Tower Sacco has recorded a growth of over Sh2 billion in total assets and deposits in the last eight months.

This was revealed to members on Monday during a special general meeting to review the society's performance in the past eight months.

The meeting held in Ol Kalou Catholic grounds in Nyandarua county, the members were also presented with the Sacco budget for the next financial year.

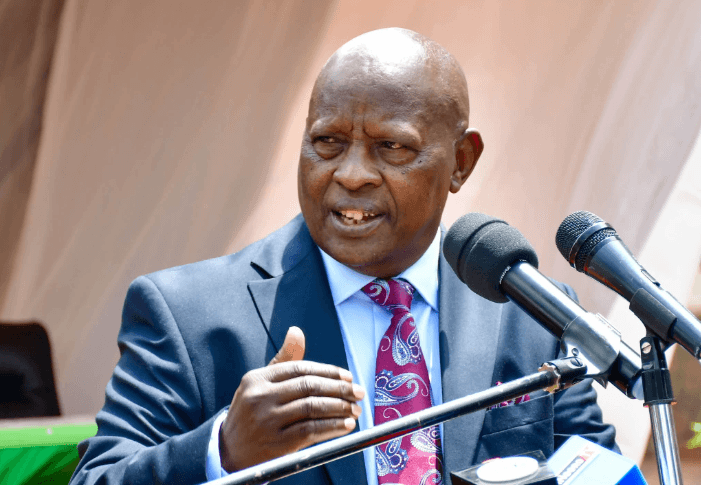

Sacco chairman Peter Ngugi said they have a total asset base of more than Sh20 billion.

He said by August 31, 2023, the share capital and deposits were Sh18,213,714,624 compared to Sh15,427,629,191 in the same period last year.

"This is a growth of Sh2,786,085,433 or 18 per cent. I encourage members to embrace the saving culture by prioritising savings. Saving has a return at the end of the year and boosts on loan eligibility. Wealth creation is realised through continuous accumulation of savings," Ngugi said.

He said the society has disbursed Sh8,218,735,893 in loans compared to Sh6,568,230,776 in the same period last year.

"This is a growth of Sh1,650,505,117 or 25 per cent," the chairman said.

He said the total outstanding loans amount to Sh17,418,836,465 compared to Sh14, 417,891,856 in the same period last year. This is an increase of Sh3,000,944,609 or 20 per cent.

Ngugi said the Sacco realised revenue of Sh1,469,925,279 as at June 30, 2023 compared to Sh1,267,919,731 in the same period 2022. This is a growth of Sh202,005,548 or 16 per cent.

The surplus increased by 12 per cent of Sh975,059,565 as at June 30, 2023, compared to Sh869,004,481 which was realised as at June 30, 2022, translating to a growth of Sh105,763,116.

In membership, Ngugi said the society had 216,382 members by August 31, 2023, compared to 188,115 in the same period last year, a growth of 28,267 or 15 per cent increase.

"Due to the need for affordable credit and the importance of savings, people within the region and in the diaspora have embraced the need of being Sacco members," he said.

Ngugi urged young people to join Saccos, saying it is one way of achieving financial freedom.

He said that the period under review was faced by harsh economic conditions that led to high cost of living.

"There has been a hike in prices of goods and services that led to low borrowing power by members. The increase in prices of fuel and other basic commodities had an adverse effect on the members borrowing and savings, a factor that has led to increased cost of operation," Ngugi said.

The Sacco Societies Regulatory Authority annual supervision for year 2022 published in August this year, ranked Tower Sacco position eight out of 176 deposit taking Sacco’s nationally in terms of assets.

It was also among top three in dividends and interests on deposits for the last five years as it offers 20 per cent and 13 per cent respectively.

"The board of management is still focused on the target of achieving an asset base of Sh30 billion by 2026 when the Sacco shall celebrate its 50th anniversary," Ngugi said.

The members approved the Sacco's 2024 budget where total income is expected to be Sh3,791,816,000 and an expenditure of Sh397,200,000.

He said the Sacco has partnered with various insurance companies to enable member’s access insurance services in a convenient way and has done vetting of the companies on behalf of the members.

"Members can access any insurance cover from any of our branches. They include life assurance, general insurance that includes motor vehicles and buildings, education cover, among others," Ngugi said.

