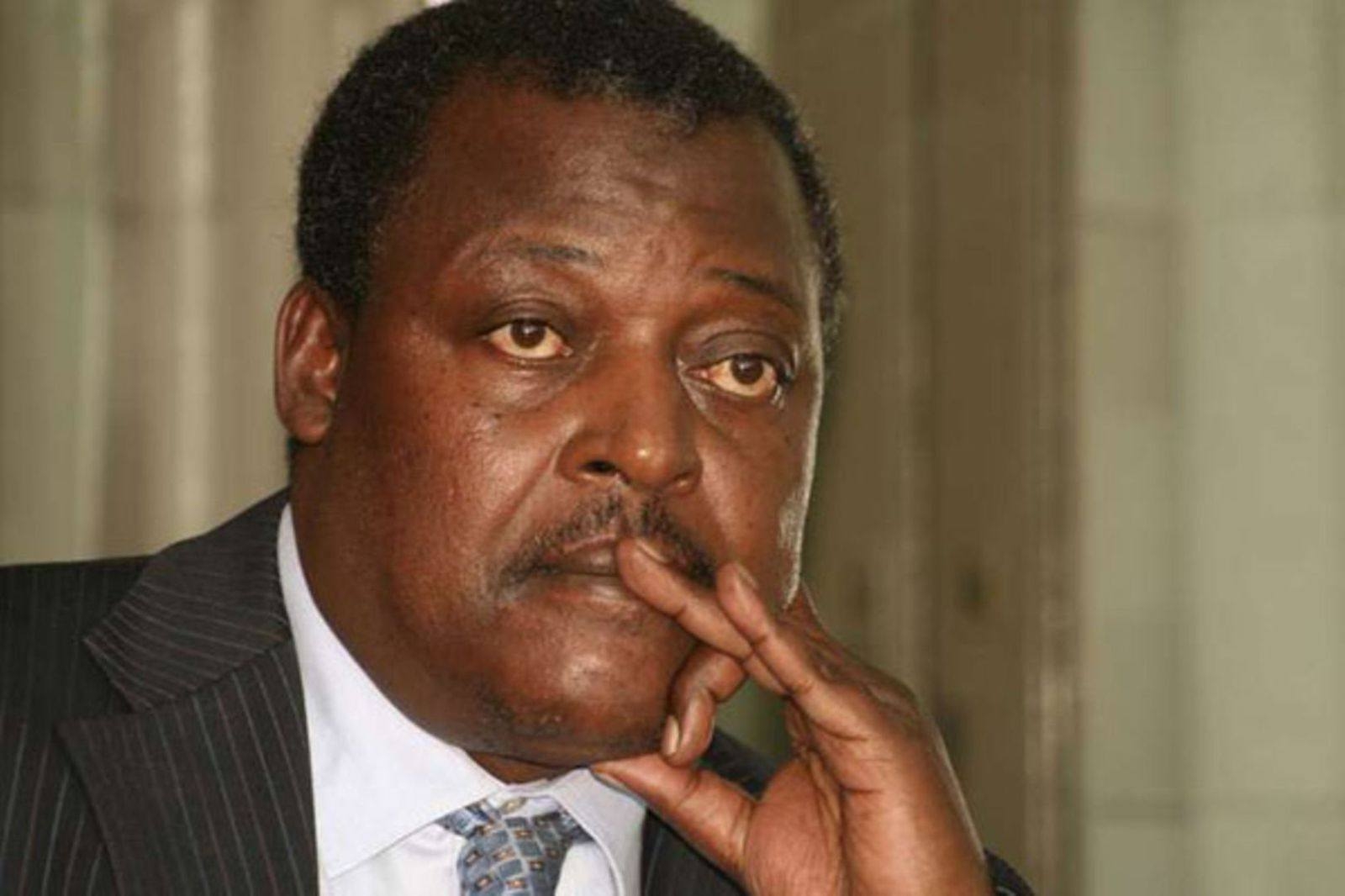

The Centre Bank of Kenya (CBK) governor Kamau Thugge told Reuters at the ongoing IMF/World Bank summit in Morocco that the country plans to buy back up to a quarter of its $2 billion in 2024.

He said that this is aimed at alleviating concerns it can repay the looming debt.

"The country is in talks to raise between $500 million and $1 billion in commercial loans from two regional policy banks, the Trade & Development Bank and the African Export-Import Bank," Thugge said.

"We would use part of that for the buyback, for the liability management, and the rest would be for the budget support," said Thugge, who earlier this month said Kenya was expecting to "progressively reduce the liability of the Eurobond".

He said the process of sourcing the funds starts immediately.

Analysts are however surprised by the government's apparent lack of clear position on repayment of the loan after the National Treasury recently dismissed the buyback plan.

Last month, Treasury boss Njuguna Ndung'u said Kenya is not keen on buying back part of the $2 billion Eurobond that matures in June 2024 citing investors’ ‘strong’ confidence in the government’s fiscal policy stance.

“Buyback is one of the strategies for 2024 but doubts whether investors are willing to sell before the maturity of the bonds,” Treasury Director of Debt Management Haron Sirma told media at a monthly press conference.

"Which is which? This double-speak sends the wrong signal to investors. It is no wonder that yields on Eurobond have almost tripled. I see it hitting 20 per cent by December,'' Economist James Wamukoya told the Star.

Julie Mutiso of Shiled Capital who likens the several repayment strategies by Kenya to a cornered mongoose echoes his sentiments.

''Kenya is behaving like a cornered Mongoose. He wants to cross through fire. He is weighing between going naked or dressed. End result is a burn,'' she said.

Kenya's approach to repaying the $2 billion 2024 bond is being watched closely by overseas investors, given its rising debt repayments, weakening currency and soaring bond yields, which have locked many developing countries out of international capital markets.

Kenya has tried several strategies to generate enough resources to pay off the loan amid heavy criticism and doubts from experts who fear a default. Kenya’s Eurobonds plunged after Moody’s Investors Service said it might treat a planned buyback of some of the debt as a default.

According to Moody's vice president and senior credit officer, David Rogovic, redeeming the bonds at a price below par value would have constituted an economic loss to investors said two months ago.

This was after President William Ruto announced at the New Global Financing Pact in Paris that the government planned to buy back at least 50 per cent of its $2 billion Eurobond before the end of this year.

The yields on the bond have been soaring, currently hovering between 18.4 and 18.7 per cent.

The 10-year bond is priced at 6.78 per cent while the five-year. This reflects the rising risk investors are placing on Kenya’s short-term debt.

In total, Kenya took up $2.75 billion in two tranches – a 10-year paper at a 6.78 per cent interest rate and a five-year issuance at 5.87 per cent.

The news of new borrowing to ease repayment obligations is coming at a time IMF is worried that most African states whose syndicated loans are due in the near future will struggle to repay.

The fund, in its latest economic outlook for the region, fears that yield on Eurobonds have more than doubled to hit past 12 per cent.

"At current yields, no Eurobond has been issued since April 2022 and some countries may struggle to roll over near-term liabilities- indeed, aggregate upcoming Eurobond repayments of about $6 billion in both 2024 and 2025 are of particular concern,'' IMF says.