Opinions by the Auditor General on financial statements have remained static over the years, with the number of qualified (unclean) opinions on the rise.

This according to the Institute of Certified Public Accountants of Kenya, which further says there are a number of counties, ministries, departments and agencies that have received modified opinion (qualified, adverse, disclaimer) over the past ten years.

A review of the Auditor’s report for Ministries Departments and Agencies for the financial year 2022/23 indicates 109 entities out of 340 had qualified opinion, two were disclaimer while one was adverse.

Qualified opinion on county governments’ financial statements on the other hand stood at 41 during the same year, having been on a rising trend since 2018 when it stood at 30.

A qualified opinion is an auditor's declaration that there is an area of uncertainty in a company's financial statements.

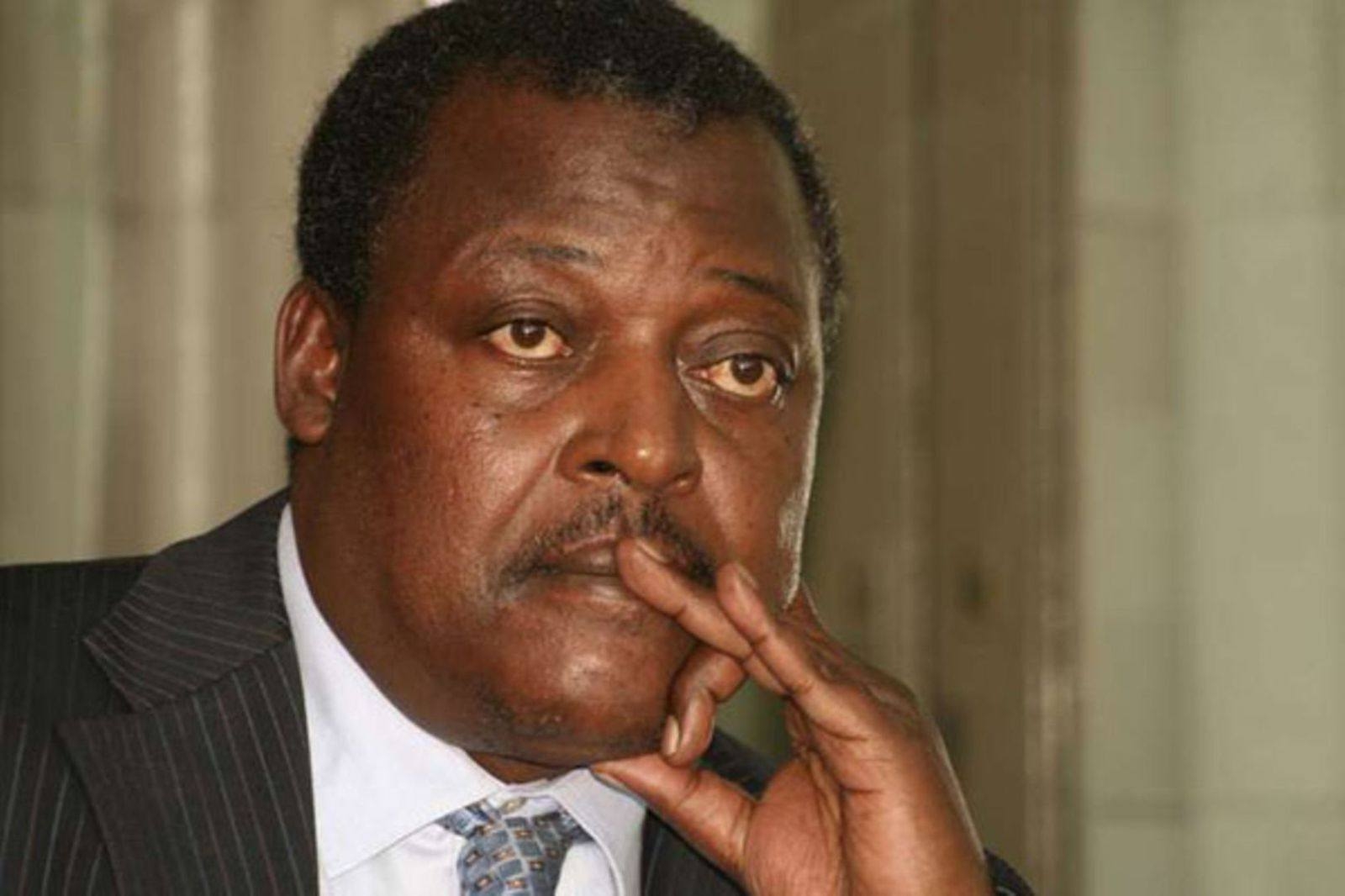

“For the few cases where unmodified (clean) reports have been issued, the same has not been sustained in the subsequent year,” ICPAK chairman Philip Kakai said during a press briefing on Tuesday.

“This therefore calls for an analysis of the root cause not only of the preparers of the financial statements, but also other stakeholders in the financial management chain.”

The regulator noted it has officially launched a probe into specific cases purporting to have a potential breach on the code of financial reporting, and will in the next one month be tabling the full report of all the investigations with consequent disciplinary actions on rogue members.

“This is to ensure the highest professional standards are adhered to by vigilantly weeding out unqualified individuals and holding our members accountable through disciplinary actions,” Kakai said.

He added that the commitment extends to firm support to the National Treasury, Auditor General, Controller of budget, Senate and Parliament among other Accountability Institutions.

“Together, we strive for a future of zero-fault audits, fighting corruption, and strengthening financial reporting across the nation to create a financial governance system that fosters economic growth for the benefit of all Kenyans.”

The regulator recommended some considerations in the auditing cycle that would go a long way to cut down the cases of malicious reporting which is also negating the country's investor confidence.

They include: Establishment of financial reporting units, incorporation of technical expertise for senate public accounts committee and strengthening oversight through internal audit and audit committee reports.

ICPAK further calls for the establishment of a national whistle blower policy and enactment of whistle blower Act even as it firmly supports whistle-blowers who utilize the established framework to report such misconduct, promoting ethical conduct within the profession.