Budget experts who advise Parliament have cautioned President William Ruto against introducing new tax measures and policies, saying it is not a guarantee for improved revenue collections.

The Parliamentary Budget Office points out that despite the country witnessing annual changes in tax policies over previous years, they have not translated into higher revenue collections.

“This points to a fundamental problem, in that simply introducing new tax policies does not guarantee better compliance or higher revenue,” the Dr Martin Masinde-led team said.

The experts have also sounded the alarm of costly tax expenditures and spelled the danger tax amnesties poses to revenue targets.

The team has strongly advised that future tax policies have to consider the ripple effects of such measures to avoid undermining revenue collection in the targeted sectors.

PBO said as a result of the drastic untested measures, the government has been missing the set tax collection targets.

In the year to June 2023, the government missed its targets by Sh123.6 billion while it missed the 2024 target by Sh205 billion.

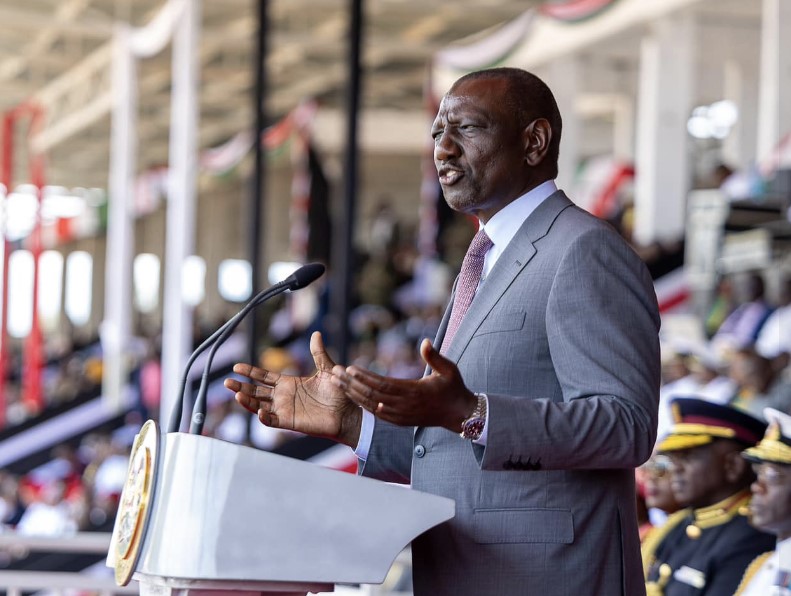

President Ruto’s administration faced a revolt this year, which culminated to the storming of Parliament as Kenyans expressed their anger over new taxes.

This forced the President to drop the Finance Bill, 2024, which the government was banking on to raise additional revenue to the tune of Sh344.3 billion.

Kenyans, in the now famed Gen Z protests, rejected the introduction of new taxes among them a motor vehicle tax and eco levy on plastics.

The National Treasury has equally admitted there is a problem with overtaxing a few Kenyans and leaving majority not paying their fair share of taxes.

Recently, Treasury CS John Mbadi said the government was developing a system to enhance tax visibility, with a focus on improving collection of Value Added Tax.

But for the experts, the government should instead focus on improving tax administration.

“The loss of the Finance Bill gives the government a perfect opportunity to consider the improvement of tax administrative systems. This decision marks a significant shift in the government’s approach to revenue collection.”

PBO says this could be by enforcing existing policies better, enhancing data analytics and employing technology to simply tax processes and improve compliance.

“Stricter enforcement and continuous evaluation of these policies will help address such challenges and improve the outcomes in tax administration,” PBO said.

In the bold report to MPs, the experts are also concerned that the government is burdening taxpayers with tax refunds and exemptions.

The argument is that the expenditures which include exemptions, zero-rating, and deductions, which significantly reduce the potential revenue from VAT.

An earlier report by KRA to MPs revealed that the reliefs are skewed in favour of big corporate names and multimillion-dollar entities.

National Treasury data reveals that in 2022, tax expenditures increased to about Sh395 billion, a growth of more than Sh100 billion from Sh292 billion in 2021.

A considerable portion of Sh310 billion was attributed to VAT expenditures driven largely by domestic VAT exemptions and VAT application on fuel.

Kenyans forked out Sh46 billion to refund income tax, Sh14.8 billion on fees and levies and Sh13 billion for import duty.

“The growing cost associated with these measures also raises concerns about the sustainability of such policies,” PBO said.

In the budget watch for 2024-25, the experts hold that Kenya needs to focus on improving revenue mobilisation and fiscal consolidation other than grant tax reliefs or settle refunds.

“The government should strike a balance between the need to maintain a stable and sustainable tax base and the goal of promoting economic activity,” the experts said in the latest advisory to MPs.

Experts want a clear focus placed on ensuring that tax waivers support economic growth, promote equity and address public welfare without eroding the country’s tax base.

On tax amnesty, the team said there should be a review as the policy risks making people fail to honour tax obligations.

“Tax amnesty policy risks undermine the overall tax compliance culture as businesses and individuals may choose to evade taxes believing they will eventually benefit from waived penalties and interests,” the report reads.

For the experts, the success of tax amnesty will depend on how the taxman engages taxpayers who have benefited from the amnesty with a view to improving enforcement.

As a way out, experts want MPs to watch out for the upcoming amendments to tax laws, especially on VAT- which Treasury mulls reducing to 14 per cent.

“The planned amendments to Kenya's tax laws, particularly regarding VAT, warrant scrutiny, as VAT has historically accounted for the largest share of tax expenditures,” PBO said.

To improve the collections, MPs have been asked to recommend that the KRA system fully integrated with counties and government entities.

It emerged that many MDS and counties were still operating outside Ifmis, leaving to loss of revenues.

PAYE arrears amounted to Sh97 billion, with details showing that the primary contributors were public sector entities.

Reports by the Controller of Budget have over time cited inconsistencies between the payroll databases and IFMIS as a potential source of revenue collection woes.

Cargo undervaluation was also cited as yet another cause for revenue shortfalls amid a call for the same to be streamlined.