Parliament is investigating circumstances under which the Energy ministry received an extra Sh290 million from the National Treasury for a donor funded project.

An audit flagged the extra budget after it emerged that while the ministry budgeted for Sh90 million, it received Sh378 million, being an overfunding of Sh288 million.

In the query, Auditor General Nancy Gathungu expresses dissatisfaction with the management’s explanation that the overfunding was as a result of the project erroneously receiving funds meant for another entity.

Members of the Public Accounts Committee, in a meeting with Energy PS Alex Wachira, said the transaction was suspect.

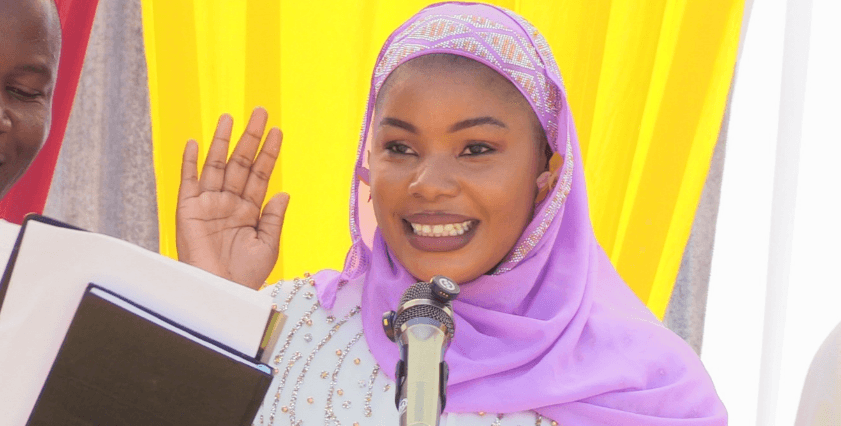

The committee in a session chaired by PAC vice chair Tindi Mwale (Butere MP) questioned how the error occurred and whether it was a common happening in government transactions.

