The higher premium raises the possibility that many Kenyans will continue to default on their premiums.

The higher premium raises the possibility that many Kenyans will continue to default on their premiums.

Self-employed and jobless Kenyans are, on average, paying Sh600 to the Social Health Authority, the Ministry of Health has said.

The amount is double the Sh300 minimum that was promised by the current government during the 2022 campaigns.

It is also higher than the Sh500 that Kenyans in the informal sector paid to the defunct National Health Insurance Fund (NHIF).

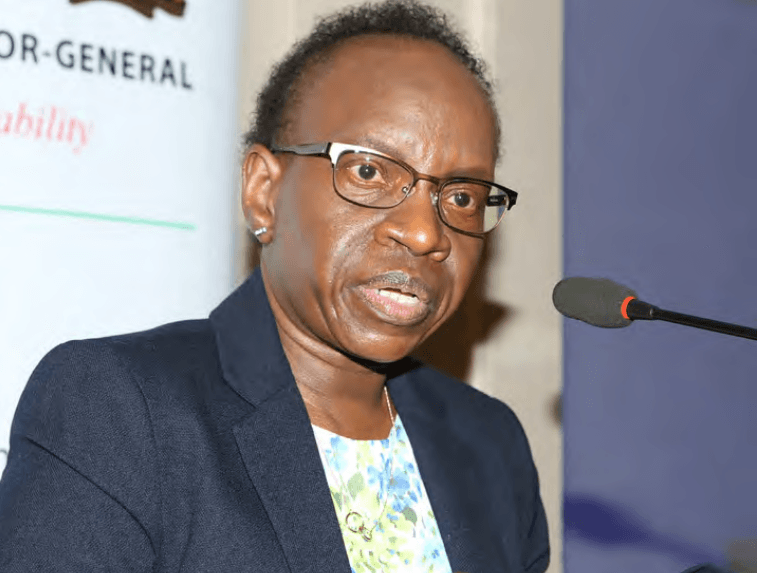

Patrick Amoth, the director general for health, said some Kenyans in the informal sector are paying the base rate Sh300 but many others are paying more than Sh600.

“Our average means testing figure for now is about Sh600 Kenyan per household. Of course, we are alive to the fact that we have indigent households in this republic, and the government is committed to be able to pay for their premiums,” he said at a media forum that the Ministry organised to update Kenyans on state of health.

The higher premium raises the possibility that many Kenyans will continue to default on their premiums. SHA offers opportunity for Jua Kali and jobless Kenyans to appeal the higher premiums, but appeals below Sh1,000 are typically not considered.

The defunct NHIF experienced massive defaults as 80 per cent of members expected to pay Sh500 were unable to pay every month. For instance, in 2021/2022, while NHIF membership grew from 13.94 million to 15.4 million, only 6.7 million, mostly those employed, paid premiums.

Those in the informal sector used to pay voluntary contributions of Sh500 a month to the NHIF while those employed contributed between Sh150 and Sh1,700 every month, depending on the salary scale. Consequently, NHIF failed to hit its Sh90.57 billion revenue target from premium collections that year.

The Kenya Kwanza regime lowered to Sh300 the lowest paying informal member when SHA was inaugurated last year. The idea was that most poor Kenyans would pay about Sh300 to SHA every month.

The national poverty headcount rate is at 39.8 per cent in Kenya, implying that over 20 million individuals are unable to afford food and other basics, according to the Kenya National Bureau of Statistics. On Wednesday, Amoth noted SHA was introduced to reduce the health financial burden to Kenyans.

“Every year, Kenyans face severe financial hardship due to out-of-pocket payments at the point of care, pushing many into extreme poverty,” he said. He said as at January 13, at least 17.8 million individuals had registered with SHA, 13.2 million being new members enthused by the promised lower premiums and benefits.

“While the households have done well in registering the adults- we are performing dismally in the adding of dependants. We have received feedback that the biggest issue is capturing birth certificates,” he said.

However, so far, most payments to SHA are still coming from employed Kenyans, who are remitting 2.7 per cent of their salaries. Amoth placed the figure of the employed members at 3.2 million.

“Employers are a greater contributor for the resources required to ensure achievement of qualified care. So far, we have been able to onboard more than 70,000 employers, that is more than what we have in the defunct NHIF system. And these employers have declared more than 3.2 million employees. And 68 per cent of these employers have already made their contributions,” he said.

SHA CEO Robert Ingasira said the new outfit collected at least Sh20 billion between October, 2024 and January 2025 and paid out Sh9 billion to health facilities. “And we continue to disburse to hospitals. This week alone, we have disbursed Sh2.6 billion to health care providers,” he said.

SHA is expected to collect about Sh148 billion from Kenyans within 12 months, compared to NHIF, which collected about Sh80 billlion every year.