Commercial banks are rushing to cut borrowing rates after the Central Bank threatened hefty fines to lenders who fail to pass the benefits of lower benchmark rates to customers.

The Central Bank of Kenya’s Monetary Policy Committee (MPC) last week slashed the benchmark rate by 50 basis points to 10.75 per cent and the cash reserve ratio to 3.25 per cent from 4.25 per cent, effectively releasing Sh73.7 billion into the economy.

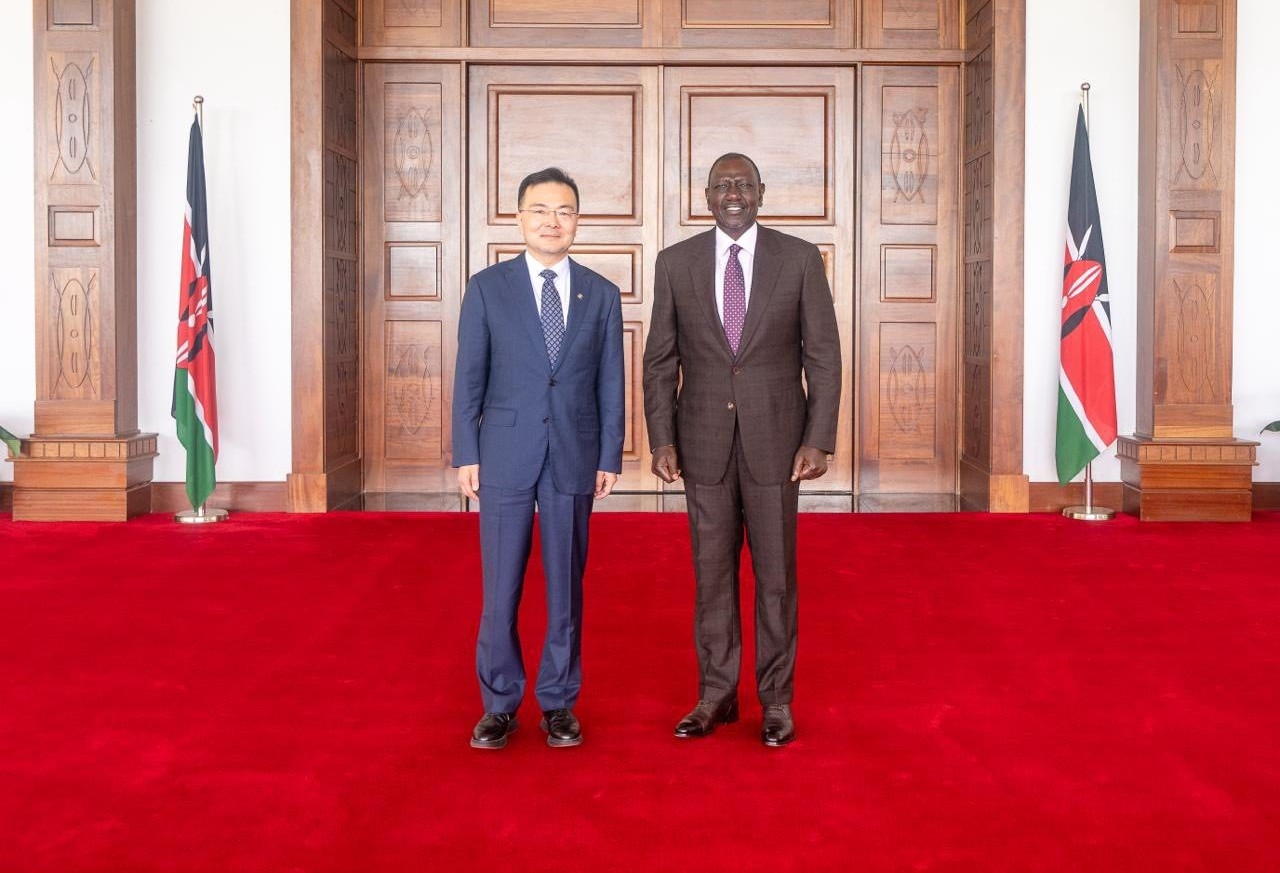

CBK governor Kamau Thugge, said with borrowers struggling under expensive credit, the intervention aims to stimulate lending, support economic recovery, and improve access to affordable credit.

He said lower rates could also help banks manage rising non-performing loans, which have begun to decline in key sectors like trade, real estate, and manufacturing. In an unprecedented directive, the banking regulator said it has launched on-site inspections to ensure banks comply.

“To ensure that banks are implementing the Risk-Based Credit Pricing Model (RBCPM), CBK has embarked on an on-site inspection of banks to ascertain that they are reducing their interest rates in line with the RBCPM,” Thugge said.

“Under the amendments to the Banking Act recently enacted by Parliament, any bank that has not passed on the benefits of reduced cost of funds to reduce lending rates will be penalised by the law.”

On Tuesday, Kenya’s biggest lender in terms of assets, KCB lowered its lending rate from 15.6 to 14.6 per cent, effective February 10, 2025.

New rates will apply on older loans starting March 10.

“The final lending rate is based on a customer-specific margin, adjusted to the base rate, in line with the approved Risk-Based Credit Pricing Model,” KCB said in a statement.

“This applies to all existing and new Shilling -denominated facilities and excludes fixed-rate credit facilities.” KCB follows in the footsteps of Co-operative Bank Kenya, which cut its average rate from 16.5 per cent to 14.5 per cent, passing the much-needed rate cuts benefit to borrowers.

Even though the banking lobby, the Kenya Bankers Association (KBA) expressed its reservation on dropping rates in quick succession, with its chairperson who doubles as MD NCBA Bank, John Gachora terming CBK’s order as not feasible, the regulator is not swayed.

“If we just follow the risk-based credit pricing model, there is no reason why the lending rates to the private sector should not come down. There is a provision now, to charge the banks by penalties that are three times the amount the individual banks have benefited by,” Thugge said.

Banking sector experts are however divided on the matter, with those supporting the regulator saying the move will increase lending to the private sector, which has been dropping in recent days.

Banking sector analyst Brown Soita told the Star that businesses are shying away from costly loans, opting to cut on production to avoid solvency.

‘’This directive is timely and good for the economy. The regulator should go back to the rate cap regime.’’ Tonny Kimotho of Dunhill Capital who said that high lending has crippled economic growth; citing high unemployment rate and non-performing loans echoed his sentiments.

According to CBK, commercial bank lending to the private sector contracted by 1.4 per cent in December 2024 compared to the previous year, mainly reflecting exchange rate valuation effects on foreign currency-denominated loans following the appreciation of the shilling.

An investment banker Juliet

Lutenyo disagrees with them

saying that too much capital will

trigger high cost of living as banks

hawk loans.