The new Kenya Planters Cooperative Union (New KPCU) has so far extended Sh5 billion cherry fund loans to 371,242 farmers, management has reported.

This is on the back of low interest rates and improved governance disbursement systems.

The coffee cherry advance developing fund report released by the organisation indicates as at August 5, 2024, the loan advancement to farmers had increased by 354.5 per cent from mid-November 2023.

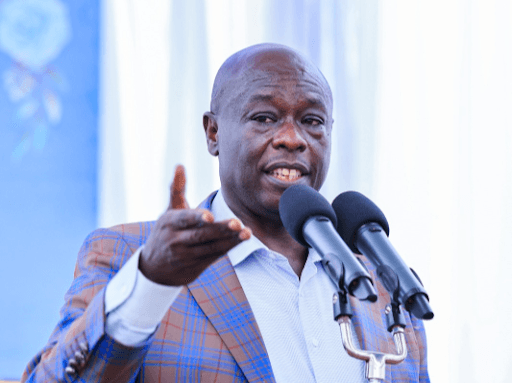

According to New KPCU managing director Timothy Mirugi, the appetite by farmers to borrow more from the kitty has been occasioned by low interest rates.

“The increase in loan advancement has been prompted by the fact that there is no collateral needed apart from coffee and cherry required, no cumbersome paperwork like the financial institutions as long as you are proved to be a farmer who is producing coffee in Kenya," said Mirugi.

There is also the aspect of quick disbursements and recovery of the same through the Direct Settlement System (DSS) or once coffee has been sold.

The Direct Settlement System by the Co-operative Bank has helped address delayed payments to farmers.

Co-op Bank was appointed by the Nairobi Coffee Exchange to provide the DSS technology platform, on which coffee trading is now being conducted.

This is as provided for in the new coffee trading regime, supervised by the Capital Markets Authority.

Coop Bank was picked as the DSS service provider following a competitive bidding process that had nine financial institutions submit their bids.

Coffee market users, which include brokers, traders, warehousemen, coffee farmers and other service providers, were trained on the workings of DSS.

Since the beginning of the 2023-24 coffee year, or October 2023 to date, Sh1.5 billion has been recovered through the DSS.

“As at November 14, 2023, the farmers had borrowed Sh1.1 billion. New KPCU in collaboration with other stakeholders have aggressively undertaken sensitisation sessions with farmers countrywide on the importance of borrowing the fund,"Mirugi said.

In the last nine months, 371,242 farmers have borrowed Sh5 billion, money that increased by Sh3.9 billion from November, 2023.

Seven counties from Mount Kenya have borrowed Sh2.9 billion of the total amount, accounting 58 per cent.

Nyeri County topped the list of beneficiaries after 70,660 coffee growers borrowed Sh701.1 million followed by Kirinyaga where 70,353 farmers borrowed Sh566.7 million.

In Kiambu, Murang’a, Embu, Meru, and Tharaka Nithi counties, about 109,152 farmers borrowed Sh557.9 million, Sh482.8 million, Sh330 million, Sh254.2 million and Sh39.5million, respectively.

Trans Nzoia, Uasin Gishu, Nandi, Migori, Nyamira, Baringo and Kisii farmers have received Sh582.7 million from the kitty, where about 19,963 farmers have benefited.

Between July 29 and August 5, New KPCU disbursed Sh69.2 million to 5,370 beneficiaries across 14 counties of Bungoma, Embu, Kericho, Kiambu, Machakos, Nandi, Trans Nzoia, Tharaka Nithi, Nyamira, Meru, Migori, Murang’a, Nakuru and Nyeri.

The highest disbursement in the review week was in Machakos County where 4,915 coffee farmers benefitted with cherry advance of Sh45.9 million.

The amount was disbursed to small-holder coffee estates and small holder coffee growers.

Farmers in Machakos are at the peak of the coffee picking season.

"The highest disbursement to specific farmers’ cooperative society was to Mukuyuni where 879 farmers benefitted from a cherry advance of Sh13.8 million at the rate of Sh40 per kg of cherry,” Mirugi confirmed.

During the 124th Session of International Coffee Organisation (ICO) at the Kenyatta International Convention Centre (KICC), Nairobi in March 2019, former President Uhuru Kenyatta announced the establishment of a Sh3 billion cherry advance revolving fund as part of bigger plans to revive the struggling coffee sub-sector.

The Kenya Kwanza government boosted the fund with Sh4 billion more in December 2023, to accelerate recovery of the once leading foreign exchange earner.

