Trade in cryptocurrency has not been outlawed in Kenya as there are no regulatory frameworks currently in place, the Central Bank of Kenya (CBK) has now said.

It has, however, maintained that the cryptocurrency remains an illegal tender in the country.

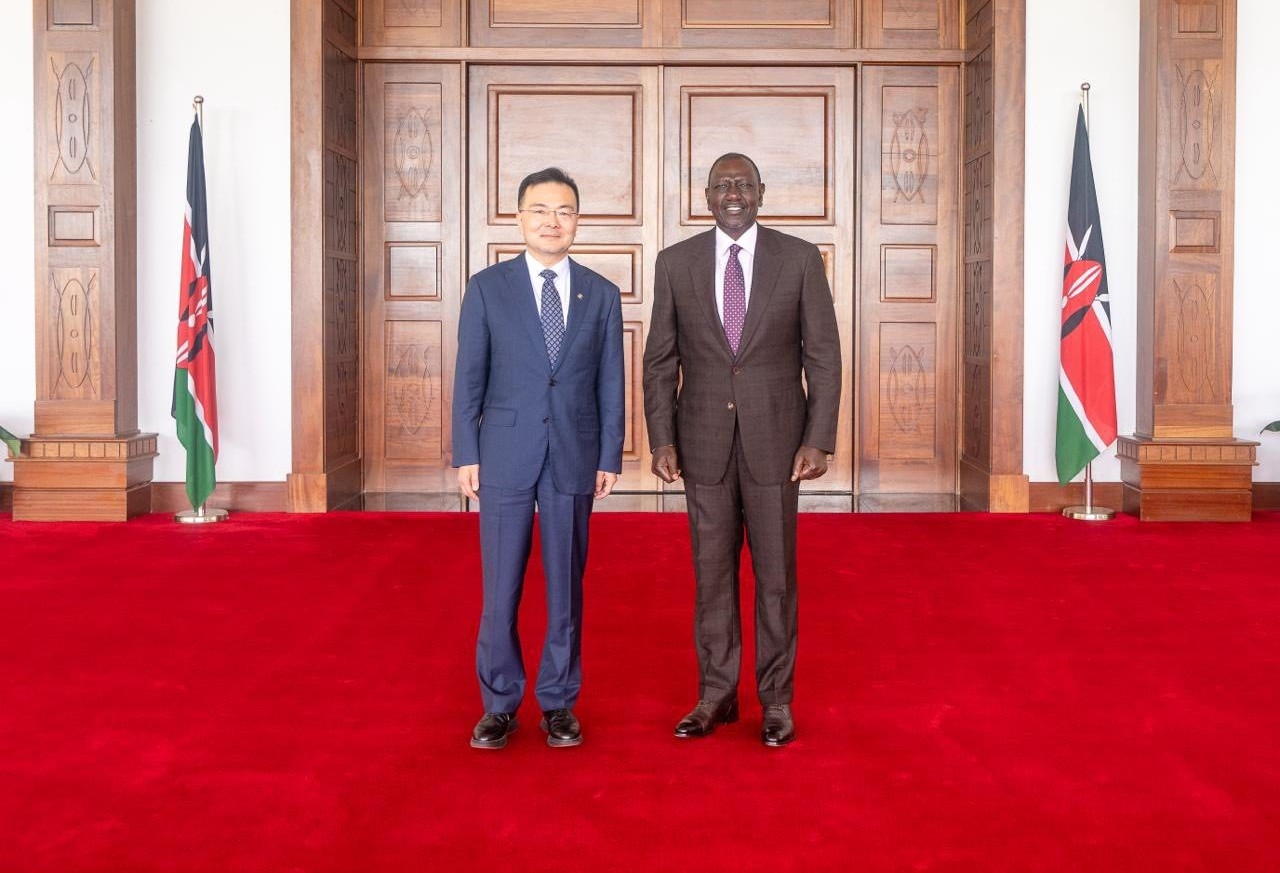

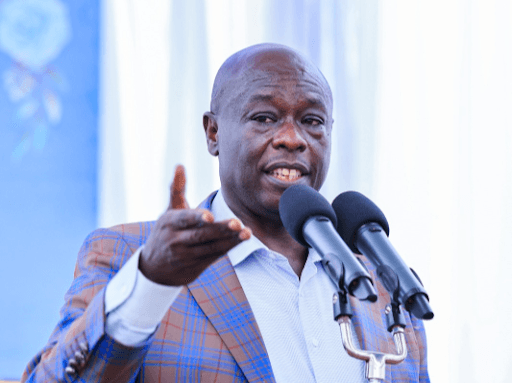

Appearing before a parliamentary Ad hoc committee inquiring into the activities of Worldcoin, CBK Governor Kamau Thugge submitted that as an institution, they have no mandate with the licensing or regulation.

“To my knowledge, trade-in cryptocurrency has not been made illegal in Kenya and so the fact that there is trade in it is not itself illegal,” said Thugge.

He said the only concerns they have had as a country in seeking to address emerging challenges surrounding it was on the risks which includes fears of money laundering and terrorism financing.

To protect Kenyans from its vulnerability, Thugge disclosed that as a monetary authority, they have issued notices to warn about its trade-in it.

"When the issue of crypto became more prominent in the country in 2015, CBK issued a public notice warning Kenyans to be careful of the new legal asset whose owners were unknown and a public institution that is behind it,” he stated.

In the same year, he added, CBK issued another circular to commercial banks warning them against involving themselves in virtual assets.

“In 2018, together with other regulatory agencies, we issued another notice warning Kenyans not to deal with financial products and services that have not been licensed, so we have never licensed cryptocurrency or bitcoin,” he remarked.

Thugge who also appeared on behalf of Treasury Cabinet Secretary Njuguna Ndung’u further highlighted steps that have been taken so far to embrace digital currency in the country.

While asserting that having a CBK digital currency is not a priority at the moment, the Governor pointed out that Kenya was currently doing well, especially with the current system of payment which includes Mpesa and financial inclusion.

“We are cautious. We want to maximize opportunities while minimizing risks because this is an area that is rapidly changing so that we are not left behind on this technological progress and innovation,” he explained.

In 2022, he noted, it issued a discussion paper that sought the potential applicability of CBK digital currency in the country.

The paper elicited hundreds of responses from nine counties which included individuals, governments, commercial banks, payment and technology service providers, academia, the legal profession and international development partners.

“Responses we got was that it increases efficiency, transparency as well lower costs while disintermediation of banks, high implementation costs, technology, and financial exclusion and cyber threats being cited as risks involved,” he added.

In June 2023, a technical paper detailing the trade in the crypto regulations with lessons on global standards status and proposed actions was also published.

Various jurisdictions, he said, have already adopted policies on dealing with crypto assets which underscores financial ability, money laundering and terrorism financing risks.