The government is mulling bringing on board three firms for the upgrading and expansion of Kenya’s power transmission lines under private-public partnership.

This as it grapples with financing constraints amid rising demand for electricity supply.

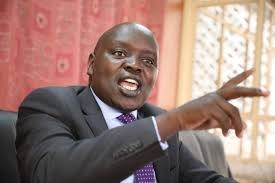

Energy CS Opiyo Wandayi said the country is developing new generation capacity like wind, solar and geothermal to meet rising demand but lacks adequate transmission to get the power to the people and industries.

“In simple terms, generation without transmission is like having water but no pipes to deliver it. And in our case, the pipes need serious upgrading and expansion,” Wandayi said.

The firms include India’s Adani Energy Solution Limited, Morocco’s Africa50 and their Indian partner, PowerGrid.

Speaking on Monday during a public participation engagement with stakeholders at Kawi complex in Nairobi, Wandayi said it has become necessary for the government to engage the three entities to bridge a Sh645 billion financing deficit for upgrade and expansion of transmission infrastructure in the country.

“The total investment requirement for the 20-year Transmission Master Plan is estimated at $5.3 billion (Sh683.86bn). So far, we have secured or committed around $305 million (Sh39bn) through Development Finance Institutions (DFIs) and EPC (Engineering, Procurement and Construction) financing frameworks. This leaves us with a financing gap of about $5 billion (Sh645 billion),” Wandayi said.

The CS said over the years, the mandate to plan, build, operate and maintain Kenya’s transmission networks and regional interconnectors has been managed by the Kenya Electricity Transmission Company Limited – Ketraco.

He said since 2008, Ketraco has been heavily reliant on Development Finance Institutions (DFIs) and the government for the development of the transmission lines.

“However, and I need to be very clear here—the challenges we face today require us to think beyond traditional financing methods,” Wandayi said.

The CS said the proposed onboarding of the foreign financiers will be guided by the PPP Act, 2021.

Section 40 of the Act provides for Privately Initiated Proposals (PIP), while Section 42 provides for steps on evaluation of submitted PIPs.

Section 43 provides for the preparation of the project development report.

Wandayi said the government has settled on the three foreign entities given the time and complexity involved in securing traditional loans, which often have long lead times from conception, appraisal and signing.

“We simply do not have the luxury of time,” the CS said, adding that all three companies have proven track records.

He said Africa50 has an IPP in Nigeria, Egypt, Senegal in the power sector and ongoing transmission PPPs in Gabon, Zambia and Mozambique; a PPP bridge project in DRC, several PPP projects for joint border posts in West Africa, ongoing IPPs under development in Mozambique and Angola.

PowerGrid of India, Wandayi said, has a development portfolio of over 175,000 circuit kilometres of power transmission lines in India and has undertaken PPP projects in Bangladesh and Nepal.

“They have done many project management consultancy roles for transmission projects in Kenya, Uganda, Ethiopia, South Africa, Mozambique and elsewhere,” Wandayi added.

Adani Energy Solution Limited, on the other hand, has a cumulative transmission network of 21,783 circuit kilometres of power transmission lines and 61,686 MVA transformation capacity.

“They privately own more energy infrastructure than Kenya, Uganda and Tanzania combined,” Wandayi revealed.

He added that Adani, one of the largest private sector power transmission companies operating in India, serves over 13 million consumer meters in Mumbai and the industrial hub of Mundra SEZ.

“In Kenya, their current project proposal covers approximately 222 km 400 kV Gilgil-Thika-Malaa-Konza transmission line and associated substations. 400/220/132kV substations at Rongai and approximately 99km 220kV D/C Rongai-Keringet-Chemosit transmission line and associated substations,” Wandayi said.

The CS said Adani has also proposed to cover approximately 98km 132kV Menengai-OI Kalou-Rumuruti transmission line and associated substations and 132/33kV Thurdibuoro substation.

He said the projects are expected to be completed between 2026 and 2027 as per the Ketraco Master Plan and the Least Cost Power Development Plan.

Wandayi lauded the proposed PPPs saying they will save the public undue frustration traditionally associated with delays in public projects because the companies only get paid if they perform.

He said there is also the benefit of risk transfer where a substantial portion of the risks associated with the projects, including financing, site acquisition, design and construction and operation and maintenance risks will be borne by the private sector.

“And the added benefit is that the government can focus on other critical areas, such as food security and social services, while the private sector helps us meet our energy infrastructure needs,” he said.

“And let us not forget that the public also stands to gain through innovative project designs and local content provisions that ensure job creation for Kenyans, especially in project areas,” Wandayi added.

Wandayi said once completed, the perennial serious challenges of inadequate transmission capacity, insufficient evacuation capacity for renewable energy, system reliability issues, increased technical losses due to overloading and limited transmission coverage in remote areas will be a thing of the past.

“This is the future we envision—a future where Kenya’s energy sector not only meets the demands of today but is fully prepared to power the industries and homes of tomorrow,” Wandayi said.