A new audit has unearthed how proceeds of crime recovered from suspects of graft and money laundering are being mismanaged.

The review by Auditor General Nancy Gathungu has flagged infractions in the fund putting Asset Recovery Agency managers on the spot.

Her report says proceeds of crime are not properly recorded, are inaccurately valued and some cannot be traced.

Gathungu says a review of the accounts for fiscal years 2018-19, 2019-20, 2020-21 and 2021-22, revealed several anomalies.

“The four financial statements were audited in January, 2024 and the anomalies observed included inaccuracies in the financial statements, unconfirmed forfeited movable and immovable assets and overstated preserved assets,” she says.

The auditor says the managers did not submit bank reconciliation statements to the National Treasury and did not maintain the fund records.

She says managers did not maintain a register for the forfeited and preserved assets.

Management also did not maintain records for the rental income collected from the preserved and the forfeited assets, contrary to regulations.

Accounting officers should brief the National Assembly on measures taken to prepare the financial reports that reflect a true and fair financial position of the entity.

“In the circumstances, the management was in breach of the law,” Gathungu said in the report for the year to June 30, 2023.

The report obtained by the Star says management did not support balances to the tune of about Sh704 million.

“Management did not provide the cash book, corresponding bank confirmation certificate and bank reconciliation statement in support of the balance.”

“In the circumstances, the accuracy of the reported cash and cash equivalents balance of Sh703,959,433 as at 30 June, 2023 could not be confirmed,” Gathungu said.

The auditor said the accuracy and completeness of the financial statements could not be confirmed after variances were noted in what was reported in the statements and the recomputed values.

Five movable and three immovable forfeited assets of undetermined value had also not been valued at the time of the audit. The books reported they were worth Sh402 million.

On overstated preserved assets, the audit established that the assets balance of Sh1 billion was incorrect. There were assets worth Sh2.9 million which had not been incorporated into the fund’s financial statements as equity.

“In the circumstances, the reported preserved assets balance of Sh1.07 billion as at June 30, 2023, is overstated,” Gathungu said.

On records, the fund management did not maintain fund records during the year under review.

Regulation 100 of the Public Finance Management (National Government) Regulations, 2015, requires accounting officers to keep in all offices concerned with receiving cash or making payments, a cash book showing the receipts and payments.

They are also to “maintain such other books and registers as may be necessary for the proper maintenance and production of the accounts of the vote for which he or she is responsible.”

But the fund was found without the records and was adjudged as in breache of the law in the ensuing circumstances.

Gathungu is also concerned that the fund managers did not submit bank reconciliation statements for accounts held at the Kenya Commercial Bank for each month.

The PFM regulations require accounting officers to ensure bank reconciliations are completed for each bank account held by an accounting officer every month.

A copy of the reconciliations should be sent to the National Treasury within the first 10 days of any new month, with a copy to the Auditor General.

ARA has also been called out for failing to implement a court order on depositing funds in an escrow account.

The audit cited a 2026 order which required the fund managers to deposit Sh8.8 million in an anti-corruption suit but only Sh1.2 million was deposited.

Gathungu says the management was in breach of the court order after it emerged that the remaining Sh7.6 million was yet to be collected at the time of the audit.

The Proceeds of Crime and Anti-Money Laundering Act, 2009, mandates the Asset Recovery Agency to combat illicit cash flows.

It is the collections from the enforcement by the agency that Gathungu says have not been accounted for adequately.

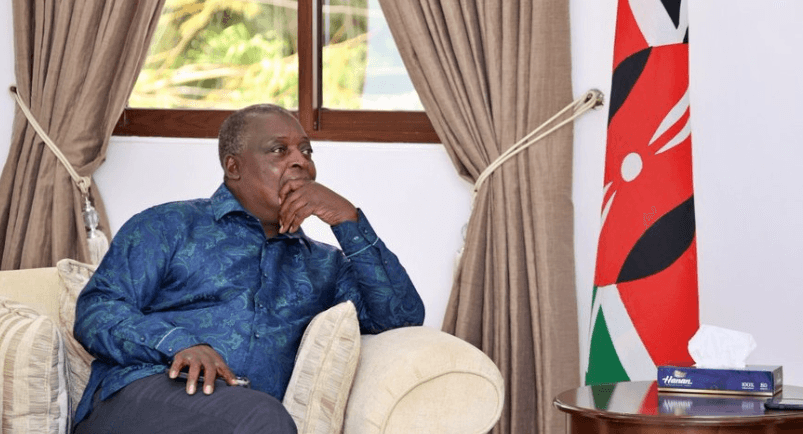

Ethics and Anti-Corruption Commission has also been recovering proceeds of graft, of which it handed back to the state assets worth Sh5 billion on Wednesday.

Among the assets handed back included a parcel of land valued at Sh1.4 billion, belonging to the judiciary which was grabbed in Kisumu.

Land parcels belonging to the police, state law office and Uasin Gishu Referral Hospital were also returned, besides cash assets totaling Sh511 million.

Properties belonging to municipalities of Bungoma, Kakamega, Kisii, Kabarnet, Nakuru and Kitale were among the assets EACC restored to the state.