KENYA is considering the issuance of bonds in Hong Kong as part of financing model diversification for its mega infrastructure project.

The move comes at a time the country faces challenges in extra borrowing due to high debt levels.

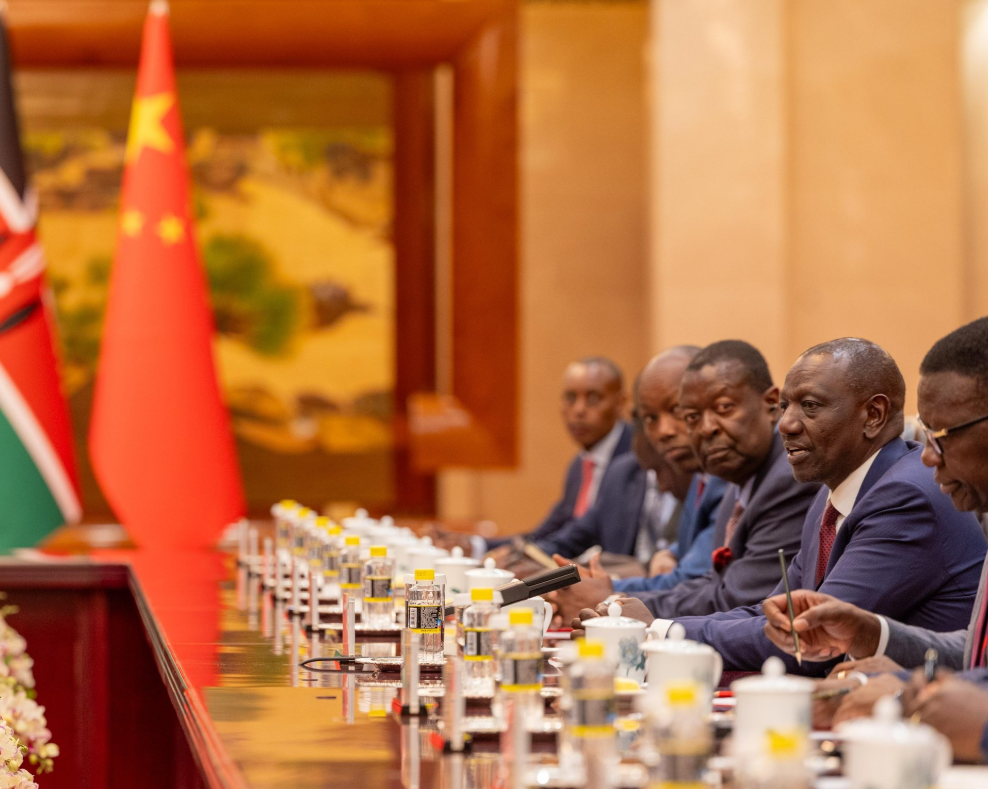

Foreign Affairs Principal Secretary Korir Singóe told the Star: “We are looking for innovative ways to finance our projects and floating bonds in Hong Kong is an idea that could be considered.”

Hong Kong is a prominent financial hub with a well-established banking system and favourable tax regulations, making it an appealing choice for fund raising.

Over the last 15 years, Kenya's government debt has risen sharply. In 2010, the debt was a manageable 39 per cent of the country's GDP, but by March 2023, it shot to 68 per cent.

This rise is primarily attributed to extensive borrowing from 2013 to 2022 under President Uhuru Kenyatta’s administration to fund significant infrastructure projects. Unfortunately, many of these projects did not yield sufficient economic growth to offset their costs.

Total debt had hit Sh11.2 trillion as of January this year.

To tackle the escalating debt, Treasury CS John Mbadi announced plans to reduce the debt-to-GDP ratio to below 55 per cent within the next two years.

The target is to bring it down to 52.8 per cent by the 2027-28 financial year, which would align with sustainable levels recommended by the International Monetary Fund (IMF) and the World Bank.

Additionally, Kenya has joined the Asian Infrastructure Investment Bank (AIIB), a multilateral development institution founded in 2016.

This membership provides Kenya access to concessional funding for various initiatives, including infrastructure development and climate change projects.

The AIIB emphasises sustainable projects that foster economic growth and enhance regional connectivity.

By exploring bond issuance in Hong Kong and utilising its membership in the AIIB, Kenya aims to secure the financial resources necessary for its ambitious development goals while effectively managing its debt.