Multiple levies by counties along Kenya’s Northern Corridor segment, cargo clearing system downtimes and insecurity in some countries are hurting regional trade, industry players now say, despite improved efficiency at ports and borders.

Poor road network in countries such as DR Congo is also adding to the bottlenecks hindering smooth trade in the region, the Mombasa Port and Northern Corridor Community Charter secretariat has said.

There has been numerous levies by counties in Kenya on cargo passing through their territories as they seek to boost internal revenues.

Counties along the corridor which connects the Port of Mombasa to the hinterland include Mombasa, Taita Taveta, Makueni, Machakos, Nairobi, Nakuru, Uasin Gishu and Busia.

The latest incidence was in August where Busia County was pushing to levy all road motorised transport , where it wanted Sh1,000 per entry per truck for foreign vehicles and Sh400 per truck per entry into the county for Kenyan trucks.

This is in addition to a Sh500 parking fee for trucks and trailers, a levy that is charged by other counties.Trucks are parting with up to Sh3,200 in some counties as parking and entry fees.

These are countering progress being made in both local and transit cargo handling where cargo dwell time at the Port of Mombasa has improved to an average 3.5 days, with turnaround times between the port and the landlocked countries averaging six days.

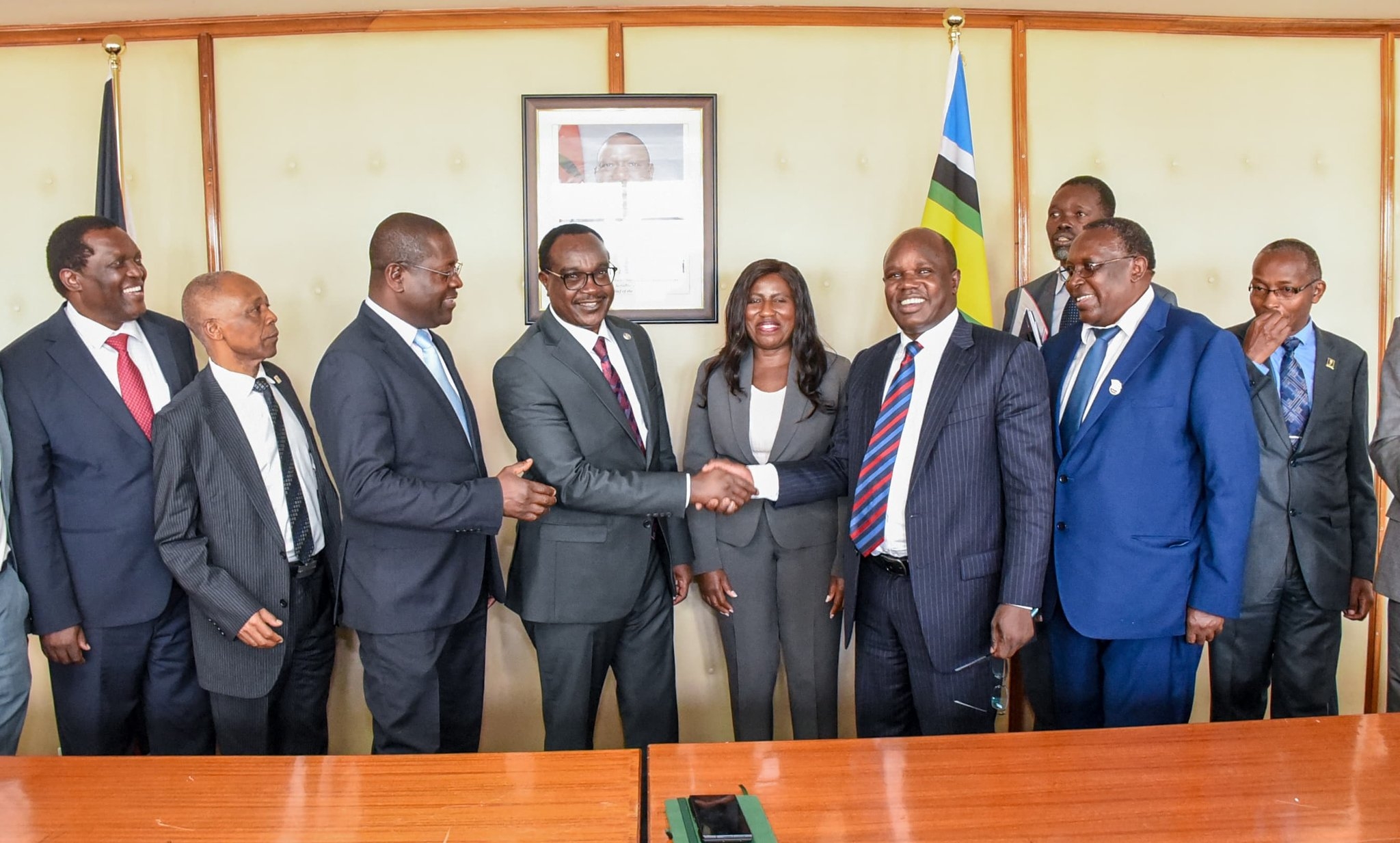

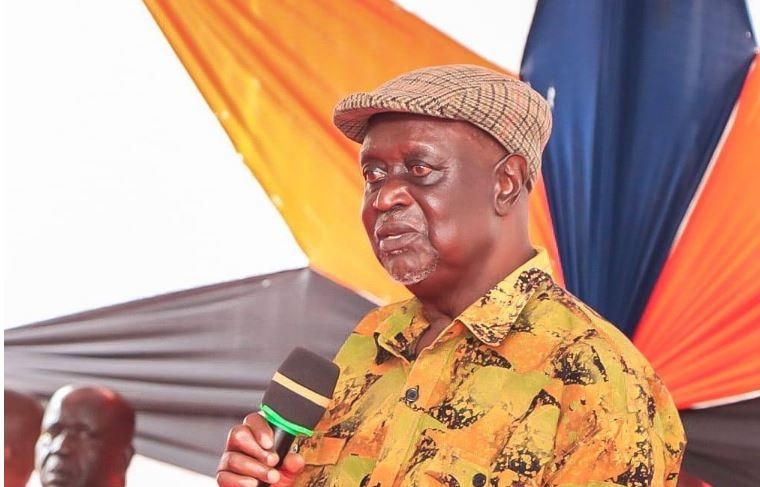

“Transit cargo should be treated differently. Counties should not be another barrier to trade,” Northern Corridor Transit and Transport Coordination Authority (NCTTCA) Executive Secretary, John Deng, said.

He spoke at the Nairobi Inland Container Depot during a tour of the facility, as part of the secretariat’s assessment of the corridor between Mombasa and Malaba.

Shippers Council of Eastern Africa CEO Agayo Ogambi said while counties are entitled to raise revenue, they should not hurt smooth movement of goods.

