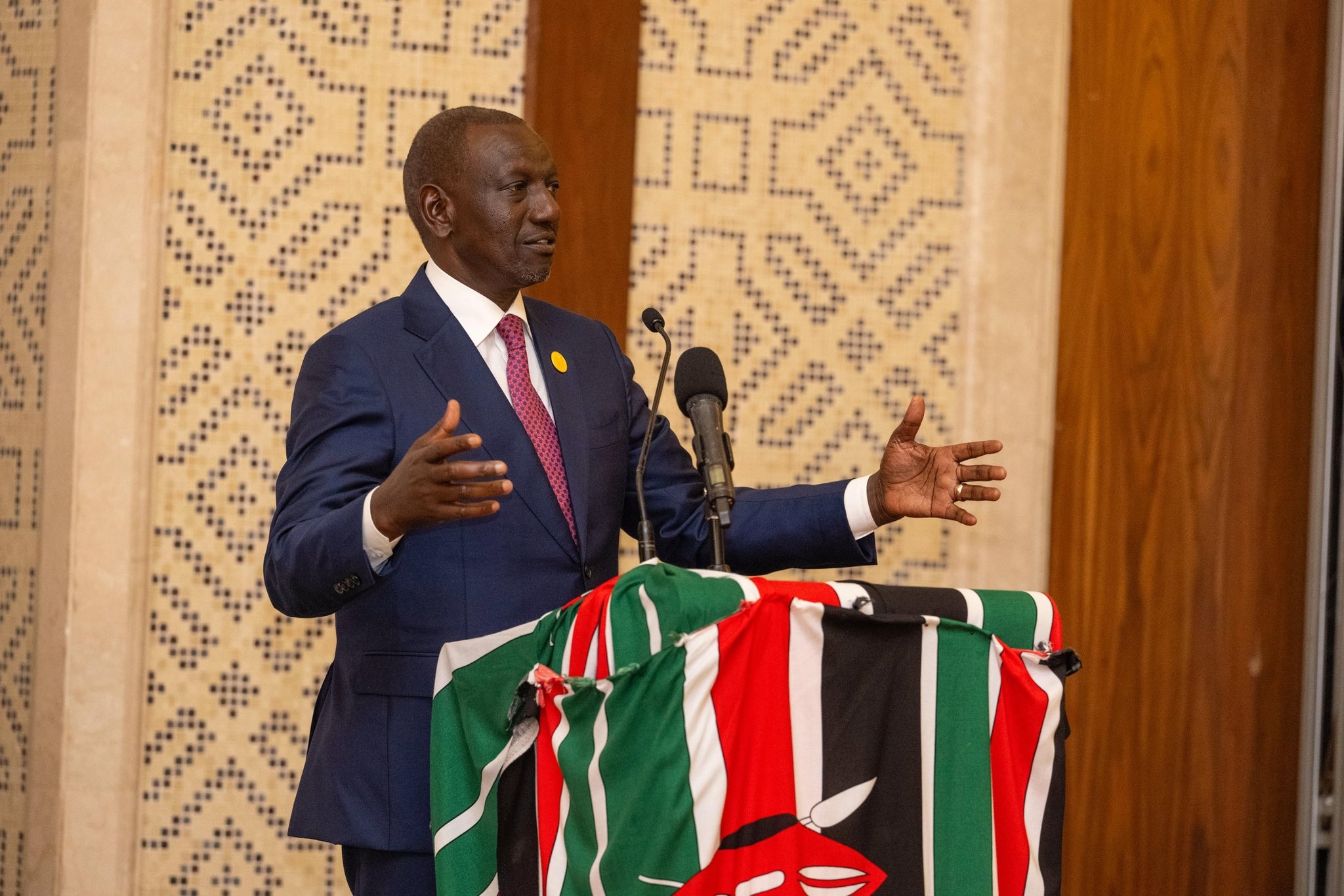

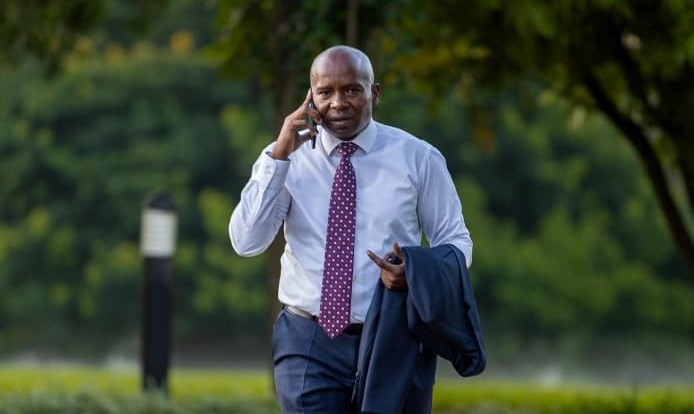

Former Agriculture Minister Kipruto Arap Kirwa now says that President William Ruto should not be written off after signing the Finance Bill into law.

According to Kirwa, Ruto has overcome many difficult situations before, and in the same way, he can overcome this one.

The former minister insisted that what President Ruto needs to do is to seal corruption loopholes.

He added that the head of state should also go easy on borrowing as well ensuring he manages the resources of the country better.

"What I know about President William Ruto, he has survived many tricky situations. Unlike Boni Khalwale, I am reluctant to write the obituary of William Ruto in so far as the Finance Act. If he is able to seal the loopholes of corruption and able to manage the resources better, he is likely to come out strong," Kirwa said.

"If he continues borrowing the way he has, despite being in denial. Then it is going to be dangerous for him."

Ruto assented to the Finance Bill, 2023 effectively making the Finance Act, 2023.

While it was a bill, many Kenyans termed proposals contained in it as punitive to the taxpayer.

However, most of the proposals were passed without any amendments despite the opposition party in the National Assembly putting on a spirited fight.

The Kenya Kwanza has the majority in the National Assembly.

Following the signing by Ruto, it means it will now be a requirement to pay 1.5 per cent of gross salary towards the contribution of the Affordable Housing Project.

This will be a new deduction on Kenyan payslips as of July 1, 2023.

On petroleum products, Kenyans will now have to pay double from 8 per cent to 16 per cent.

Digital content creators will part with 5 per cent of their earnings, down from the 15 per cent proposed before the amendment of the Bill.

Others are the betting and insurance withholding tax, which will be charged at 12.5 per cent and 16 per cent respectively.

This means if you bet with Sh100, some Sh12.50 of your primary stake will go to the tax man.

The five per cent tax on wigs, fake beards and eyebrows and other beauty products was done away with.