Kenya has done its part and is hopeful of receiving the much delayed $611 million (Sh79 billion) from the International Monetary Fund (IMF) on October 30.

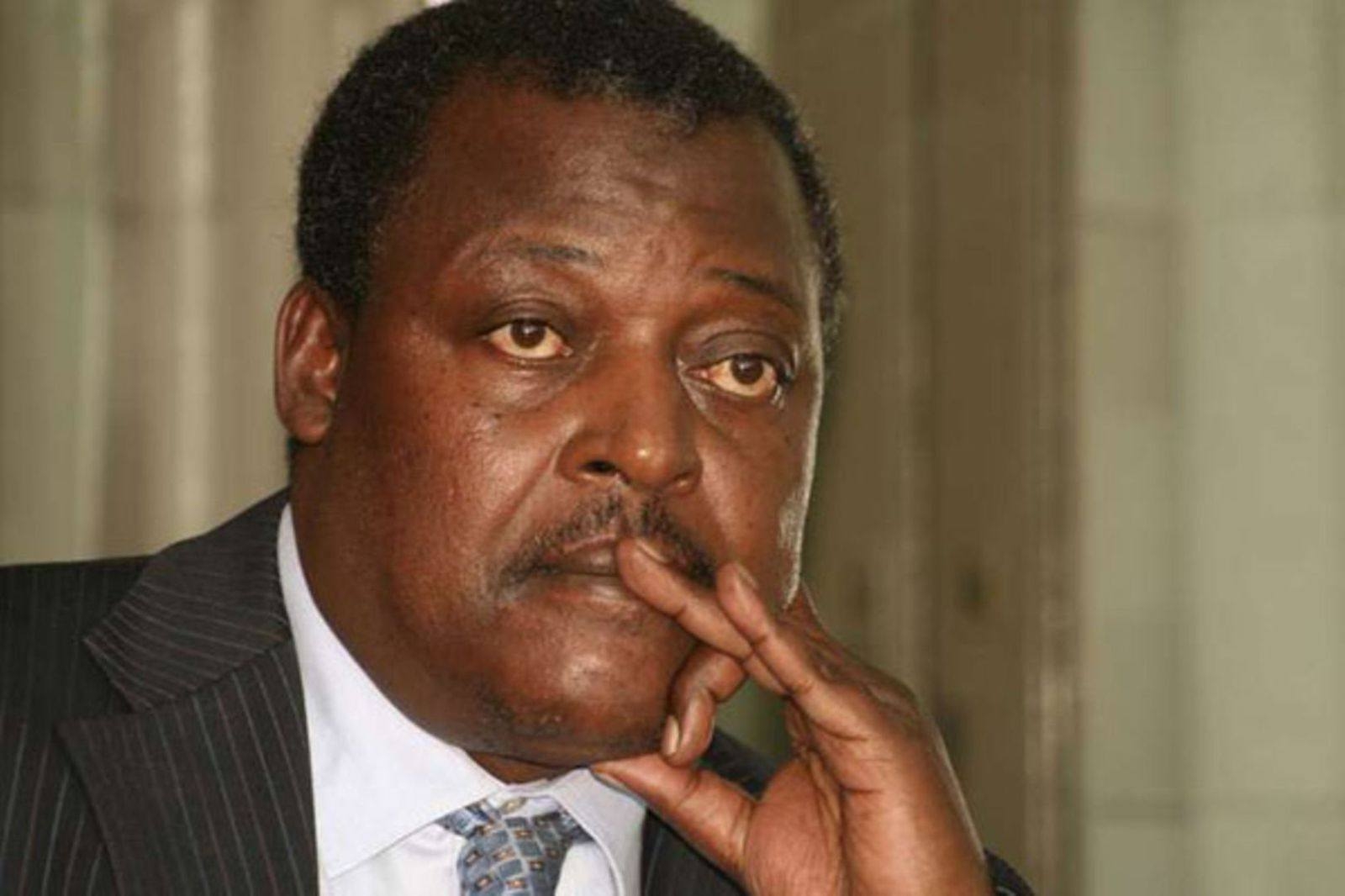

The Central Bank of Kenya governor Kamau Thugge who is in Washington DC for the annual convention by Bretton Woods Institutions (IMF and World Bank) told journalists the country has fulfilled all targets mandated by the lender in a review of its loan programme.

“We’ve achieved all that was needed for the reviews to be completed. Obviously after the review there are still the targets for December,’’ Thugge told Reuters.

Although the IMF and the Kenyan authorities reached a staff-level agreement for the seventh review of the Extended Fund Facility (EFF) and Extended Credit Facility (ECF) arrangements in June, the lender withheld approval of the fund following countrywide protests against President William Ruto’s regime that culminated in withdrawal of the Finance Bill, 2024.

Kenya reached a staff level agreement with the IMF in June on the seventh review of its programme, but the protest and ensuing withdrawal of the finance bill put a sign-off by the fund’s executive board, and subsequent payout, on hold.

The cash-strapped government was banking on the IMF’s facility to partly fill the Sh344 billion hole for the current financial year due to the withdrawal of the Finance Bill but the lender has been hesitant.

Last month, the IMF team led by Haimanot Teferra held discussions with Kenyan authorities on recent developments and their policies to manage the emerging challenges.

At the end of the engagement on September 17, the team said “We remain fully committed to support the authorities on their efforts to identify a set of policies that could support the completion of the reviews under the ongoing program as soon as feasible.

”The IMF team said that it is contended with Kenya’s commitment to advancing economic and governance reforms, which are crucial for fostering sustainable and inclusive growth.We will continue our discussions with the authorities,’’ Teferra said in a statement.

Kenya agreed to a four-year loan with the IMF in 2021 and has also signed up for climate change lending, taking its total loan access with the Fund to $3.6 billion (Sh465 billion).

The 36- months programme which was expected to lapse in June last year was extended for another 10 months and is now expected to end in April next year.

The double tragedy of delayed funding by the IMF and the absence of the domestic tax funding mechanism has seen the country embark on a raft of cost-cutting measures that have seen the 2024/5 budget slashed by over Sh200 billion to Sh3.85 trillion.

While the government is patiently waiting for the IMF facility, the public is against, accusing the lender of bombarding the country with tough loan conditions that have resulted in a high tax regime.

Despite the apparent resentment, Thugge insists that the country was going to request another financing programme with the IMF after the current one runs out in April.

Thugge said that would be the base case, though the size and duration were yet to be confirmed. “It will depend on the balance of payments and needs, it will depend on the ambitiousness of the reforms that we agree,” he said.

“But definitely, we will have our relationship going forward with the IMF.”

He praised the country’s macroeconomic outlook, saying that inflation continues to decline and the country has built up more foreign exchange reserves.

Inflation is set to decline below the 3.6 annual rate recorded in September, adding that the country’s FX reserves currently stood at $8.6 billion (Sh1.09 trillion), representing 4.3 months’ worth of imports.

The central bank had said earlier in October that reserves stood at $8.25 billion (Sh1.06 trillion).

Thugge painted a colourful microeconomics picture of the nation in the coming days, stating that the country’s local currency has stabilised against major international currencies.

Early this month, the apex bank‘s

policymakers slashed the benchmark-lending rate by 75 basis points

to 12.00%, following a 25-basis-point

reduction in August – the first rate cut

in approximately four years.