Experts have shredded significant tax proposals by President William Ruto’s administration terming them as punitive and with a potential to deny most households even the basic needs.

In separate presentations before the National Assembly Finance Committee, the tax experts took issue, especially with the excise duty proposals in the Finance Bill, 2024.

The Institute of Economic Affairs, ICPAK, Institute of Public Finance, singled out proposed motor vehicle tax, excise on vegetable oils, and eco-levy as posing negative implications.

ICPAK, for instance, singled out the impact of the eco-levy on bottled water saying it will make the product more expensive.

“The resin used to manufacture bottled water attracts levy of Sh150 per kilo. If we add the eco-levy, it will make water more expensive as the container itself is already attracting tax,” the accountants’ body said.

On eco-levy, the experts lamented that there was no coherent framework for determining impact of various goods on the environment.

The other argument was that the Sustainable Waste Management Act, 2022, has already provided for a situation where manufacturers compensate for pollution.

The team thus sought a review of the proposal to determine the appropriate rate of levy, adding that it would be hard to determine which goods should appear on the list.

The experts also held that an introduction of 25 per cent excise tax on vegetable oils will make the products in the value chain more expensive.

Accountants are also opposed to the proposal that payment of excise tax be made within 24 hours saying it would strain the cash flow for businesses.

“Goods are not paid for immediately they are produced. We should go to the old regime of having the dues settled by 20th of every month,” ICPAK said.

They stated that Treasury sticks to the National Tax Policy which provides that excise tax should focus on goods with negative externalities.

Proposed taxation on banking services, beyond excise duty which is going up to 20 per cent, has also been opposed by the experts.

“The increase to 20 per cent is punitive. We advise that we retain at 15 per cent if it is for revenue collection,” ICPAK said.

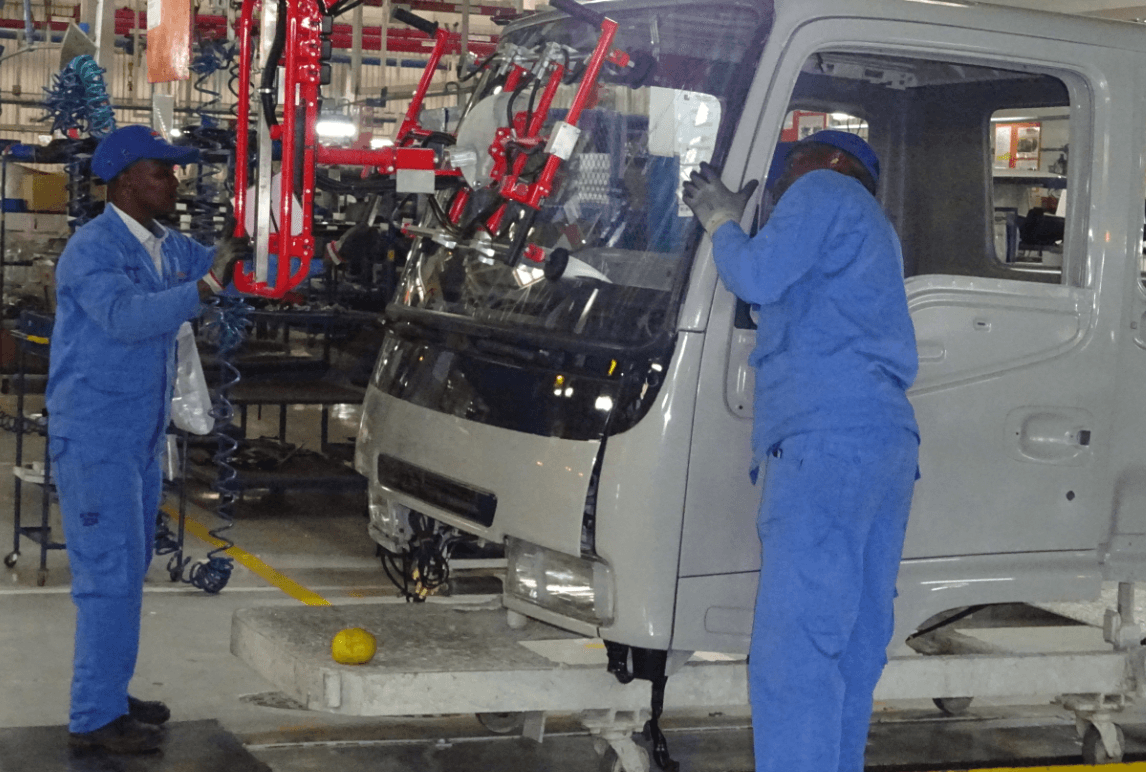

Deloitte and Touche, for its part, proposed that motor vehicle tax be reduced to 0.5 per cent and the floor be based at Sh1,000 and maximum of Sh20,000.

“This is not a good idea. We have to recognise that when a car is imported, duty was paid so was VAT, railway development levy, import declaration levy, and import duty.

“Most of the vehicles are personal, therefore, levying 2.5 per cent tax would be punitive. We advise that MPs should consider possibly imposing a Sh2 road maintenance levy increment per litre of fuel instead of taxing vehicles. We stand to collect more and will avert litigation,” Deloitte said.

The experts also opposed the imposition of withholding tax on supplies to goods to government.

Experts also sought that a threshold be put for tax on non-residents with business presence in the country.

For the IEA, the motor vehicle tax of 2.5 per cent has no legitimate economic purpose, and that the design would be the question should MPs insist on the same.

The institute urged Parliament to consider it as a lump sum tax as charging it as proposed would introduces inequity.

“Private individuals will have to raise the cost. Let us consider a nominal, say Sh5,000, as this would provide for certainty and the ease of payment would be clear,” IEA said.

They also opposed taxes on bread saying the statistics show that most Kenyans are unable to afford bread.

“At least 30 per cent of Kenyan children under five years are stunted. This is because cash and incomes in Kenya households are insufficient to feed children,” the institute said.

“Parliament should consider morality of taxing food. We should be cautious about it. Inflation figures shows Kenyans are yet to recover from impacts of Covid-19.”

The experts further urged for consistency of tax application stating that distortions created in every year’s finance bills should be done away with.

"Make Kenya’s taxes coherent…consider whether there is value in applying excise tax," IEA urged.

Committee chairman Francis Kimani, who is Molo MP, said they would consider the proposals when reporting on the bill.

This was after the experts lamented that their views are barely considered by Parliament.

"We have always allowed proposals made in forums. We conceded on many proposals in the last year's finance bill. We will do the same this year because it is in our interest to ensure Kenyans views are factored," the MP said.