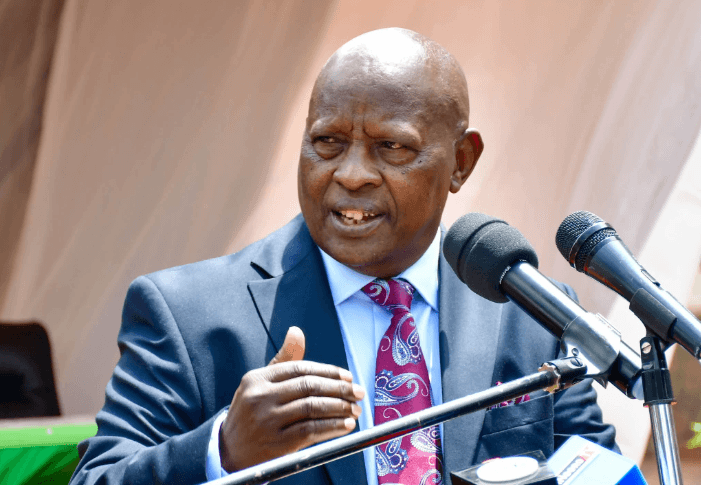

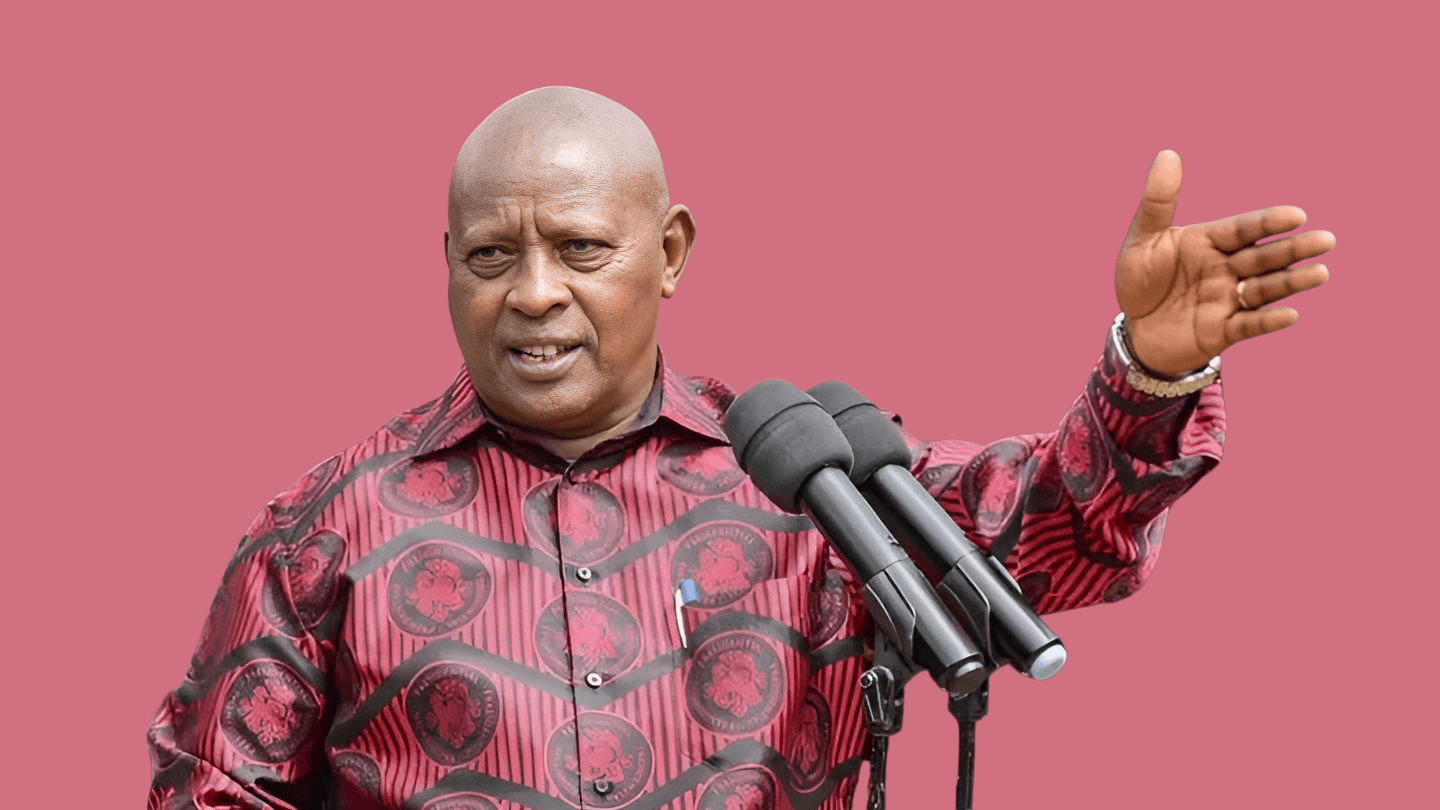

East African Community and Regional Development CS Adan Mohamed wants a law on company takeover changed to protect minority shareholders.

He said the Statute Law (Miscellaneous Amendments) Act No 12 of 2019, which allows shareholders with a 50 per cent stake to compulsorily acquire the shares of other investors, is predatory and unfair.

Adan wants the previous law that required shareholders seeking buyout to accumulate at least 90 per cent shareholding maintained.

His views mirror those of other stakeholders, including the private sector, who have expressed reservation with the law gazetted last October.

Most jurisdictions globally have set the threshold at 90 per cent - and with good reason. Reduction of this threshold erodes investor confidence in the capital markets.

The Kenya Association of Stockbrokers and Investment Banks (KASIB) was the first to oppose the amendment to the Companies Act, saying a 50 per cent threshold is too low to accord the majority shareholders the right to acquire the shares of minority shareholders.

"Most jurisdictions globally have set the threshold at 90 per cent - and with good reason. Reduction of this threshold erodes investor confidence in the capital markets," KASIB said.

Chairperson Willy Njoroge said the law makes it increasingly easy for majority shareholders in listed companies to acquire the shares of the minority shareholders for purposes of delisting.

The Nairobi Securities Exchange (NSE) termed the law a blow to its effort to enhance sound corporate management in companies through listings at the bourse.

The National Assembly issued a public notice this week seeking views from the public in order to further improve Kenya’s ease of doing business ranking.

The move is expected to go a long way in positioning Kenya as a conducive, facilitative and competitive business environment.