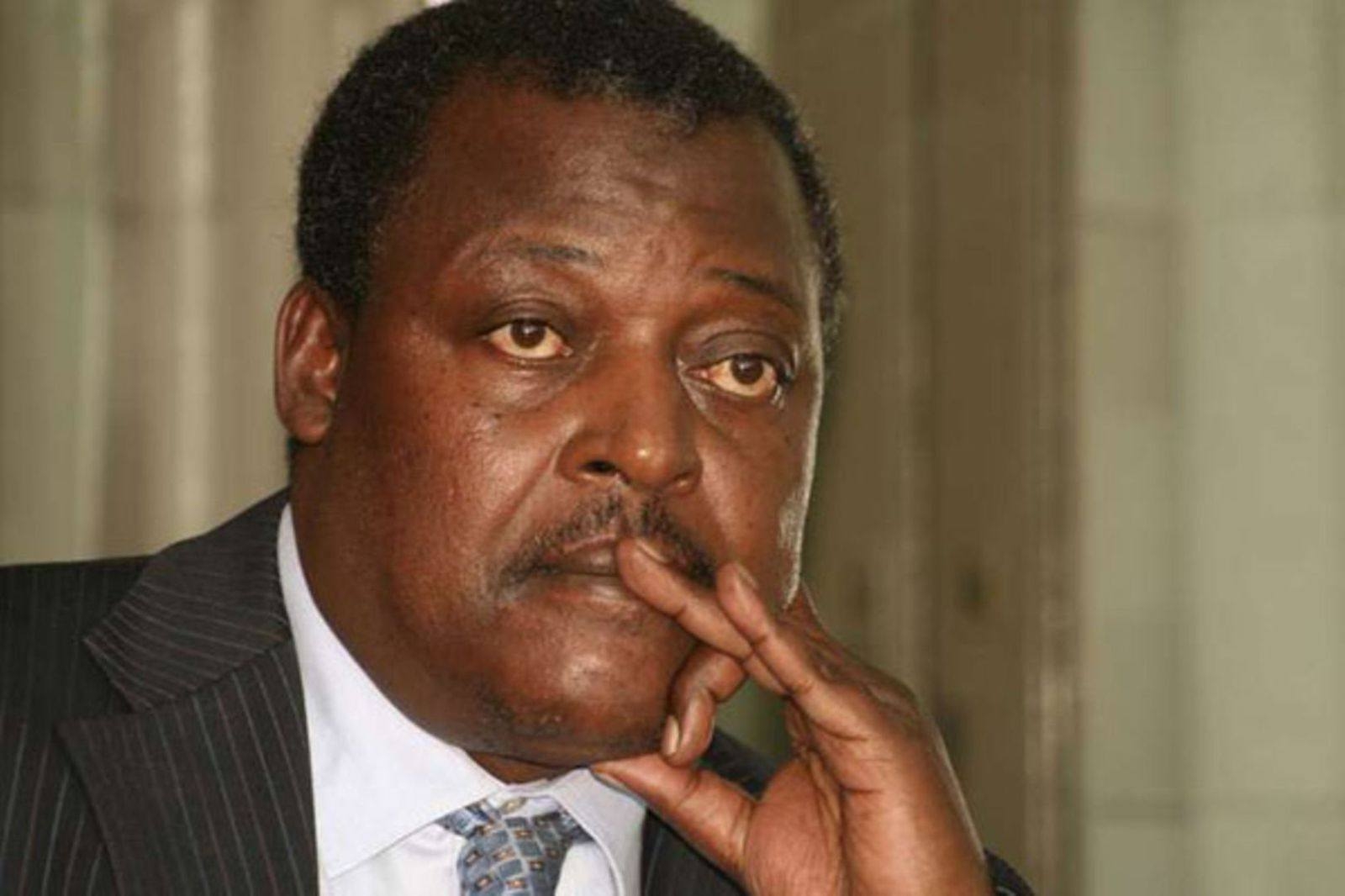

“You said you erroneously got Sh288m. How did the generous error arise? Which other entity is involved?” Rarieda MP Otiende Amollo asked.

The lawmakers said the explanation by the state department was inadequate, after it emerged that its written response made no reference to the extra amounts.

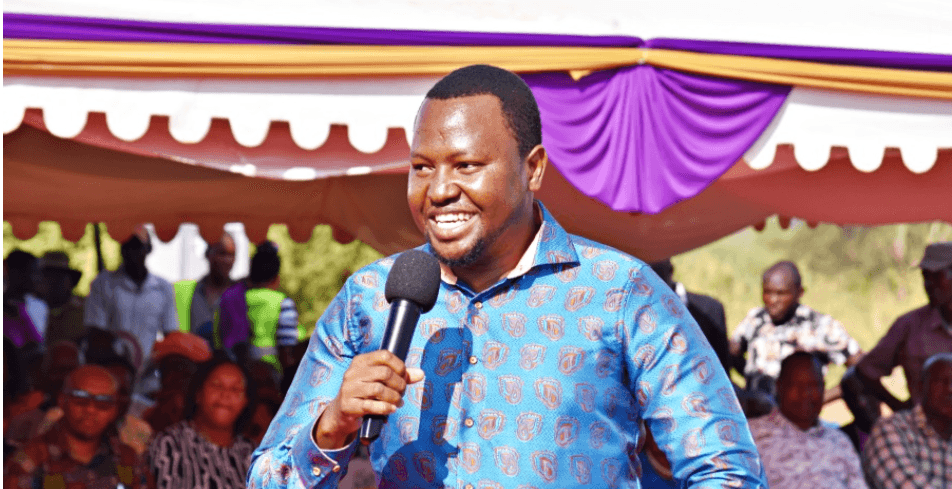

“You could have attached evidence to explain this further. The question we are asking is; did it go back to the sender or did it disappear from the Treasury?” Soy MP David Kiplagat asked.

MPs took issue with the department for glossing over the matter and now want to be furnished with the agreements signed between the Treasury and the World Bank on the same.

