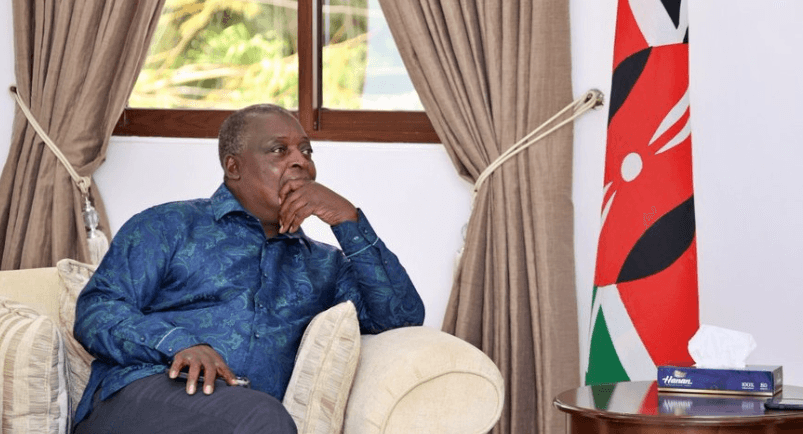

Mohamed Ousmane, an ustadh, has been living in Madogo ward, Bura constituency, in Tana River county almost his entire life.

This area is a flood-prone zone.

“But it wasn’t always like this. In the past, it used to take time before we experienced floods, which used to come 10 years apart,” he said on Wednesday.

He said things were normal with businesses booming until climate change kicked in and floods started becoming the norm.

For residents, the River Tana passing through their land is a tale of joy and pain experienced in near equal measure depending on the season.

On sunny days, the river supports pastoralism, crop farming and fishing.

However, on rainy days, the river breaches its banks causing flooding, which often destroys people’s livelihoods rendering them destitute.

Ousmane remembers the events on diverse dates between September 2023 and May 2024, with pain written all over his face.

He chokes on his words as he narrates how he lost virtually everything he owned when the River Tana broke its banks twice during this period.

In a flash, his home was gone and so was his livelihood and his sense of security.

The raging floodwaters had rendered his efforts useless, leaving him in a precarious position.

“The floods were relentless,” he recalls, his voice heavy.

“It felt like an unending nightmare. My rental houses and livestock, my main sources of income, vanished overnight.”

Ousmane is just one of thousands of residents whose lives were upended by the floods.

Most of his neighbours are low-income earners, eking out a living through informal trade, small-scale farming and pastoralism.

The floods not only destroyed homes but also disrupted livelihoods, education and the overall fabric of the community.

Schools were forced to relocate, leaving learners without access to education.

According to the Kenya Red Cross Society, at least 10,200 households were affected by the floods in Tana River county.

Many were forced to move to camps and rescue centres. The future looked dark and uncertain.

“Life has become hard. I had plenty of livestock, especially sheep. All were washed away,” Ousmane said.

“My house was destroyed. The school where my children went was moved seven kilometres away and now I cannot send them to school every day because I have no means."

“Sometimes they go to school and many times they don’t. That has affected even my mental state. I feel bad seeing my children at home,” he added.

However, thanks to a memorandum of understanding between the Tana River county government and insurance firm Britam, there is reprieve for Ousmane and 299 other households.

In early May 2023, they were registered for the Britam Mafuriko, a product designed to cushion Madogo residents from the effects of floods as a pilot programme.

But many months later, with no word from the programme implementers, Ousmane and 299 households gave up, thinking it had been another empty promise by government officials as usual, with the floods raging.

“But while in the camp a few weeks ago, we were told our payment is almost out. We were happy. We had been told we would get Sh50,000 if the level of water reached a certain point. That point had been surpassed by the waters,” he said.

The money would be given in three tranches, the thinking being if given as a lump sum, most of the beneficiaries would misuse the money.

Ousmane got Sh12,000 each for the first and second tranches before getting the rest in the third.

“I was happy. I bought food, school uniform and my children went to school. When I got the rest, I added my little savings and rebuilt my rental houses,” he said.

Liza Maru, the head of innovation at Britam Micro-insurance Company, said the Britam Mafuriko, a flood insurance programme started in 2022 in support of FST Africa, which did a feasibility study on floods in Tana River county, is a game changer.

“We created a product that was designed using satellite data and riverline information with the help of some parties such as Oxfam as well as Risk Shield and we were able to pilot it to communities in Madogo ward in Tana River in the last two rainy seasons,” Maru said.

She said they are in Tana River to assess the benefits of the programme to the people and look for ways to scale it up based on the feedback.

They make payouts based on the weather as opposed to the usual insurance cover where officers assess the damage on property to make compensation.

“Here we are using the weather as well as the river level to trigger payouts. If the level of the river is very high then we are able to trigger a higher payout compared to when the river level is much lower,” Maru said.

She said the key idea is to make the product affordable to the poor people of Tana River.

Maru said they have covered households very close to the river.

She said, however, the people not on the pilot programme feel left out because the main target was the people close to the river.

The company is looking for ways to incorporate those people far away from the river as well.

“Our mission is to scale up the programme across all households in the region,” Maru said.

"At the moment, the pilot programme covers Madogo ward because we are looking at a specific river gauge close to the ward."

The scale up will cover Hola and Garsen.

“So far, we have paid Sh15 million to 300 households, each getting Sh50,000,” she said.

Maru said their main partners have been FST Africa who conducted the feasibility study and came up with the product design. AB Consultants helped explain the product to community members.

Oxfam financed the first level of premiums and Risk Shield did the product design and pricing.

Swiss Re ensured they have capacity and made the payouts

The Tana River government has been roped in to support enrolment.

“We want to leverage a lot more on partnerships and make the product more affordable. We are cognisant that the current premium may not be reachable by all the members of the community,” Maru said.

The seasonal nature of the rainfall is also a factor to consider and Maru said they want to design it further to make it seasonal too.

The product is the first flood insurance product in East Africa.