ActionAid has faulted the International Monetary Fund over failure to provide policy advice to Kenya on revenue raising measures to service debt.

This has seen the country raise taxes on essential goods and services as part of a debt repayment strategy, a move that has been met with public backlash.

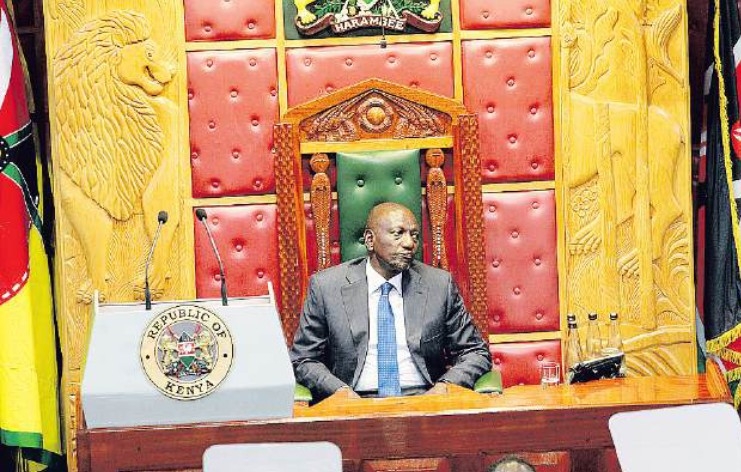

Kenya is among 23 countries expected to dedicate over 20 per cent of their revenue to external debt payment even as the topic continues to prick President William Ruto's regime.

ActionAid International Kenya Programs and Strategy Lead Samson Orao, said that by advising the Kenyan government to prioritise debt repayment through tax hikes over funding for basic needs, development, and social programs, the IMF has exposed the most vulnerable to an extremely high cost of living.

“Raising taxes to service debt instead of addressing issues that affects everyday people, like tax rates or road conditions is a recipe for disaster and one whip too many on the backs of Kenyans, who continue to tighten their belts and bear the burden of the government’s austerity measures,” said Orao.

He added that it is unfortunate that the IMF has learned nothing from its past failed policy advice to governments in Africa, dating back to the structural adjustment programmes in the ‘80s.

The Kenyan government had planned to raise $2.7 billion (Sh346 billion) from additional taxes, including levies on bread, a 2.5 per cent motor vehicle tax, tax on income from digital content, tax on betting, gaming, and lotteries, tax on imported sanitary towels and diapers, tax on money transfers and bank charges, and tax on goods supplied to public entities, among others.

Currently, Kenya is witnessing significant budget reductions averaging 11 per cent in critical sectors such as education, research, social protection, disaster response, and agriculture.

“It is perplexing that the Kenyan government would propose further taxation on sectors that affect gender-responsive public services like education, water, and health,” added Orao

The moratorium on employment for teachers and medical personnel is a challenge to the education and health sectors respectively.

ActionAid International Economic Justice Lead Roos Saalbrink, emphasised the need for the IMF to reassess its debt sustainability analysis to include a government's ability to pay for basic social needs before prioritising debt repayment.

“The IMF is pushing the interests of its global north-dominated board to facilitate debt collection regardless of the implications for people in borrowing nations," she said.

The official said the advised tax raises have only served to burden the poor further with the additional funds going towards debt repayment and not development.

The impact of these policies in Kenya demonstrates that a one-size-fits-all approach does not work. ActionAid urges the IMF to change its approach to prioritise and promote long-term economic development over short-term policy measures.

![[PHOTOS] Ruto present as NIS boss Noordin Haji's son weds](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2Ff8833a6a-7b6b-4e15-b378-8624f16917f0.jpg&w=3840&q=100)