Low financial literacy and awareness among the Kenyan population is to blame for the low pension coverage in the country which remains at a low of 26 per cent, industry players now say.

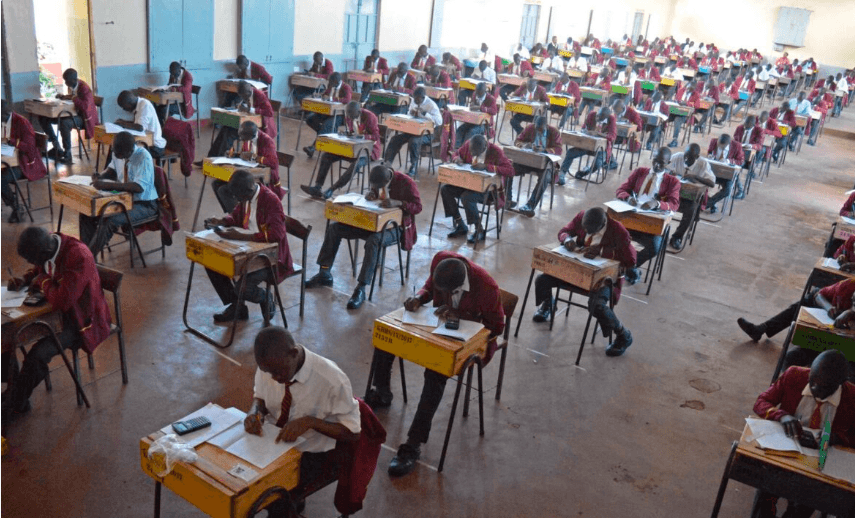

A huge number of Kenyans also work in the informal sector, where pension schemes are either unavailable or underutilised.

Without targeted interventions, these individuals remain vulnerable, lacking the financial safety net that pensions provide, the Association of Pension Trustees and Administrators of Kenya (APTAK) has noted.

The association is advocating for mandatory pension savings for all citizens to ensure financial security and stability for individuals in their retirement years.

“With pension coverage at a modest 26 per cent, far below South Africa’s 66 per cent, there is an urgent need to address these challenges, improve coverage, and ensure that the industry can sustain the financial well-being of future generations,” APTAK president Hosea Kili said.

Another significant challenge is the over-concentration of investments in a limited number of asset classes.

Many pension funds in Kenya are heavily invested in traditional asset classes like government bonds and real estate, due to the difficulty in accessing large-scale transactions in alternative investments, such as private equity or infrastructure.

This narrow focus, APTAK notes, limits the potential for higher returns and reduces the overall diversification of pension portfolios, making them more susceptible to market fluctuations.

Kenya’s pension industry manages assets exceeding Sh1.7 trillion.

During the discussion of Association of Pension Trustee and Fund Manager Association convention on July 29, 2024, Kili further noted that pension schemes must stop financing salaries and recurrent expenditure through government bonds.

“It is time to invest in social impact project that have more impact in line with the constitutional mandate Article 42 and 43, “ he said.

The industry also suffers from a fragmented investment approach where many pension funds operate independently, leading to missed opportunities for pooling resources and investing in larger, more profitable projects.

This fragmentation prevents the industry from achieving economies of scale, which could enhance returns and reduce costs for all participants, Kili noted.

Regulatory and compliance challenges further complicates the landscape, experts say, where smaller pension funds, in particular, struggle to navigate the complex web of regulations imposed by the Retirement Benefits Authority (RBA).

“Compliance can be burdensome, and the costs associated with meeting these regulatory requirements can be prohibitive, especially for funds with limited administrative capacity. Finally, there is a pervasive issue of limited financial literacy among pension scheme members. Many members do not fully understand how pension systems work or the benefits of long-term investment strategies,” APTAK notes in a report.

This knowledge gap often leads to poor financial decisions, such as early withdrawals, which can significantly diminish the value of their retirement savings.

To address these challenges and increase the uptake of pension schemes, several strategies need to be implemented, APTAK notes, among them being the need for enhanced financial literacy programmes.

“Educating the public about the importance of saving for retirement and the benefits of participating in a pension scheme is essential. These programmes should target both the formal and informal sectors, ensuring that everyone, regardless of their employment status, understands the value of securing their financial future,” Kili said.