“There is need for a balance between revenue generation and trade facilitation,” Ogambi said.

Importers and exporters have also been concerned over frequent downtimes on Kenya Revenue Authority’s customs system saying it is affecting cargo clearance and denying government revenues.

The Integrated Customs Management Systems (iCMS) has had back-to-back downtimes in recent months, disrupting cargo clearing at major Kenya points of entry, exposing traders and importers to extra costs and losses.

The secretariat has called on regional member states to streamline tax policies and facilitate cargo movement, as Mombasa Port continues to grow handling capacity amid growth in trade volumes in the region.

This is on the back of increasing economic activities. According to Deng, Mombasa is projected to handle 50 million tonnes from the current 36 million tonnes.

The port is expected to set a new record this year evidenced by the latest throughput performance for the period January to October 2024, where it handled 33.8 million tonned compared to 29.6 million tonnes same period last year.

The main driver of this performance , according to KPA managing director William Rutto, was containerised cargo which increased by 3.1 million tonnes while liquid bulk also increased by 697,648 tonnes.

In terms of container traffic, the port handled 1.6 million TEUs (containers) against 1.3 million handled in the same period in 2023, a 24.2 per cent growth.With just two months remaining, the Port which last year cumulatively witnessed container traffic 1,623,080 TEUs, is on track to exceed its revised target of 1.8 million TEUs and is likely to achieve a remarkable 1.972 million TEUs in container traffic, management has noted.

Current projections

for the end of 2024 indicate that the

Port of Mombasa will handle approximately 40.535 million tonnes

in cargo throughput, 480,241 TEUs

in transshipment traffic and 13.416

million tonnes in transit traffic.