Kenya on Tuesday paid back $1.5 billion of the inaugural $2 billion 2014 Eurobond, marking a successful settlement of the buy back plan and boosting investor confidence.

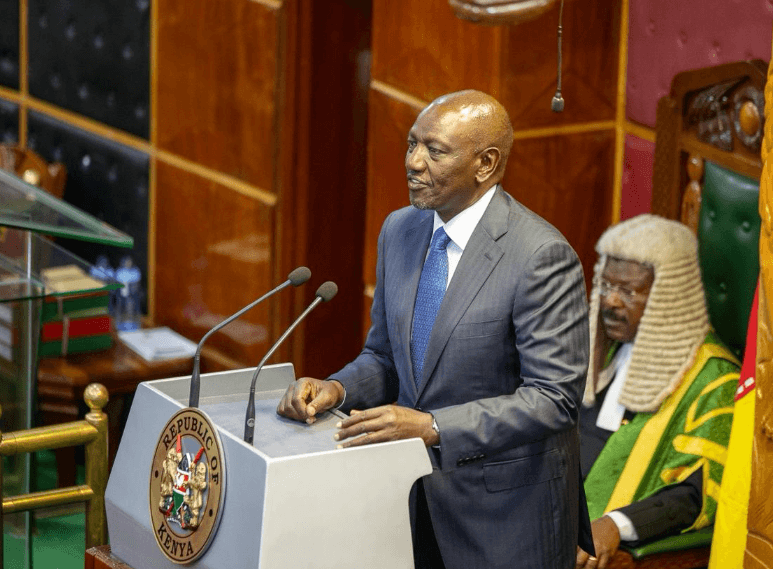

Speaking on Wednesday in Naivasha at a four day Cabinet retreat, president William Ruto said the successful buy back has boosted the local currency.

“Investor confidence has been significantly enhanced, resulting in the appreciation of the shilling against the US dollar, from Sh162 to Sh142,” Ruto said.

“In turn, this has reduced our overall debt by Sh722 billion, and also reduced our debt service costs by Sh195 billion over the next six years, saving the country a total of Sh917 billion.”

The Central Bank of Kenya (CBK) yesterday quoted the shilling at 144.14, up from the lows of 161.35 in January, reflecting a 17-unit value gain.

Ruto further disclosed that the money used for the buy back was raised through the recently issued Eurobond Worth $1.5 billion.

The new loan is divided into three instalments, with a weight average life of six years and is expected to mature in 2031.

The bond is priced at 10.37 per cent, the highest rate an African state has ever offered.

Kenya’s shilling has taken a major beating against the dollar in the past three years, loosing about 61 per cent of its value since it started weakening in early 2020 to January this year.

This meant much pain for importers, as they were incurring extra costs for goods. The burden is often passed to consumers, prompting an increase in the general cost of living.

Kenya being a net importer, this means importers as of January this year, were incurring close to an extra Sh60 to buy a dollar for imports, as compared to early 2020.

A weak shilling also piles pressure on the country’s forex reserves as importers seek the much-needed dollar to pay for imports.

This is evident, as the country’s reserves have remained below the statutory level of four months of import cover since August last year.

Latest data by the CBK weekly bulletin shows the foreign exchange reserves stood at $7,031 million (3.8 months of import cover) as of February 15.

Kenya's external debt burden is also expected to grow on a weak shilling, as majority of it is dollar denominated.

Kenya’s public debt shot up by $13.3 billion (Sh1.92 trillion) in the year ended December 2023, raising the country's indebtedness to a new high of $76.83 billion (Sh11.1 trillion).

This is on the back of the weakening shilling, which shed about 27 per cent of its value during the year.

It had a heavy impact on external public debts, accounting for 73 per cent (Sh1.4 trillion) of the Ksh1.9 trillion increase during the year.

However, the president reiterated that in the interest of sound debt management, the government has implemented a combination of strategies to ensure debt is sustainable at all times.

The strategies include the diversification of financing sources, smoothening the maturity profiles and proactive management of debt liabilities in general.

![[PHOTOS] Betty Bayo laid to rest in Kiambu](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2F3b166e2e-d964-4503-8096-6b954dee1bd0.jpg&w=3840&q=100)

![[PHOTOS]Goons vandalise Nargis Restaurant in Westlands](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2Fa1c98f6c-2b1d-4b50-b112-1def4d93a193.jpeg&w=3840&q=100)