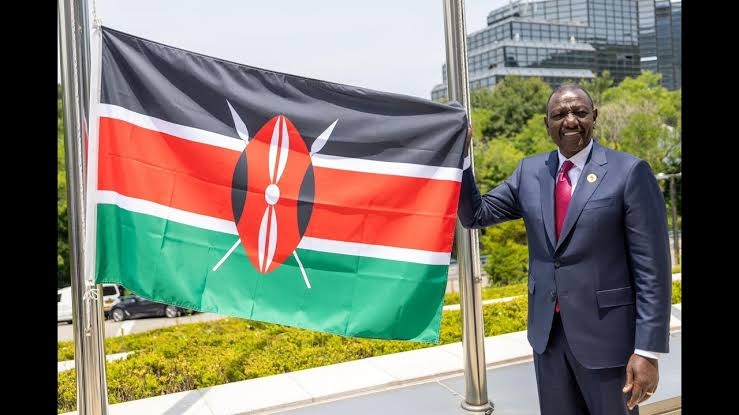

The Kenyan government has set an ambitious goal of deploying world-class infrastructure facilities and services by 2030.

This goal aligns with the country’s vision to become a regional economic powerhouse and improve the quality of life for its citizens. However, recent protests have highlighted the country's challenges in achieving this vision.

One of the key challenges facing Kenya is its over-dependence on Western technology.

Many financial institutions in the country rely on expensive and complex solutions from foreign vendors, which are not always well-suited to the local context.

This dependence has led to a weakening of the country’s currency and has put a strain on the overall GDP.

By reducing its reliance on expensive foreign technology, Kenya can better position itself to compete against global economies.

The government is working to foster innovation and self-reliance in the technology sector, with a focus on developing solutions that are affordable, user-friendly, and scalable.

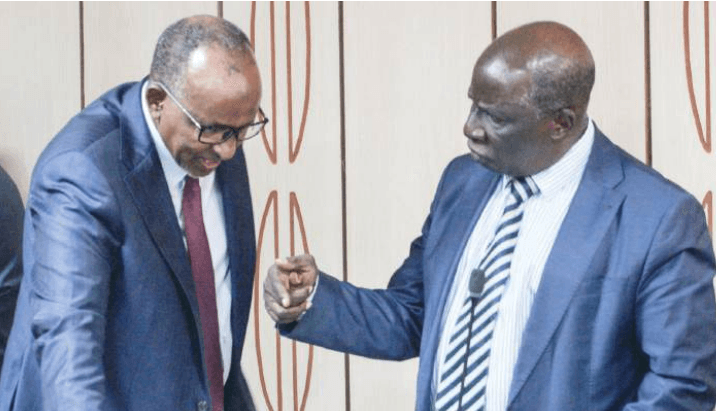

In a significant development, Qore - a leading Banking-as-a-Service platform that delivers a one-stop-shop for fully automated core and digital banking solutions, is partnering with Kenyan financial institutions and is in talks with the government to enable more accessible and efficient financial services delivery in the country.

This partnership will further the government’s policy objectives under the Economic Recovery Strategy (ERS).

They are focused on achieving full automation of financial institution operations, including seamless access to loans and card issuance.

For instance, increased deployment of mobile banking and online platforms can reach more remote areas where traditional banking infrastructures are scarce thus improving accessibility.

In terms of greater efficiency in service delivery, the adoption of automated services is typically faster and more reliable than manual processes.

They can handle large volumes of transactions simultaneously, reducing waiting times and improving customer satisfaction.

For example, automated loan processing can provide instant approvals based on predefined criteria, eliminating the need for lengthy manual reviews.

The end goal is to provide core services to end customers through various channels, such as mobile, internet, and self-service options. Through cloud-based BaaS platforms in Kenya, the cost of financial services software utilization can be reduced by at least 50 per cent.

It can further ease access to payment by supporting the seamless completion of transactions in both USD and shillings.

Despite the recent protests, which have brought attention to issues such as the cost of living and alleged electoral malpractice, Kenya remains committed to its vision for 2030.

With less than six years to go, the country is on track to thrive against global economies and emerge as a leader in the region.

The future looks promising for Kenya as it strides towards its ambitious goals.

Partnership with more companies like Qore is a testament to the country’s commitment to leveraging technology to drive economic growth and prosperity, even in the face of adversity.

The writer is a financial services commentator and communications specialist based in Nairobi.