The Acorn Student Accommodation Development REIT (ASA D-REIT) and the Acorn Student Accommodation Income REIT (ASA I-REIT) has reported a 24 per cent jump in half-year profit, on high occupancy.

The real estate investments delivered a combined operating profit of Sh586 million for the period ended June 30, compared to Sh474 million over a similar period last year.

Both REITs overcame a challenging economic environment to sustain a strong performance over the period, posting a 21.4 per cent in net profit growth to Sh345 million, up from Sh284 million last year.

The ASA I-REIT maintained an upward growth trajectory, driven by rental escalations, increased occupancy across its operational assets and the successful new acquisitions of Qwetu Aberdare Heights II in Q1 2024, as well as Qwetu Hurlingham in September last year.

This resulted to an increase in the total asset value of the ASA I-REIT by 44 per cent to Sh10.6 billion as at June 2024, from Sh7.3 billion in June 2023.

The net asset value per unit consequently increased to Sh22.21 per unit, up from Sh22.03 per unit at start of the year, reflecting a 0.8 per cent growth and a 11 per cent growth since its launch in 2021.

The I-REIT continues its strong distribution track record by announcing its seventh consecutive distribution payment of Sh0.30 per unit, which totals Sh99 million, as investors get returns.

“The occupancy across the portfolio remains strong underpinning the quality of the offering and the strength of the portfolio,” the firm said on Wednesday.

Looking ahead, the ASA I-REIT plans to further enhance its portfolio with the targeted acquisition of its eighth and ninth assets from ASA D-REIT later in the year, upon those properties attaining the stabilisation threshold.

Reduction in the cost of debt within the portfolio remains a top priority for the REIT Manager to improve the distributable income and overall yield to investors.

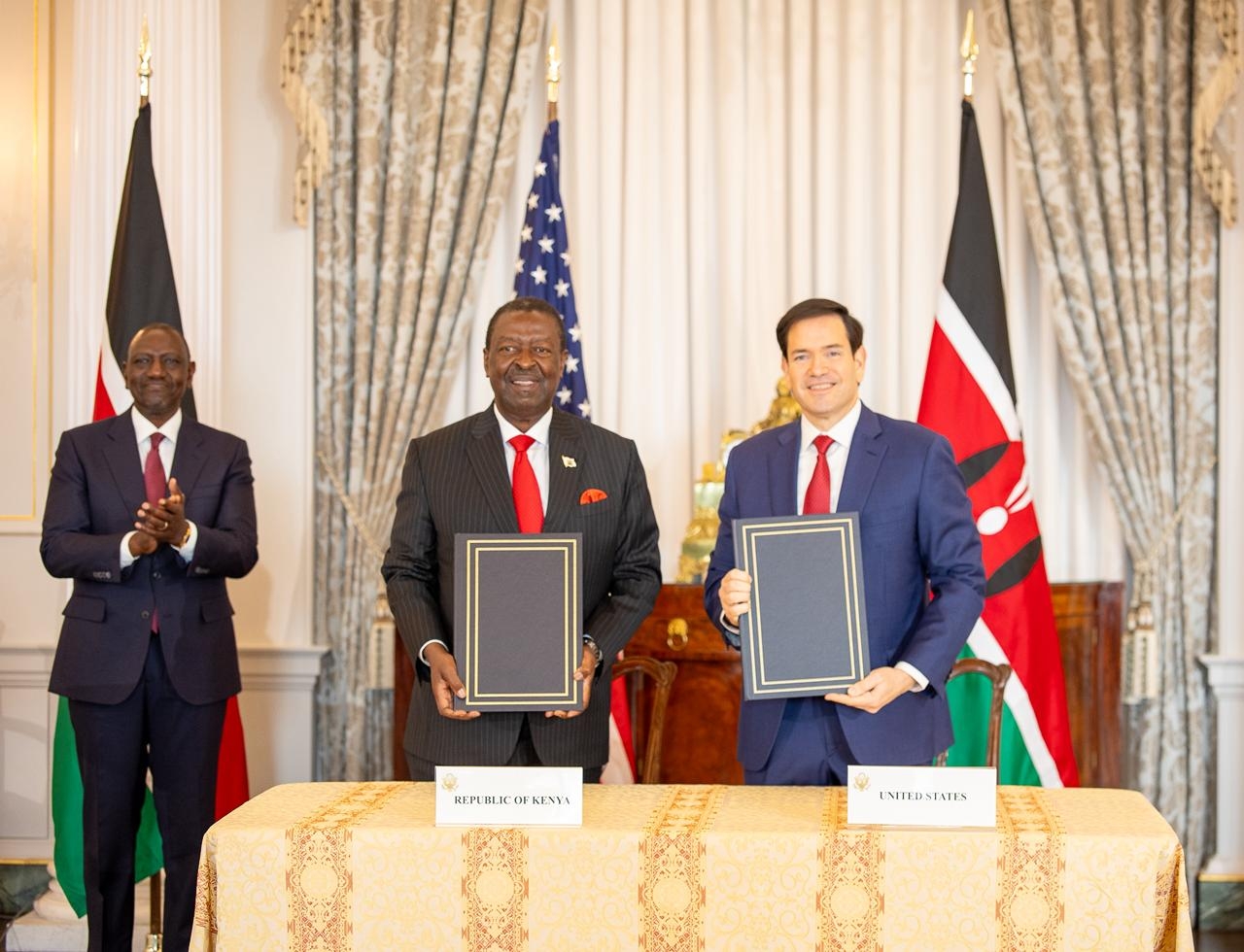

This will be addressed by utilising the recently secured long-term debt facility with the US Development Finance Corporation (DFC) and other debt reduction mechanisms at its disposal, yielding higher returns for investors.

The $180 million (Sh23.2 billion) facility will fund the development of 35 affordable student-housing units in Kenya, delivering 48,000 additional beds to the portfolio.

During the period under review, the total asset value of the ASA D-REIT increased by 11.5 per cent to Sh12.6 billion, from Sh11.3 billion in June 2023.

The net asset value per unit consequently increased to Sh25.35 per unit, up from Sh24.54 per unit at the start of the year, reflecting a 3.3 per cent growth and a 27 per cent growth, respectively.

This performance highlights the strength and quality of the developments as existing projects at various stages of development track to completion and the embedded value get realised.

The long-term borrowings decreased because of reclassification of the Acorn Green Bond to short-term borrowings as the medium-term note (MTN) will be maturing in the last quarter of the year.

The MTN funded eight development projects, four of which have been sold to the ASA I-REIT. The four remaining projects Qwetu and Qejani Karen and Qwetu and Qejani Chiromo will be exited once stabilised later in 2024 and in the first half of year 2025.

Collectively, the ASA I-REIT and ASA D-REIT are contributing to the growth of the quality and affordable student accommodation in Kenya while delivering stable, robust and predictable returns for investors.

“As we advance through 2024, our focus will remain the delivery of on-going projects on time and within budget, while utilising mechanisms within our disposal to reduce the cost of debt across the operating portfolio to further enhance investor returns,” acting executive director, Acorn Investment Management Limited, Mathew Maina said.