In June this year, the government also started the process of pumping Sh6.7 billion into the coffee farmers' bailout plan.

Meanwhile, the government continues to implement reforms in the sector, guided by the Coffee Policy 2023, Coffee Bill 2023, and the Cooperatives Bill 2023.

Some of the successful reforms so far include the restructuring of the Nairobi Coffee Exchange which has enabled coffee cooperative unions to participate in the auction.

About 15 cooperative unions had been licensed as of June and participate on the weekly trading floor of the auction.

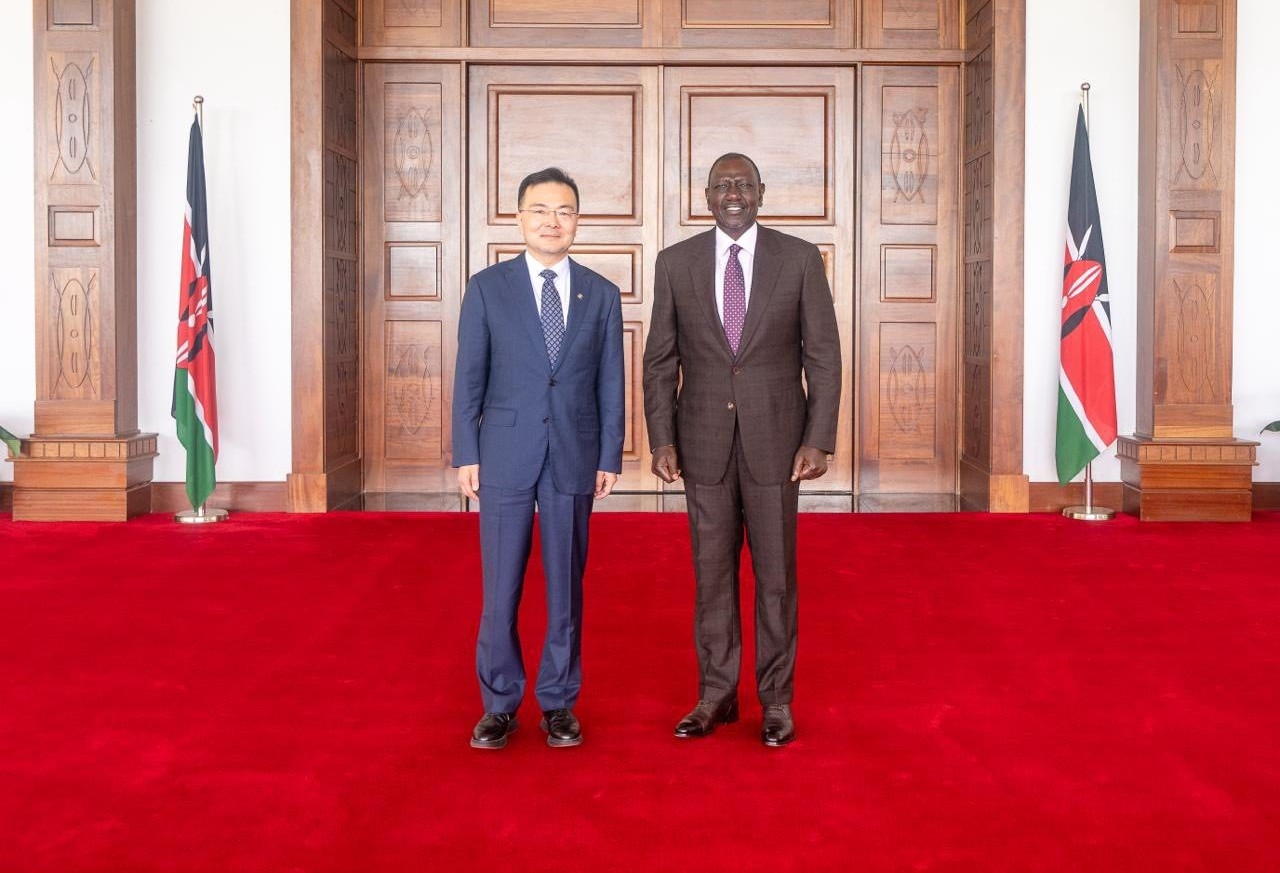

Meanwhile, President William Ruto has advised coffee cooperatives to desist from seeking loans from commercial banks and instead borrow from the Coffee Cherry Advance Revolving Fund.

The fund was established to provide affordable, sustainable and accessible cherry advance to smallholder coffee farmers with land under coffee not exceeding 20 acres.