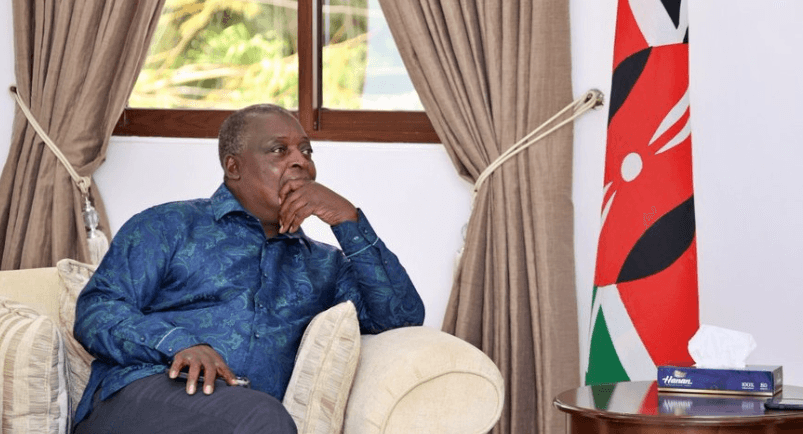

Azimio leader Raila Odinga has called for the Finance Bill 2024 to be subjected to radical surgery saying Kenyans will be way worse off if it’s enacted as it is.

In a statement on Friday, Raila said most of the tax proposals in the Bill “are as insensitive as they are callous”.

“The Finance Bill 2024 fails the taxation dictums of predictability, simplicity, transparency, equality and administrative ease and fairness,” he said.

“It is worse than the one of 2023, an investment killer and a huge milestone around the necks of millions of poor Kenyans who had hoped that the tears they shed over taxes last year would see the government lessen the tax burden in 2024,” Raila added.

The Finance Bill 2024 has proposed a raft of tax measures as the government seeks to raise Sh302 billion of additional revenue of the Sh3.35 trillion revenue target in the 2024-25 financial year.

Among the measures include raising the cost of mobile money transfer fees from the current 15 per cent to 20 per cent and impose a 16 per cent VAT on foreign exchange transactions.

This will make it costly to send and receive money and kill diaspora remittances, Raila said.

The Bill further proposes to stop zero-rating bread and impose a 16 per cent tax and 25 per cent excise duty on cooking oil.

Other taxes include a 16 per cent tax on cane transportation and the introduction of an Eco tax on items such as diapers.

He said most of the tax proposals target the poor who are already struggling under heavy taxation introduced by the Finance Act, of 2023.

“Again, it’s a fact that the poor often have the most children in our country. Tax on diapers hits them in a place where they have little alternative.

Further, he said tax on edible oil will make the cost of cooked food go up and affect millions of Kenyan casual labourers who rely on food served in kiosks and vibandas.

This, he said, is beside the imminent collapse of the insurance industry should insurance and insurance services be taxed at 16 per cent.

“Then there is the most weird and punitive of them all; the Motor Vehicle Tax. It’s a proposal that beats all logic. A motor vehicle is the most taxed item in the country today,” Raila said.

He termed the tax as retrogressive and double taxation saying 40 per cent of the cost of vehicles in Kenya comprises taxes including the fuel levy and payment to acquire number plates.

Raila pointed out that despite the already heavy taxation Kenyans are already subjected to, the public services have largely remained on their knees and the Kenya Revenue Authority has consistently failed to meet its revenue targets.

The end result of the proposed new taxes, he said, will be scaring investors and inflicting more pain on the poor who expect relief.

“We see no positive result that the country which is a net importer of nearly everything can derive from the proposal to raise Import Declaration Fees from 2 per cent to 3 per cent. The impact is that the cost of goods will go up.

“Parliament must therefore inject radical surgery on the outrageous proposals in the Finance Bill 2024. We will not accept the mistakes and pains inflicted on the Kenyans by Finance Act 2023 to be continued into 2025 through Finance Bill, 2024,” Raila said.