Banking sector risk minimizer, the Kenya Depositors Insurance Corporation (KDIC) has embarked on a study aimed at reviewing the minimum initial amount depositors can access immediately in case of bank failure.

This is coming just four years after it reviewed upwards the coverage limit to Sh500,000 from Sh100,000 that was set in 1989, effectively covering 99 per cent of bank depositors in Kenya.

The low compensation had exposed wealthy savers to higher losses in the event of bank closures because the refund was not adjusted to take into account changing economic realities over the three decades.

The corporation told journalists over the weekend that it had settled on actuarial firm, Zamara to conduct the study, which seeks to align the coverage limit with the country’s economic reality.

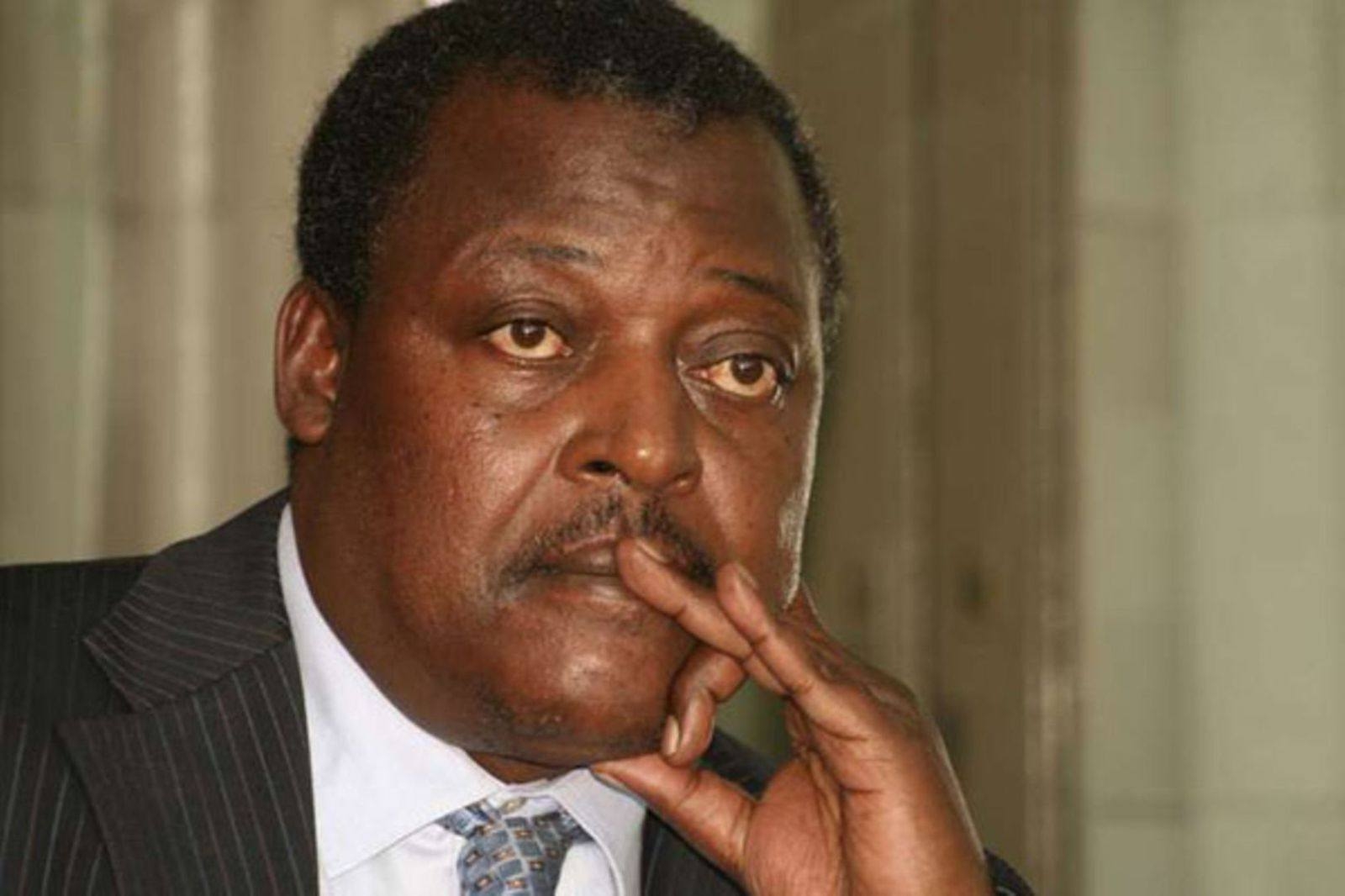

“The survey seeks to establish the fair value of coverage limit, factoring in inflation and other economic realities. The review does not necessarily mean an upward or downward revision,’’ KDIC’s director in charge of Risk and Bank Examination, Paul Manga said.

“As of now, the amount of deposit covered by KDIC is limited to a maximum of Sh500,000, a threshold that covers up to 99 per cent of depositors. Additional funds are distributed as liquidation dividends after realisation of the assets of the failed institution. However, mechanisms are in place to review the same but all efforts must be geared towards mitigating bank failures.”

He hailed the corporation’s progress over the years from merely compensating depositors to a sound risk minimizer, a move that has seen no bank fail since 2016.

The deposit insurance fund, which is run by KDIC, was created to compensate depositors of collapsed institutions and to boost confidence in the banking industry that had been rocked by a series of bank failures in the 1980s and early 1990s.

The Corporation which was initially a unit under CBK, gained its autonomy in 2012 following the operationalisation of the KDI Act, and has since become a yardstick of excellence in matters deposit insurance not just in Kenya but also globally.

So far KDIC has conclusively resolved 9 institutions and is currently handling 2 others in receivership as well as 17 institutions in liquidation.

In 2021, the corporation introduced risk-based premiums where banks rated low risk pay the normal flat rate of 0.15 per cent of their annual deposits to the corporation while those rated high risk will pay 0.206 per cent, an additional 0.056 percent.

Prior to the new mode, the fund was being funded by member banks at a flat rate of 0.15 percent of the total deposits per annum.

The deposit insurance scheme in other countries such as the United Kingdom and the United States of America is relatively advanced in terms of funding and coverage.

For instance, in the US the Federal Deposit Insurance Corporation covers up to $250,000 (Sh33 million) depending on the type of account one holds with an institution. This amount is quite generous and lends credibility to the ultimate objective of deposit insurance.

In the UK, quite apart from insuring deposits, the Financial Services Compensation Scheme extends the protection offered to insurance policies and insurance brokers.

Furthermore, deposits

are covered up to a maximum of

$100,000 (Sh130 million).

Naturally, this kind of protection

comes at a price, as it is commensurate to the high premiums levied

on member institutions.