When former President of Estonia Kersti Kaljulaid visited Kenya in September 2021, it was the beginning of a new era of collaboration between not only the East African economic powerhouse, but the entire African continent.

It opened opportunities for Estonian companies to invest in the country and the region, which is hence paying off if the success of Estonian companies in the region is anything to go by, as they forge strong partnerships with local Startups.

In Kenya, startup companies are fronted as having the potential of accelerating up to 70 per cent of the country’s digital transformation, according to the Communications Authority.

However, major bottlenecks such as funding and compliance constraints see the majority of them close shop in less than a year.

Close to 80 per cent of startups often die within the first year of operation, while only three to five per cent make it beyond the one year period of survival, industry trends show.

Estonian company-SMTM Holding OU (LLC) which has partnered with Rwandan Stayonline Ltd is however determined to defy the odds and make a statement not only in Rwanda and Kenya, but the entire East African region and beyond.

This comes as East African markets continue to offer high growth rates, new users and an untapped market opportunity for global companies mainly in the digital space.

The World Bank’s latest economic analysis for Sub-Saharan Africa shows African countries are not wasting the opportunity from the Covid-19 crisis, they are increasingly adopting digital technologies to boost productivity in current jobs, and increase employment opportunities, particularly for women and youth.

The SMTM Holding OU (LLC) and Stayonline partnership has since seen them cement their position in Rwanda’s digital space and have since expanded to Kenya.

SMTM Holding OU (LLC) whose subsidiaries include Magua Pay INC (Canada) and Smartpayments OU (Estonia) prides itself as a major player in the fintech industry, having started its business around 2014, in Estonia, and grown to become an international company.

“We see the Eastern Africa market as a very potential market with huge opportunities,” Dmitri Orlov, CEO and Co-Founder said during an interview in Nairobi.

“We started noticing that since 2017 (when Estonia’s President visited Rwanda) , not only businesses but also the Estonian government has driven a lot of interest from Estonian companies with the East Africa region as an investment destination,” he added.

Estonia’s interest in East Africa and the continent has led to concrete success stories, driving innovation and transforming digital landscapes.

“The East African market is becoming more and more interesting from the point of view of global businesses,” Dmitri explained.

The company ventured into the East African region in 2021 through its partnership with Stayonline Limited and has since pushed for growth into new markets among them Kenya.

According to Dmitri, Kenya has been a target market for the Estonian firm owing to its population, technological advancements and strong economy.

“We have always believed that if we enter the Kenyan market with proper business structures and investment we will succeed,” he said, “Over six months ago, finally we were able to enter the Kenyan market through the partnership with Stayonline Ltd.”

Kenya’s strong digital space, internet penetration and cashless systems such as Mpesa, e-government platform that supports access to services with reduced bureaucracy, he said, make Kenya attractive to investments, especially in financial technology.

SMTM provides financial services to companies and individuals, including money transfer, bank accounts, cards, among others.

Estonia which became independent in 1991 after separation from the Soviet Union prides itself as the first fully digital country.

It was the first country in the world to go through electronic collection.

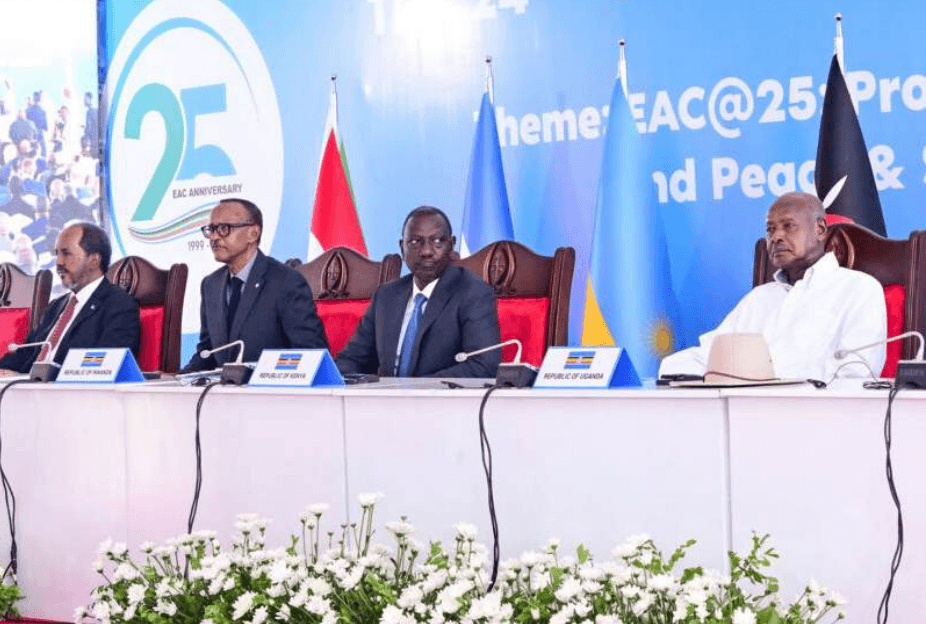

“We see Kenya and EAC on the same path, we expect that in the near future, more investors will be interested in investing in the region,” Dmitri said.