Incentivizing contributions is another effective strategy, he said, noting that the government and pension funds can offer incentives such as tax reliefs, matching contributions, or bonuses for consistent contributions.

These incentives can motivate individuals to participate more actively in pension schemes, increasing overall coverage.

Leveraging Kenya’s strong mobile money ecosystem can also boost participation, where pension schemes can be integrated with mobile and digital platforms to make it easier for individuals to enroll, contribute, and manage their pension accounts, experts have noted.

This approach is particularly effective for the informal sector, where access to traditional banking services may be limited.

Additionally, introducing micro-pension schemes tailored to the needs of the informal sector can make pensions more accessible.

According APTAK, these schemes could allow for small, flexible contributions, accommodating those who earn daily or irregular incomes.

Employers are also advised to set up pension schemes for their employees to ensure that more Kenyans have access to retirement savings.

Looking ahead, the Kenyan pension industry is expected to experience moderate growth, driven by several factors, among them the introduction of hybrid investment models.

These models, such as the proposed Pack Hunters Club (PHC), are expected to allow pension funds to pool resources while still maintaining some level of independent investment.

There is also likely to be increased diversification across pension portfolios as funds explore alternative asset classes, the potential for stable returns and growth within the sector increases.

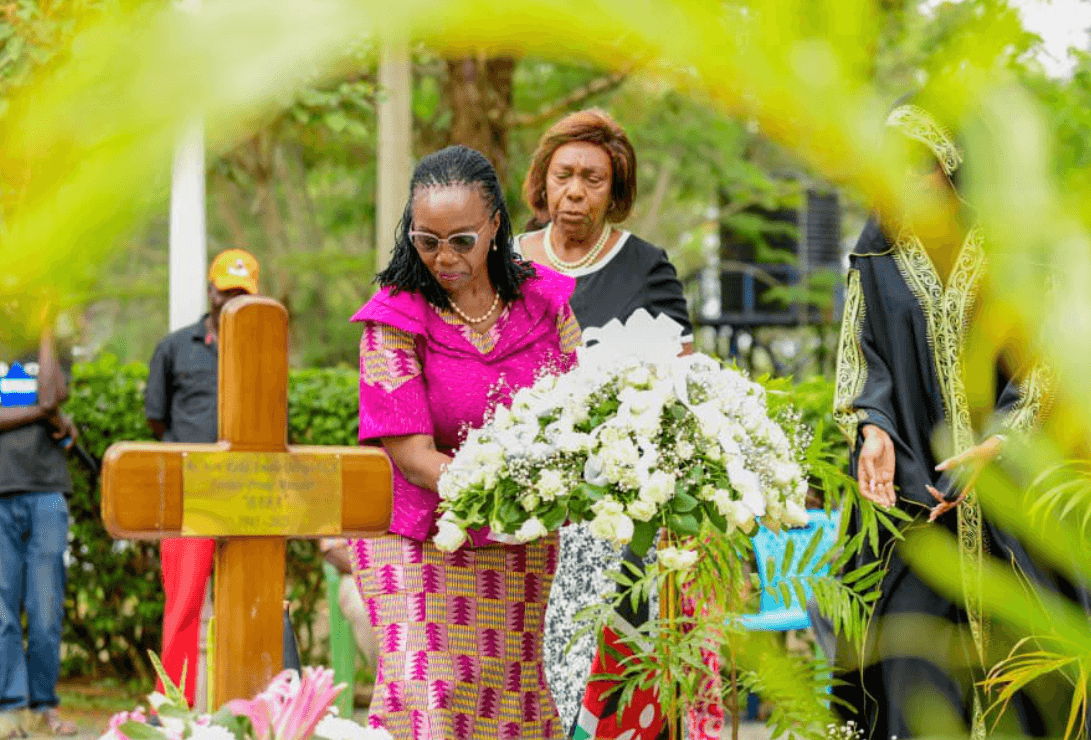

![[PHOTOS] How Suluhu’s swearing in went down](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2F9cbad8a5-9bff-410e-b157-a335c61d6d8d.jpg&w=3840&q=100)