The cost of goods is likely to shoot up in the short-term as the Kenyan shilling maintained a free fall against the US dollar, hitting a new low yesterday.

Kenya remains a net importer with a widening trade deficit, which hit Sh1.62 trillion last year, the Economic Survey 2023 shows.

The country’s import bill rose by 17.5 per cent to Sh2.5 trillion against Sh873.1 billion in export earnings.

Yesterday, Central Bank of Kenya (CBK) quoted the shilling at a mean exchange rate of Sh141. 20 a unit of the dollar.

Year-to-date, the shilling has shed more than 13 per cent of its value from the Sh124.49 it averaged against the dollar in January.

It crossed the 140 mark last month with analysts predicting it could hit 145 by the end of August, mainly on high US Federal Reserve rates.

The fed’s benchmark interest rate are forecast to go up later this month to a 5.25 per cent-5.5 per cent range as the US Central Bank continues to manage high inflation.

The shilling has been on a back foot since mid-2018 when it stood at 101.29, even as CBK maintains the local currency remains stable.

“The Kenya shilling remained relatively stable against major international and regional currencies during the week ending July 6,” CBK says in a bulletin.

A weak shilling means local traders and manufacturers are spending more to secure dollars to make payments in international trade, costs that are traditionally passed to consumers.

Banks have been asking for more than Sh142 for a dollar, way above the CBK average rates that are expected to go further up as the shilling falls.

With this, Kenyan households are staring at an even higher cost of living this month as manufacturers pass extra costs incurred in bringing in raw materials and other goods, similar to other traders who source merchandise from foreign markets.

The Kenya Association of Manufacturers (KAM) said local industries have limited option but pass the extra costs to retailers who would definitely pass this on to consumers.

Petroleum products are among Kenya’s key imports and are greatly affected by a weak shilling, with high prices having multiplier effects in the transport, farming, production and manufacturing sectors.

The depreciation is also set to increase electricity prices through higher forex levies on power bills, as generators factor in foreign exchange fluctuation adjustment charges.

Prices of food products such as cooking oil, wheat, maize and other imports are also expected to increase, adding pressure to households already grappling with historic prices of sugar and high prices of other food commodities.

“As long as we continue to pay for most of our cross border transactions using the dollar, then demand for dollars is likely to keep the exchange rate high or even uptick it further,” financial and independent tax expert, Clifford Otieno, told the Star yesterday.

The solution, he said, is to grow the country’s exports and actively seek alternative currencies other than the US dollar, Euro and Sterling Pound for payments.

Abraham Rugo, Country Manager, International Budget Partnership said: “ I think the policy stance now is to let it (shilling) find its resting place…market forces to balance things out.”

Last month, the country’s inflation slightly eased to 7.9 per cent on cheaper food prices mainly vegetables, but remained above the preferred band of between 2.5 and 7.5 per cent.

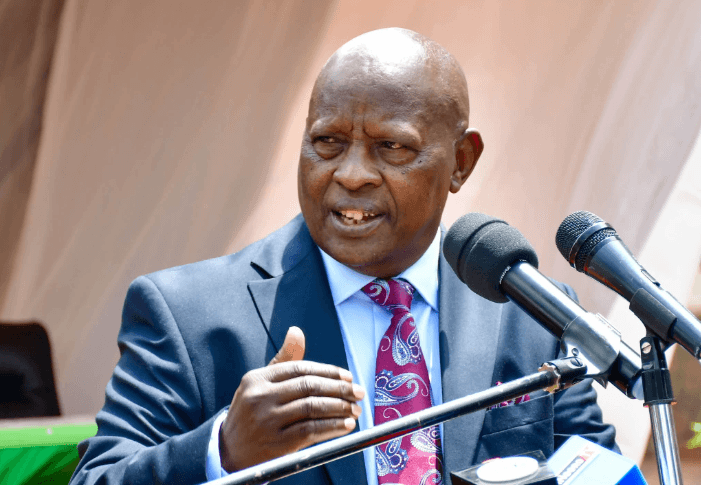

“The inflation was largely due to increase in prices of commodities under Food and Non-alcoholic Beverages (10.3%); and Housing, Water, Electricity, Gas and other fuels (9.4%); and Transport (9.4%) between June 2022 and June 2023,” KNBS director general Macdonald Obudho said.

These three divisions account for over 57 per cent of the weights of the 13 broad categories.