The two companies are closely working with United Bank of Africa, owing to its wide network in about 25 countries and its robust and advanced infrastructure and excellent customer service.

Apart from fintech,SMTM targets to expand to personalised individual services.

The company is currently developing a mobile wallet for money transfers and other digital financial services, which could drive up diaspora remittances to Africa.

“People will have an easier and cheaper way to transfer money and transact across the globe. We want to make these services as easy as possible. We understand that not everyone understands digitization so we plan to make it as simple as possible,” Dmitri explained.

The company plans to ride on its over 10 years of market experience to tap a sizable share of Kenya, Rwanda and the entire East African Community’s digital space.

SMTM Holding and Stayonline plans to partner with Mpesa in Kenya and other mobile money platforms in Africa in driving financial technology.

The government’s digital transformation also offers an opportunity for the entities to do business in Kenya, Dmitri noted, saying the firms will be seeking to support government initiatives in digitising services.

The SMTM-Stayonline partnership which officially commenced offering services in Kenya about five months ago has seen an initial investment of $8 million (Sh1.2billion) in Kenya, with plans to pump in more funds in operations.

“We plan to increase that investment as we grow in our partnerships with businesses, government and individuals. We are here to stay and increase investments in Kenya and the East Africa region,” Dmitri affirmed.

Stayonline Ltd

For Desire Muhinyuza, CEO Stayonline Limited, he sees the fintech company that started in 2013, co-founded with his partner in Rwanda, playing a big role in the future of the African market when it comes to eCommerce and online payments.

We started Stayonline to offer Software As a Service(SAS) in the business process outsourcing space back then and grew to become a digital marketplace platform that has three vectors–business to consumers, business to business and peer-to-peer, covering the entire digital space.

“ We are lucky to have our country's leadership led by our President that always encourages entrepreneurs, especially in the tech space to dare think big and scale beyond our borders to deliver excellence.It is something that is now embedded into our DNA” Muhinyuza explained .

Stayonline partners with all the SMTM Holding ubsidiaries.

Opportunities in Kenya and the East African Community integration has been a key driving force for the company’s growth and expansion in the region, according to Desire, where the company now has offices in Kigali and Nairobi.

“We want to focus on the East African market first, build solid business cases before further expansions. We have the platforms, technology, and the market is available... I think it is a good time for us to be in this market and scale later on to other regions,” said Muhinyuza.

However, the firm has already established a presence in Zambia as a launch pad for the Southern Africa region.

The firm plans to add different partners in the supply chain among them shops, malls to offer delivery services for products purchased online, with accessibility throughout the region.

This will also bring in more "non-funded revenues" to financial institutions, through cards and mobile payments.

“Five years from now, we want to be among the top players in the fintech space-payments, market place and digital services. We are also looking at including the latest technologies such as artificial intelligence, blockchain technologies to give value-added services. It is a constant innovation and we want to be a market leader in this space,” said Muhinyuza.

The online digital platform opens up job opportunities for entrepreneurs to plug into e-Commerce space where in the next two years, Stayonline plans to have created at least 10,000 direct jobs in different sectors mainly on regional e-Commerce.

Kenya’s legal and policy environment

Danstan Omari, one of Kenya's high-profile lawyers, a corporate governance practitioner and a lecturer at Catholic University (Law) defines Kenya’s legal regime as investor friendly.

According to the advocate of the High Court, a number of laws have been repealed or amended to allow the current global business standards to be applicable in Kenya.

Up to 99 per cent of processes at the registration of companies are also digitised, he explained, allowing processing from across the globe.

“ The number of directors which initially required at least two locals, now only one person can register a company. The duration for registering a company has also been shortened to almost less than 24 hours so long as one is fully compliant or meets all the requirements,” Omari explained.

There are also reduced bureaucracies in the registration of companies, where the government has created a one-stop-shop.

“The company registration process is online, certification is online, the memorandum and articles of association are online… it has become very easy for even investors to register without the input of an advocate or lawyer. So the business registration systems are up to standard. Kenya is competing with the best across the globe,” Omari noted.

Originally, Kenya was rigid in terms of foreign investors looking at issues such as local directorships, the amount of resources, work permits and migration requirements, which has since changed.

“Today company shareholding can be 100 per cent foreign. The Kenyan laws now are investor friendly, boosting Foreign Direct Investments and turning Kenya into an investment hub. The laws are continuously being reviewed to allow them (foreign investors) to come into this country and do their business,” Omari said.

Issues of double taxation have also been greatly addressed, according to Omari, making Kenya more attractive to foreign investors.

The tax regime is also being reviewed to attract investments, which over time, the overall cost of doing business is expected to go down.