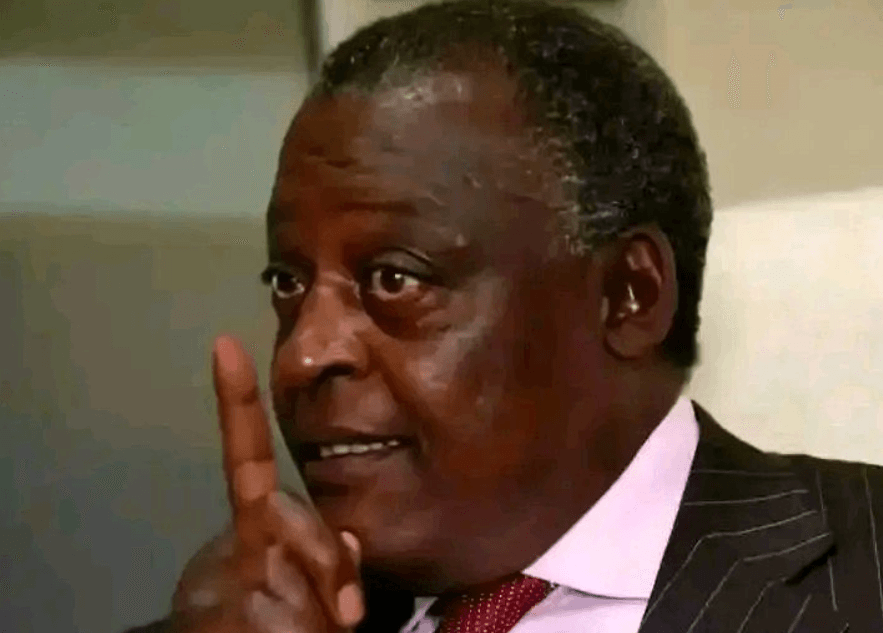

Kibwezi West MP Mwengi Mutuse said, “It would be helpful to provide the financial agreement to determine the terms.”

The committee is also probing why the provided funds were not spent fully as envisaged.

Auditors queried why - out of the Sh90 million - only 50 per cent was utilised.

The ministry explained that the under-absorption was as a result of complexities in the procurement process.

PS Wachira said the project in question is now complete and that the funds were returned to the National Treasury.

Procurement procedures were undertaken using the World Bank specifications, he said.

“The guidelines required that we get clearance at every stage. An approval at one stage would then define what to be done next.”

But Amollo said the response was not congruent with the written explanation.

“If it is about the delay not just say complexity of procurement, this would invite a further explanation. The written explanation doesn't have that detail,” he said.

Treasury officials at the meeting said the cases of mistaken overfunding were not common.

“We intend to believe it is erroneous.”

MPs also queried why a solar power project funded by the World Bank was delayed, leading to underfunding to the tune of Sh328 million.

On this, the department said land acquisition delayed project take off as the land in question, which was to be given by the county government, had no title deeds.

“We couldn't go to the National Treasury because the project was yet to take off hence the underfunding,” Wachira said, even as MPs prodded him to acknowledge that Treasury underfunded the project.

The committee noted that the solar project was wrought with a number of issues beyond the errors in budgeting.

A row over taxation is also under probe after it emerged that the organisation that implemented the project disputed tax demands.

While the SNV Netherlands claimed that they were tax exempt, KRA and the Treasury have insisted they pay not only VAT but also withholding tax.

Questions arose after the department paid part of the tax claim (Sh38 million) against an assessed claim of Sh88 million.

MPs want answers on what the department used a basis to make the partial payment.

“On what was the Sh38 million based? When an invoice is raised by KRA and pay in part, you acknowledge it is due,” Amollo stated.

“KRA takes the position that consultant must pay tax, but the latter says they are exempt. Is it on the contractual agreement? We must have that assessment,” he added.

The department’s explanation that the matter remains pending and no payment has been made to the consultant was also dismissed.

“How come you say they were paid in June 2023?” the committee asked, further asking why the department had not disclosed the outstanding amounts as pending bills.

Mutuse said, “This speaks to the murkiness of financial agreement. For a foreign company to claim non-payment of tax, there must be a double taxation agreement between Kenya and the concerned country.”

The committee was told that the consultant felt they were not supposed to pay taxes, took their complaint to KRA and a ruling was made that they are to pay 5 per cent withholding tax.