.jpeg&w=3840&q=100)

Kenyan taxpayers are still losing money from irregular and unsupported payments due to a lack of goodwill by devolved units to adopt best finance practices.

Weak internal controls and “insufficiently qualified staff” have seen taxpayers lose resources to these avenues, as the counties are reluctant to adopt better accounting standards.

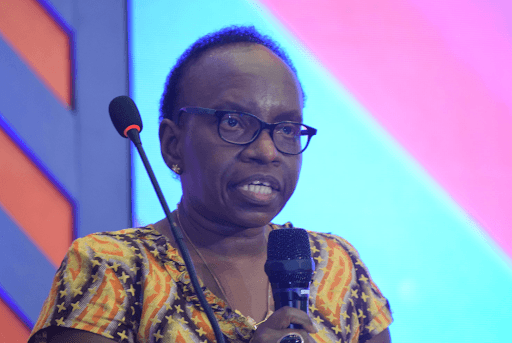

According to Deputy Auditor General Isaac Kamau, counties are still grappling with mismanagement of funds with some employing unqualified personnel in the accounting departments.

The auditor’s office pointed out that cross-cutting issues across nearly all counties is weak internal controls, and inconsistent internal accounting that is leading to financial mismanagement and an increasing number of unsupported transactions.

“We have observed some very systemic weaknesses within the financial management and staff of county assembly and county executives,” said Kamau.

The auditor pointed out that certain issues have been precarious from one report to the next, mainly irregular and unsupported payments.

The need to enhance the full adoption of accrual accounting and the troubling issue of pending bills remains a major concern.

“Auditor General has always asked herself, loudly, how we have unsupported transactions, yet from planning, we knew a transaction was going to happen, there is someone who processed the transaction, and thereafter we find that the sale is unsupported,” Kamau said.

Human resource management also emerged as a critical area of concern, with the Institute of Certified Public Accountants of Kenya (ICPAK) identifying high wage bills and a lack of structured payroll systems as problematic.

Many counties lack approved staffing structures and fail to set expenditure limits on salaries, which strains county budgets and results in inefficiencies.

INEFFICIENCIES

Frequent staff changes in key financial positions further disrupt financial stability and continuity, leading to governance challenges.

For instance in Nairobi county, over Sh1billion of taxpayers’ money was used to procure services that their documentation cannot be traced.

The Auditor has revealed that the review of the financial statements for the 2022-2023, identified unsupported payments from salary account amounting to Sh226 million and unsupported payment of goods and services amounting to Sh60.9 million.

Further, there was unsupported utilities, supplies and services amounting to Sh163.7 million and unsupported payments to Nairobi Metropolitan Services contracts amounting to Sh620.6 million, which were not accompanied by the necessary documentation required to substantiate the reported amounts.

The review of the financial statements for the financial year 2021- 2022, identified unsupported expenditure on use of goods and services amounting to Sh7.6 billion and unsupported procurement of goods amounting to Sh757.3 million.

There was also unsupported scholarship and bursaries amounting to Sh641.3 million which were not accompanied by the necessary documentation required to substantiate the reported amounts.

Elgeyo Marakwet on the other hand, in the financial year 2022- 2023, the statements indicated unsupported payments including payment of staff arrears and use of goods and services amounting to Sh88.1 million which were not accompanied by the necessary documentation required to substantiate the reported amounts.

Mombasa County in the same period revealed unsupported figures, including bank balances, deposits, retention balances, and unexplained voided transactions totaling Sh5.4 billion, lacking the requisite documentation to substantiate these amounts.

In 2023 Kisumu, had unsupported legal expenses of Sh44.6 million which were not accompanied by the necessary documentation.

“The review of the financial state ments for the year 2022, identified unsupported receipts which were not accompanied by ledgers from IFMIS amounting to Sh10,176,279,174, unsupported wages amounting to Sh4,464,057,566 and unsupported expenditures amounting to 1,131,806,559 were not accompanied by the necessary documents,” reads the new findings by the Auditor General’s office.

In Nakuru the auditor pointed out that unsupported figures including compensation of employees, imprests and advances totaling to Sh383.3 million were not accompanied by the necessary documentation required to substantiate the reported amounts.

In 2020-2021, the financial statements indicated unsupported figures including the pending accounts payable, capital grants, expenditures and legal fees amounting to Sh957.9 million that were not accompanied by relevant supporting documentation.

Turkana county obtained a qualified audit opinion in the three-year period under review. This means although by and large the financial transactions are recorded and are deemed to be in agreement with the accounting records, there may be cases where the Auditor-General is unsatisfied with the veracity of certain expenditures, which may not be significant.

“Despite the same senior officers having been responsible for financial reports and audit over the three years under review, there was no noticeable effort to close on audit exceptions and improve audit rating,” reads the OAG report.

The increasing number of unsupported payments have seen ICPAK raise concerns over the quality of financial management across county governments, citing significant issues in budgetary control, procurement, and human resources.

Speaking during the release of the report, ICPAK’s director of public policy and research, Hillary Onami, outlined challenges affecting financial reporting and accountability in counties, underscoring the need for robust reforms.

UNCERTIFIED ACCOUNTANTS

One key issue, according to Onami, is the lack of ICPAK-certified accountants in senior county finance roles, which directly impacts the quality of financial statements and accountability.

“Counties without certified professionals are prone to low-quality financial statements and oversight challenges,” Onami said, adding that without skilled financial officers, counties struggle to meet budgetary and regulatory standards.

These gaps, Onami noted, contribute to delays and inconsistencies in county financial reporting, often breaching the legal requirement to submit financial statements within three months of the fiscal year-end.

“For example, many county reports were found to be submitted as late as February or March of the following year, well beyond the deadline stipulated by the Public Finance Management Act (PFMA),” he said.

ICPAK chief executive Grace Kamau said the move towards accrual accounting, where financial transactions are recorded when they occur, rather than when cash changes hands, has been a crucial recommendation for strengthening the public financial management at both national and county levels.

However, the total adoption of accrual accounting is challenging for many counties where a huge number rely on cash-based accounting, which does not really fully capture liabilities, assets, or revenues that are yet to be realised.

The rampant loss of taxpayer’s

money comes amid low delivery of

key services to the public including

healthcare, infrastructure projects,

sanitation and overall development

at counties, denying the public the

much needed services at a time

when they feel overtaxed.

.jpg&w=3840&q=100)