The government is staring at a crisis in the pension industry, so big it is, that it will likely shake the financial markets.

The perennial extension of state employees contracts beyond the set retirement age is nearing inflection point as nearly a third of the government workforce is staring at retirement and eventual payment of their pensions.

The Pensions Department at the National Treasury had in June 2023 announced plans to process 85,400 claims over a period of three years.

This figure will see treasury process an estimated Sh685billion in pension benefits over the period.

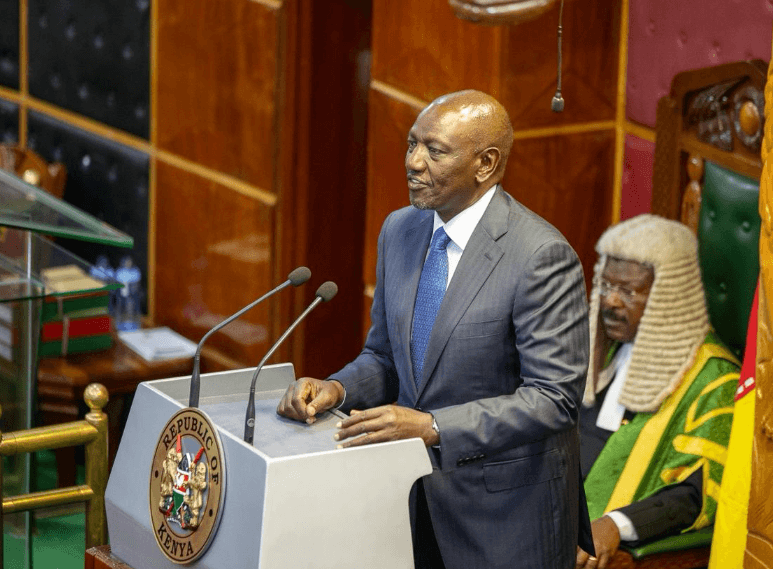

The rising pension liabilities, alongside debt repayment costs, will give President William Ruto's administration sleepless nights in the next three years.

Some 30,155 workers were expected to leave work by end of June 2024, with the number expected to fall to 28,745 in 2025 and 26,500 in 2026, according estimates by the National Treasury.

This will see the processing of pensions amounting Sh189 billion for the year ended June 2024 and a further increase of Sh207 billion for the new financial year, 2024-25.

The cash crunch witnessed early in the year 2024 saw State entities fail to remit a combined Sh72.96 billion in pension and pay-as- you-earn (PAYE) deductions.

According to the RBA, in Kenya, an estimated 3.5 million people, or 25 percent of the workforce, are covered by retirement benefit schemes

Documents by the Parliamentary Budget Office (PBO) show that unremitted pension dues stood at Sh47.6 billion while PAYE was Sh25.3 billion as at February 2024.

"The scenario points to general liquidity challenges in settling expenditure commitments as well as poor corporate governance, including weak or non-existent oversight between the respective State corporations /SAGAs Board and parent ministry/National Treasury," the government fiscal advisor on budget matters noted.

The problem hasn’t been helped by the fact that Kenya changed the retirement age from 55 to 60 years in 2009.

At the time, the reason given for the review was that the government was struggling with a huge pension bill as more people retired from service.

Extension of the retirement period has continued to be undertaken contrary to Public Service Commission Act, 2017, that provides that where a public officer has attained the mandatory retirement age, he/she shall retire from the service with- effect from the date of attaining the mandatory retirement age.

Further the Commission or other appointing authority shall not extend the service of such retired public officer beyond the mandatory retirement age.

Under the Public Service Commission Act 2017, public officers currently retire at 60 years, with the retirement age set at 65 years for individuals with disabilities.

When we met William* one of the state employees, working with Postal Corporation, he revealed that there are several civil servants in the entity who are willing to retire but their time has been pushed forward.

"In the next 3 years I will be hitting 60 years, if I can get my money immediately and go to retire, why not?" asked William rhetorically.

We meet Peter Ochieng seated at the newly landscaped concrete seats opposite the entrance of Eco bank Towers, he is in Nairobi to follow up on his pensions.

"I have been coming here to Bima house for several years now, but as it looks I'm just burning my fare to and from Nairobi," said Ochieng

His story is shared by many others who frequent the building on a daily basis, probably prompting the push for retirement extension by some government retirees.

Despite the current crisis there is yet a new proposal submitted to the Parliamentary Committee aims to reduce the mandatory retirement age from 60 to 55 years.

The Public Service Commission(Amendment) Bill, 2023 is seeking to reduce the retirement age to 55.

This proposal is intended to create employment opportunities for younger individuals and foster at professional growth within the public service by opening up at advancement opportunities.

However, players in the pension space have already raised objections to the plan.

“Lowering the retirement age would result in shorter contribution periods and longer payout periods, likely leading to Blower monthly retirement benefits and increased financial 2 strain on the County Pension Fund,” said CPF CEO Hosea Kili.

"Addressing these challenges proactively is essential to ensure financial security in retirement for the scheme members."

Another pain that the government will have to bear with, is the amends to the Pensions Act, that seeks to peg pensioner’s annuity on inflation adjustments.

The bill seeks to amend the Pensions Act, to include an automatic cost of living adjustments to the pensions earned by all retired public servants.

The Kassim Tandaza sponsored bill further seeks to provide for the use of the most current salary applicable to a job group as the basis for the calculation of the pension payable to the public servant who is retired in the job group or its equivalent.

President William Ruto has also directed public servants who have attained the retirement age of 60 to proceed to retirement.

Kingsland Court, a company that is working to professionalise pensions handling in the country says that this will be an immediate government liability that needs to be sorted.

"The government needs to support retirement programmes, retiring members need to be prepared well both financially and mentally," said the CEO of Kingsland Court, Simon Nyakundi.

The Kenya National Bureau of Statistics, in the 2024 Economic Survey says that the government is projected to spend a total Sh76.9 billion towards social safety net programmes by the close of this financial year 2024-25.

This will be a 16 percent increase this financial year compared to the Sh65.4 billion that was spent last year.

The number of households expected to receive assistance is projected to increase by more than 600 households to 124.6 thousand this year compared to last year.