New vehicle sales fell to 859 units in July compared to 901 units in June, latest industry data shows, amid reduced private sector activities.

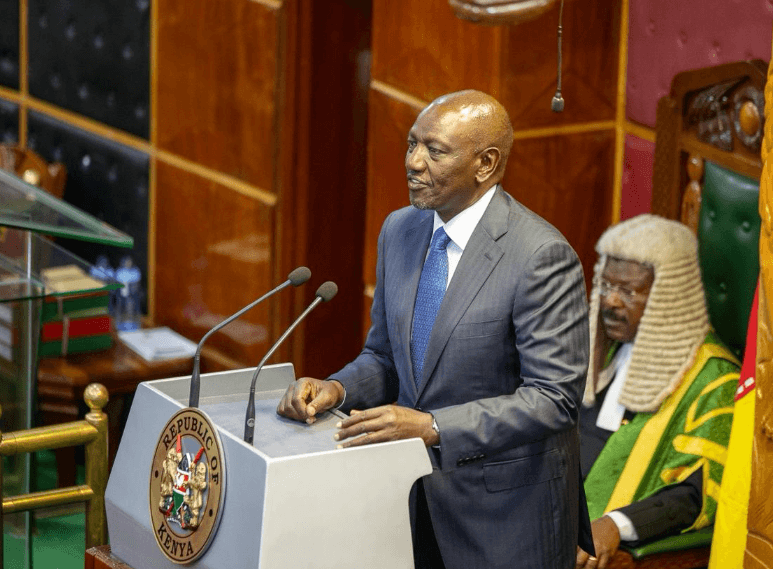

This was on the back of the recently witnessed Gen Z-led countrywide protests which impacted businesses, with the private sector activities dipping to a three-year low.

Kenya Motor Industry Association (KMIA) data shows the 11 players in the Kenyan market had sold a total 5,993 units in the Kenyan market in the seven months to July.

June and July were affected by anti-government protests with the private sector index by Stanbic Bank capturing the headline Purchasing Managers’ Index (PMI) at 43.1 from 47.2 in June.

Readings above 50.0 signal an improvement in business conditions in the previous month, while readings below 50.0 show a deterioration.

According to Stanbic, political instability led to customers' reluctance to commit to new orders, while the chaos somehow blocked access to businesses and prevented them from opening.

These factors caused steep reductions in both output and new orders, while there was evidence of delays in completing outstanding business and receiving purchased items from suppliers.

New car sales in the country are mainly driven by the agricultural sector, construction, retail and transport sectors.

Even so, there was a sizeable sale in new trucks where a total of 328 units were taken, amid somewhat sustained activities in the key sectors.

This was followed by pick-ups (both single and double cabins) where 220 units were bought while small, medium and large buses’ sales were 60 units, 48 units and 22 units, respectively, amid continued investments in the public transport sector.

During the month, Isuzu remained the top dealer accounting for up to 50 per cent of total sales with 430 units, with seven months sales closing at 2,784 units.

It was followed by CFAO with 290 units or 33.7 per cent of total industry sales during the month (2,071 year to July) while Simba Corp came a distant third with an eight per cent share after selling 69 units during the month, and a total of 591 units in seven months.

“We expect continued uptake of locally assembled heavy commercial vehicles, trucks, buses, and other units,” Isuzu Sales and Marketing Director, Wanjohi Kangangi, said noting that easing inflation and stronger shilling against the US dollar will be key drivers.

There has also been increased asset financing pacts between the dealers and institutions to drive the uptake of vehicles, with some offering 100 per cent financing.

For instance, Inchcape Kenya this week signed a strategic MOU with Safaricom Sacco Limited, providing customers access to its range of brands which include BMW, Jaguar, Land Rover and the newly launched Changan Auto.

Under the financing plan, customers get up to 100 per cent financing at a low interest rate of one per cent per month, with flexible repayment periods of up to 48 months.

NCBA and CFAO Motors Kenya are also in a similar deal.

Isuzu on the other hand has a partnership with Corporative Bank of Kenya, with a major target on buses for the matatu industry and schools.

Strong performance in the agriculture sector and construction are expected to continue supporting the motor vehicle industry as large farms and developers take up trucks, prime movers, and pickups, among others.

According to the Central Bank of Kenya CEOs Survey and Market Perceptions Survey conducted ahead of this month’s Monetary Policy Committee, there is sustained optimism about business activity and economic growth prospects for the next 12 months.

“The optimism was primarily attributed to the stable macroeconomic environment reflected in the low inflation rate and stability in the exchange rate, and the continued strong performance of agriculture,” CBK governor Kamau Thugge said.

Nevertheless, respondents expressed concerns about the impact of the recent protests on economic activities, high cost of doing business, and potential impact of increased geopolitical tensions on the economy.

Cheaper second-hand cars mainly imported from Japan however continue to dominate, with the country bringing in an average 6,000 to 8,000 units per month.