Kenya is among 23 countries expected to dedicate over 20 per cent of their revenue to external debt payment even as the topic continues to prick President William Ruto's regime.

The latest report by Debt Justice, a partner of the UK-based non-state agency, Christian Aid shows Kenya will spend 26.1 per cent of its domestic revenue to repay external loans, the eighth highest in the continent this year.

Angola leads the continent in dedicating domestic revenue to external loan repayment at 59.8 per cent, followed by Zambia at 43.5 per cent, Egypt 38.8, Djibouti 37.8, Tunisia 31.4, Gabon 29.1 and Benin at 27.3 3 per cent.

Dubbed 'Between Life and Debt', the report shows Kenya’s external debt payments have increased rapidly from an average of six per cent of the government revenue between 2008 and 2016, to hit 24 per cent in 2019 and at least 26 per cent this year.

According to the report, 44 of Kenya’s external debt payments between 2023 and 2025, almost half are to private creditors, primarily bondholders.

"This is because these debts have the highest interest rates and shortest maturities. Almost a quarter of external debt payments are to China, with the rest to multilateral lenders and other governments,'' the report by Christian Aid reads.

The rising external debt obligation could likely erode Kenya's debt relief profile as was the case in the late 1990s and early 2000s because the International Monetary Fund (IMF) regarded the country's debt as sustainable.

External government debt payments averaged 26 per cent of government revenue between 1990 and 2003.

The international lender says governments struggle to pay external debts once they are higher than 14–23 per cent of government revenue.

The report further notes that as Kenya’s debt payments increase, public spending has fallen steeply.

Between 2017 and 2022, real public spending per person (not including interest payments) fell by a huge 15 per cent.

By 2025 it is still projected to be seven per cent less than in 2017, and a similar level to 2015 – a decade without any real increase in public spending.

According to the National Taxpayers Association, a Christian Aid partner, the reduction in spending in social sectors is manifested in a lack of essential services in health and education facilities.

"This has led to a lack of medicines and specialized equipment in most of the hospitals where they can access free treatment. There are also delays in government disbursements of capitations to schools as well as payments for social protection transfers and public works programmes adequate resources to sustain social services."

Even with the ongoing stagnation in government spending, and new loans from multilateral lenders, it is unable to pay this amount.

"In the absence of an effective debt restructuring mechanism or outright debt cancellation, the government has decided to largely repay the bond through more borrowing from the same lenders."

In 2021, Eurodad found that the three largest holders of Kenya’s bonds were AllianceBernstein, Lord, Abbett and Co. and BlackRock.

In February 2024, Kenya borrowed $1.5 billion through a new bond, at 10.375 percent interest.

"Like Kenya’s previous foreign currency bonds, this new bond is governed by English law. None of this money will be invested – it will all be used to repay the previous bond."

In return, $155 million (Sh19.8 billion) will leave Kenya every year in interest payments – significantly more than with the previous bonds, which had six to seven percent interest, further restricting the ability of the government to spend on its communities.