The government has also invested heavily in infrastructure that supports trade and investments, key among them being the aviation industry (airports), roads, rail, and ports, Omari noted.

With the second major seaport of Lamu, Kenya will continue retaining its status as the gateway to East and Central Africa and a leading investment hub in the region, he said.

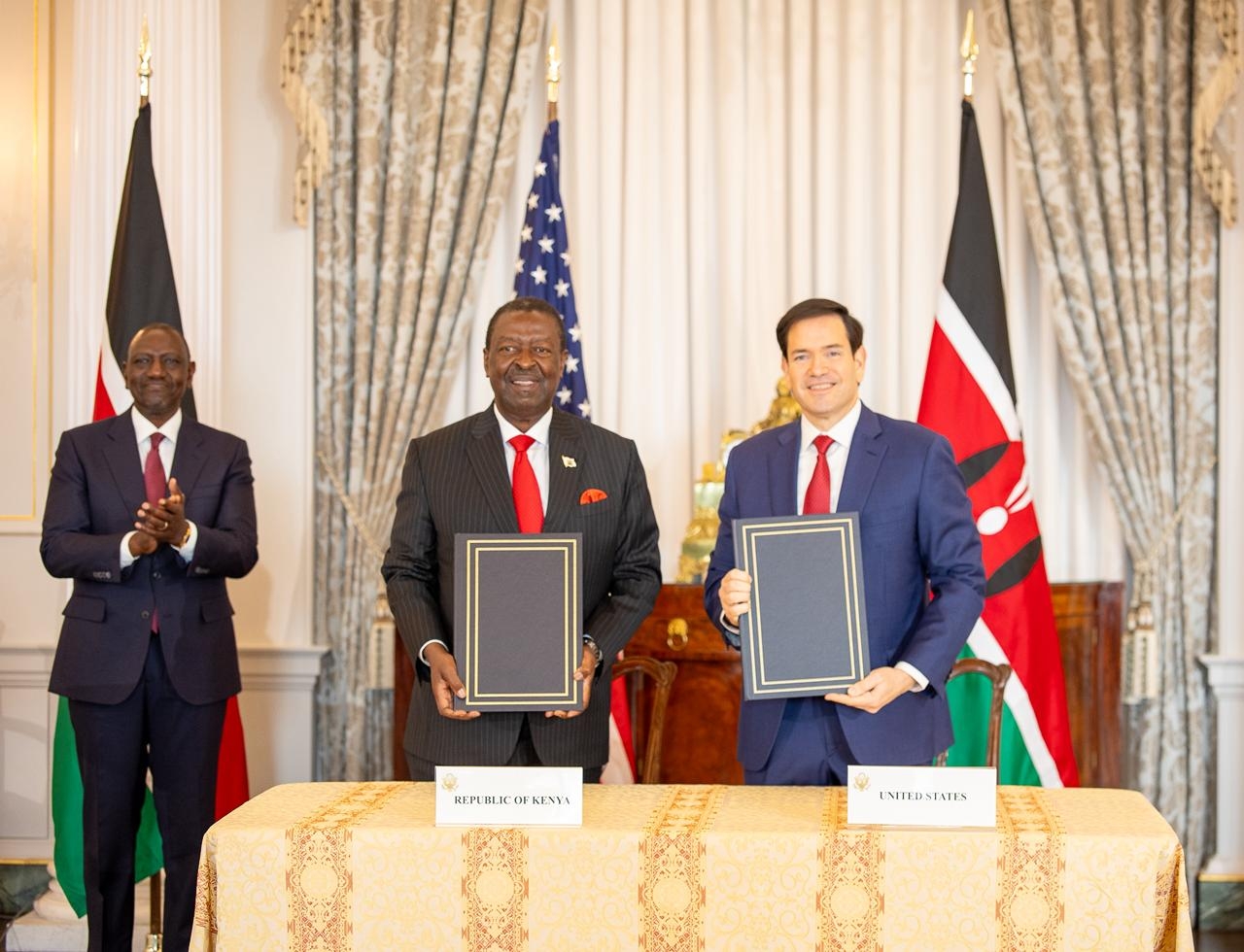

President William Ruto’s charm offensive in the foreign markets is also key in attracting FDIs to Kenya, he added.

Kenya is also leading in the continent with one of the best labor markets-qualified and skilled manpower.

Political stability in Kenya also acts as a key anchor for investments according to Omari.

Kenya hosts a number of global companies not only operating in the Kenyan market but the entire region and the African continent.

However, the lawyer believes the government should continue balancing between taxation as it abides by trade treaties, ensuring local companies thrive and a friendly investment environment mainly on the cost of doing business.

To unlock the full benefits of a digital economy, World Bank recommends policies that accompany investments in digital infrastructure such as a regulatory framework that fosters competition and innovation in telecommunications, provision of reliable and affordable electricity, investment in education and upgrading the skills of informal workers.