Local banks are playing catchup on flexible payment plans in an effort to root their customers into their payment solutions.

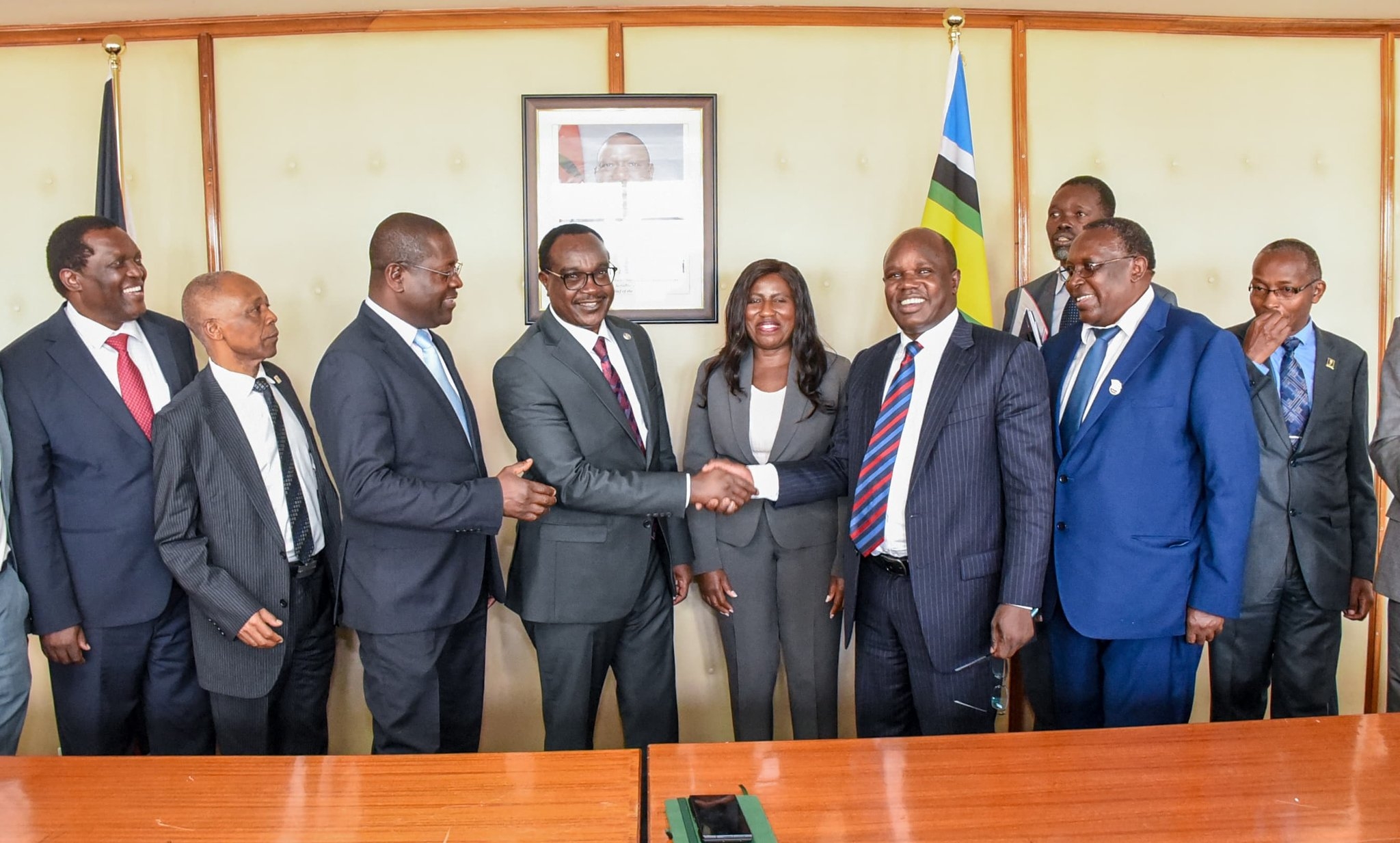

Absa Bank Kenya is the latest firm to incorporate the Buy Now, Pay Later (BNPL) option into its card, as it looks to tap into the instalment payment that will dominate sales this year according to consultancy firm-Mckinsey.

Mapping sales trends to watch in 2023, the global firm says installment payment plans, or “buy now, pay later” (BNPL) have been growing six folds year-on-year since 2018 and will top sales and marketing trends this year.

The new innovation by Absa, Dubbed, 'Buy Now Lipa Pole Pole', is a self-service payment option on the Absa mobile and internet banking platform, which provides a convenient way to manage customers' expenses by spreading the cost of their purchases over time.

Head of card payments at Absa Bank Kenya, Linda Kimani, said the introduction of the feature is a helpful tool for managing expenses and supporting customers' cashflow positions.

“Given the prevailing economic environment in which many consumers are having to make tough spending decisions, we understand the growing need to manage one’s expenses and make purchases without straining one’s wallet," said Linda.

She added: "That’s why we’re excited to launch our BNPL card feature, which gives our customers the power and ease they need to pay for their purchases flexibly over time.”

The innovation offers Absa’s credit card customers the option to either pay for their purchases in full, immediately, or in a structured repayment plan over a defined period between three to 12 months.

“By incorporating BNPL payments into their budgeting strategy, customers have more room to manage expenses such as payment of school fees or booking for holiday travel, while maintaining a healthy financial outlook,” Linda said.

The setup and confirmation process for Absa’s, Buy Now Lipa Pole Pole card feature is instant and hassle-free, management noted, ensuring a seamless experience for customers without any unnecessary delays or complications.

According to data from the Central Bank of Kenya, the number of card-based transactions recorded as of March 2023 topped 5,669,185, denoting a 5.3 percent increase.

This is compared to the number of transactions recorded in February 2023.

It is an indicator of the growing attractiveness of the convenience of the card payment option in the market.