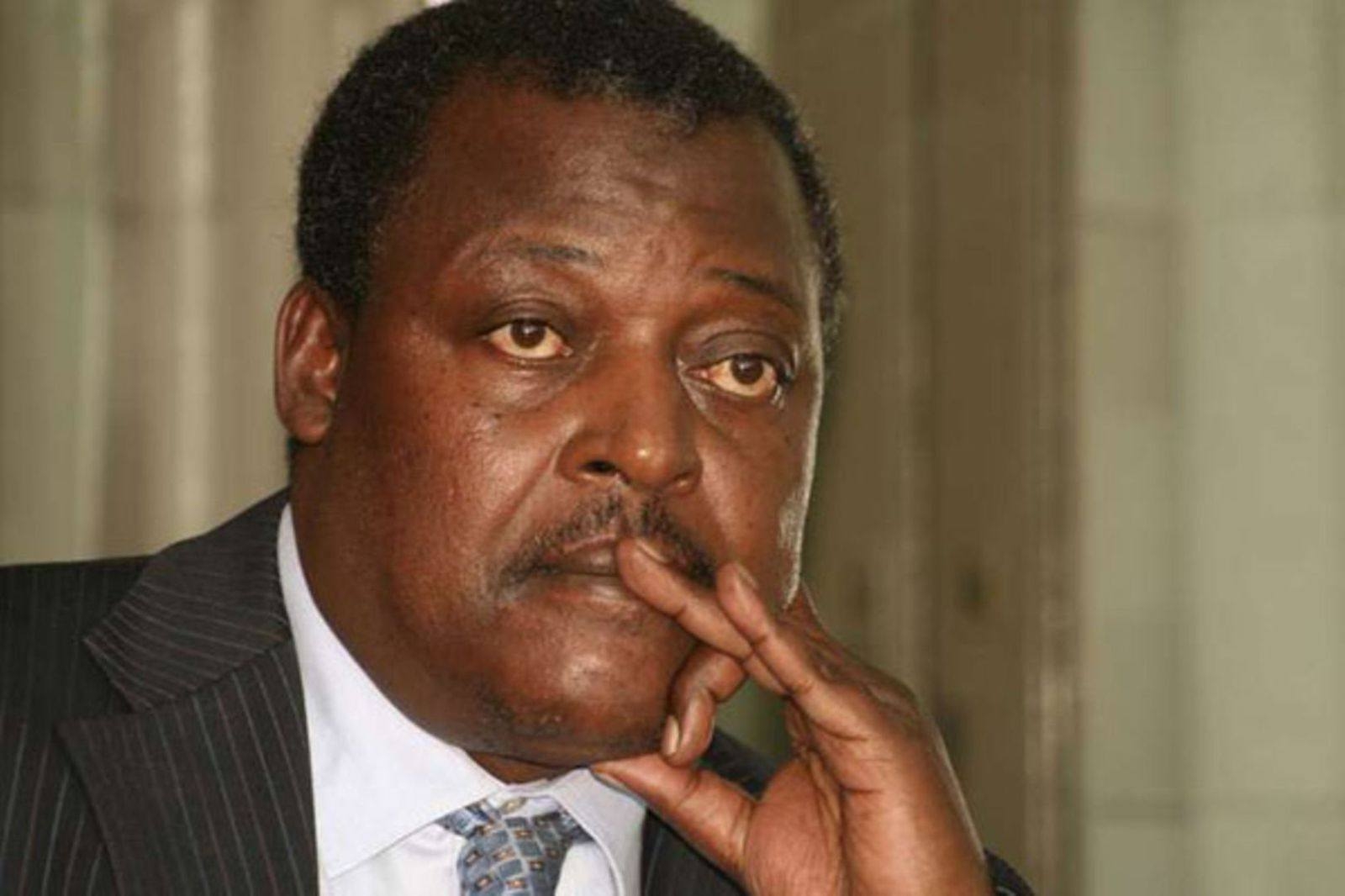

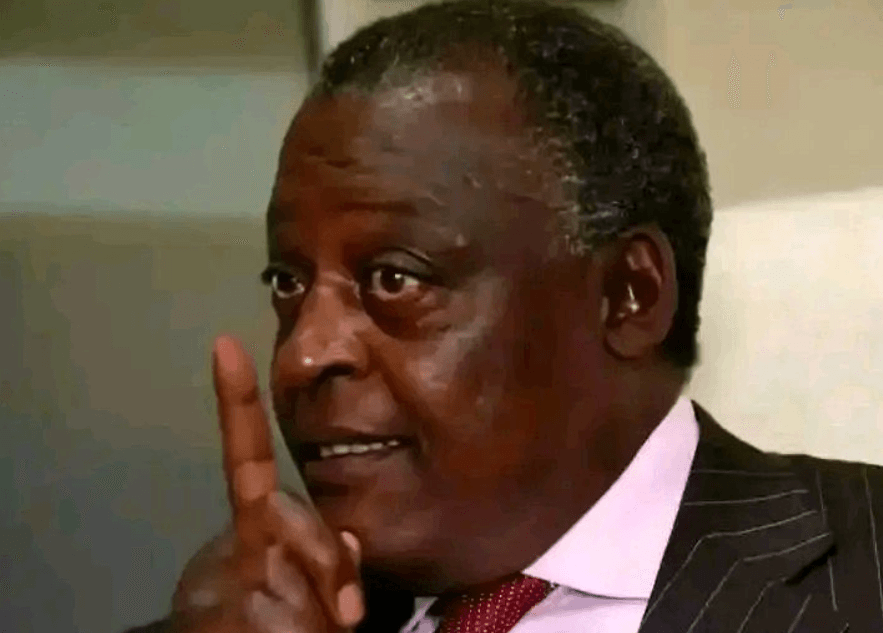

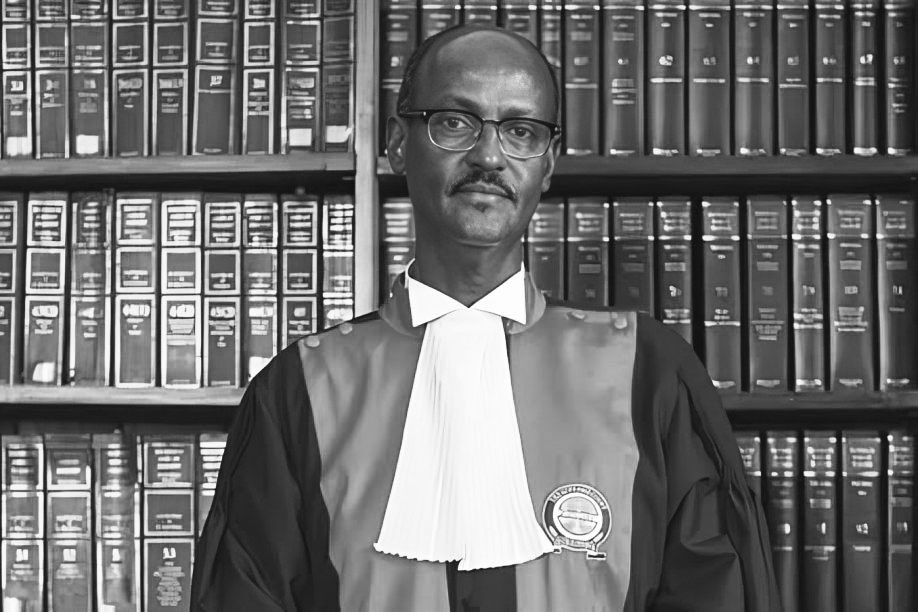

This reality has sparked public descent in the current government, with bi-weekly protests forcing President William Ruto to set up an independent task force to carry out a public debt audit.

Addressing the nation on Friday from State House, he noted that public debt continues to be a major int of engagement and conversation in Kenya.

"I have today appointed an independent task force to carry out a comprehensive forensic audit over public debt and report to us in the next three months," he said.

In 2024, 28 African countries will have external debt payments of over 14 per cent of government revenue, with 23 of these paying over 20 per cent of government revenue.

In contrast, in 2010 no African governments were spending over 20 per cent of revenue on external debt payments, and only one, Tunisia, was spending more than 14 per cent.

According to the report, African governments' external debt payments will average at least 18.5 per cent of budget revenues in 2024, the highest since 1998.

This is almost four times as much as in 2010, and the highest of any region in the world.

The root cause of the debt crisis can be traced to post-independence when many African countries inherited debt and weakened economies. Ever since then, they have been trying to navigate a structurally unequal global economy, with little choice but to borrow on highly unfavourable terms.

Christian Aid now calls for widespread debt cancellation from all creditors, including the private creditors who it accuses of delaying and weakening debt relief initiatives.

"These creditors need to be brought to the table because they do not have the institutional and structural incentives to be part of the solutions."

"Actions to cancel debts should happen alongside efforts to build a global economic system that is more just and does not consign the global majority to poverty while accumulating wealth for a tiny, yet powerful, global minority."