Central Bank is optimistic inflation will ease in two months on the back of an expected bumper maize harvest in the country's maize basket of North Rift and Western.

Speaking at the launch of Equity Bank's Kenya and DRC Investors' CBK governor Kamau Thugge raised interest rate will put breaks on rising inflation by August.

"At the Central Bank, we have taken the position that we are going to be quite aggressive in addressing inflationary pressures, and that's why we increased the CBR by 100 basis points,'' Thugge said.

He assured the country that tough days are coming to an end, with the economy expected to grow robustly, by at least 5.5 percent in 2023, driven by a recovery in agriculture which started showing signs of recovery in the first quarter.

The apex bank boss attributed the high inflation witnessed since July last year to disruptions in supply chains and an extended drought period.

Last month, the banking regulator raised the CBR by one percentage point at a surprise MPC meeting to 10.5 per cent from 9.5 per cent, setting the benchmark lending rate at the highest level since July 2016.

The rate of increase was also the highest in nearly eight years since July 2015 when the CBR rose by 1.5 per cent.

Kenya’s inflation in June remained largely flat on slight moderation in the cost of energy.

Inflation — a measure of the cost of living over the last 12 months— eased marginally to 7.9 per cent from eight per cent in the prior month, remaining above the government's ceiling of 7.5 per cent.

Thugge's sentiments are coming at a time the opposition has vowed to host countrywide demonstrations against the high cost of living which has been worsened by high fuel costs as a result of a double increase in Value Added Tax (VAT).

The increase of VAT on petroleum products to 16 per cent from eight per cent is part of the Finance Act, 2023 which is being contested in court.

Last Friday, the court halted the implementation of tax measures in the disputed law. Even so, the government has already factored in the raised VAT in the current fuel prices, pushing a litre of Super Petrol to Sh195, diesel to Sh181.64 and kerosene to Sh175.42.

On exchange rates, Thugge said CBK is pursuing a flexible exchange rate system and will intervene when they feel that there is excessive volatility in the exchange rate.

''Otherwise, we allow the exchange rate to find its own level through supply and demand forces,'' Thugge said.

The country's currency has been sliding against major international currencies, fueling a high cost of living.

Yesterday, the shilling traded at 141.56 units against the US Dollar, having shed almost 20 per cent in the past 12 months.

He hailed Equity Bank for planning an investor roadshow, challenging the private sector to work hand in hand with the government to restore the country's economic glory.

He reinforced Kenya’s suitability as an investment destination, assuring the investors of the stability of the country’s economy.

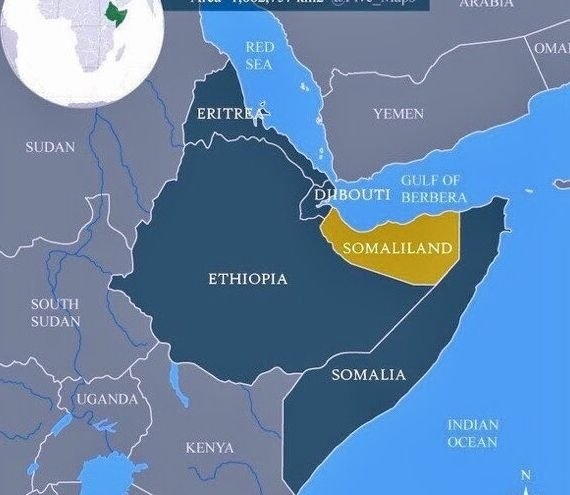

The Kenyan economy has exhibited a lot of resilience and is one of the fastest-growing economies in the region despite the global shocks from the Covid-19 pandemic and the Russia – Ukraine conflict.

"This resilience stems from the fact that our economy is heavily diversified, and with opportunities for more investment in agricultural, trade and manufacturing sectors,” Thugge said.

The Kenya and DRC Investors' Roadshow follows the success of previous trade missions conducted by Equity Group, including the Kenya-DRC, US-Tanzania, and US-Tanzania-Kenya trade missions held in 2021 and 2022.

“There is significant untapped potential in DRC given that the country has a population of over 100 million potential consumers, mineral resources, fertile agricultural land, and potential for political renewal,'' Equity Bank Group CEO James Mwangi said.

The roadshow which commenced yesterday in Nairobi will be followed by visits to Kinshasa today and Wednesday, with the final expected to take place on July 20 to 22 in Lubumbashi.

It is aimed at unlocking business networks and fostering trade and investment opportunities between the two nations.

The team will meet government officials, business associations, industry leaders, and Equity Group management, as well as site visits to showcase the potential investment opportunities firsthand.

The lender has pumped $7 billion (Sh987 billion) to champion sustainable investments that foster economic growth and wealth creation across various sectors in the region.