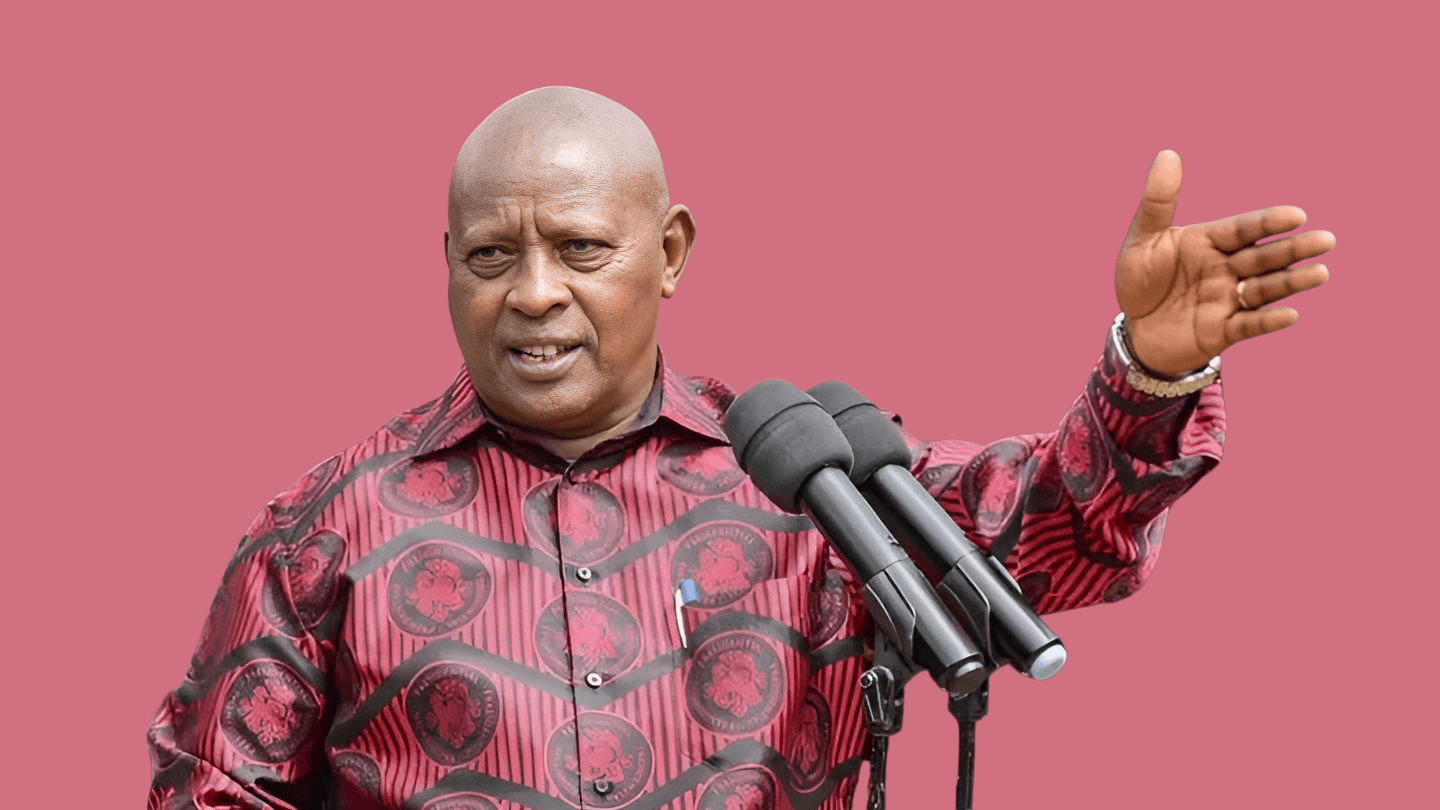

Tower Sacco CEO Patrick Njenga said they have launched a 'Heroes Card' in recognition of the elderly members for their sacrifice and support of the cooperative sector.

“The board found it fit to award the elderly members with a card for their loyalty and patronage of Sacco services," Njenga said.

He said that the card will be issued to all members who have attained the age of 65 years. It will be similar to the current Fosa card in terms of size and personal details but will bear the name 'Heroes Card' and a magenta background.

Beneficiaries of the card should never queue anytime they visit the Sacco offices for service as members will be identified immediately they produce the card.