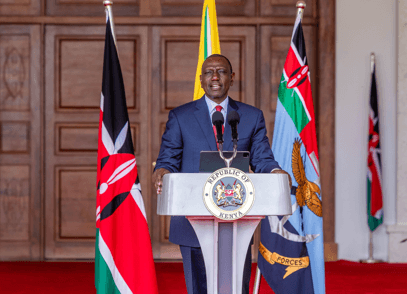

Cabinet Secretaries, PSs and senior State Agencies officials during the signing of performance contracts at State House, Nairobi on Tuesday, November 19, 2024

Cabinet Secretaries, PSs and senior State Agencies officials during the signing of performance contracts at State House, Nairobi on Tuesday, November 19, 2024

The government at the beginning of the last financial year instigated spending cuts at state corporations to tame extravagance.

Travel, training, legal expenses, overtime, and costs of all non-core activities were slashed.

Treasury directed state-owned agencies to harmonise their budgets with the priorities of the Kenya Kwanza administration.

Ruto's team further warned chief executive officers and directors of state corporations they would be held personally liable for any unapproved expenditures.

Latest disclosures by the National Treasury show that while the strategy worked for some corporations, others still struggled to make ends meet, and are heavily indebted.

State corporations, Treasury data shows, earned Sh140 billion more to hit Sh1.14 trillion in the year to June 30, 2024, which coincides with the period the Kenya Kwanza strategy was in force.

Even so, and despite the stellar performance of some agencies – especially in the energy sector - the profit declared by commercial entities decreased from Sh63 billion to Sh41 billion.

The year was not rosy for a number of state corporations led by Kenya Railways, which reported the highest net loss of Sh50.4 billion.

The defunct National Health Insurance Fund reported a Sh3.4 billion loss, followed by New Kenya Cooperative Creameries, which posted a Sh2.4 billion.

A number of state corporations reported deficits, notably the Agricultural Development Corporation at Sh955 million and Kalro at Sh1.3 billion, accounting for the largest portion of the Sh3.8 billion net loss posted by firms in the agriculture sector.

Among the dismal performers was Nzoia Sugar that posted a net loss of Sh1.1 billion, Sh1.5 billion for the country’s state oil company, and Sh1 billion at the Postal Corporation of Kenya.

Posta’s sister agency, Kenya Post Office Savings Bank, made a Sh709 million loss, the same being the case with the Consolidated Bank of Kenya, which posted Sh415 million.

Kenya National Trading Corporation made a Sh3.2 billion loss, despite being the lead state vendor for edible oils and subsidised fertiliser.

Rivatex made a Sh367 million loss while the Tourism Promotion Fund posted Sh1.2 billion during the year under review.

Tana Athi Water Works also posted a deficit of Sh1.6 billion, the same trend being witnessed at other water agencies, among them the National Water Harvesting Authority that posted a deficit of Sh346 million.

The National Irrigation Authority operated on a Sh600 million deficit, Sh298 million for Lake Victoria South Water Board and Sh348 million for its northern counterpart.

Kenya Water Institute fell short by Sh201 million, Sh200 million by NTSA, while Kenya National Highways Authority had a budget deficit of Sh3.2 billion.

The rural electrification agency Rerec and Kenya Forest Service reported a deficit of Sh1.84 billion and Sh1.77 billion respectively, with the National Council for Nomadic Education in Kenya reporting the highest deficit of Sh3.7 billion.

On the flip side, the Communication Authority of Kenya had the highest surplus of Sh6.7 billion.

Kenya Power reported the highest net profit of Sh30.8 billion, followed by Kenya Ports Authority with Sh12.9 billion.

Kenya Pipeline Corporation was among the lead performers, with a net profit of Sh6.9 billion followed by KenGen at Sh6.8 billion.

“The growth in profitability is mainly attributed to government’s concerted efforts including the turnaround strategy in energy sector state corporations,” the report reads.

State corporations posted Sh230 billion in profits cumulatively, compared with Sh133 billion posted in the previous financial year.

“It is mainly due to government policy measures on revenue enhancement and cost rationalisation,” the National Treasury said.

Overall, commercial state corporations posted net profits amounting to Sh132 billion, up from the Sh63 billion the previous fiscal period.

Treasury Cabinet Secretary John Mbadi said, “During the year under review, a significant improvement was recorded in most facets of government investments.”

He lauded better governance mechanisms and operationalisation of the Government Investments Management Information System (Gimis) for the results.

“The system has enhanced efficiency, transparency and completeness of state corporations' financial, operational performance and fiscal risk analysis,” the CS said.

In the reforms call, Kenya Kwanza directed that all transactions by state corporations be conducted through Gimis.

From the measures, Kenya Re earned Sh4.9 billion profit, a growth of Sh1.3 billion from 2023, while Kenya Airports Authority moved from a negative position to post Sh2.9 billion profit.

Kenya Development Corporation’s profits grew from Sh495 million to Sh2.7 billion, the same for Ketraco from negative Sh3.9 billion to Sh2.4 billion in profit.

East Africa Portland Cement posted Sh2.2 billion from last year’s negative Sh2.3 billion, while Geothermal Development Company made a cool Sh2.1 billion compared with Sh528 million of the previous year.

“A substantial proportion of the profits declared are from funds comprising of member contributions,” the report reads.

NSSF collected Sh88.1 billion more, Sh57.5 billion for the Public Service Superannuation Fund (pension), Sh33.6 billion for bank deposit insurance, and Sh3.4 billion in respect of the LAP fund.

Ruto’s administration rolled out new NSSF rates in February, raising contributions by six per cent per employee.

The dossier further reveals that the government received Sh10 billion more in dividends, loan redemption, interest payments, and directors’ fees.

The agencies netted Sh51.8 billion compared with last year when the government received Sh41.8 billion.

Treasury further reveals that public universities are heavily borrowing commercial loans for survival.

JKUAT had an outstanding loan of Sh2.3 billion, Sh675 million in the case of Kenyatta University, Sh447 million for Maseno University, and Sh422 million for the University of Nairobi.

NCPB had a commercial loan of Sh4.4 billion while New KCC had unsettled borrowings of Sh1.6 billion.

Treasury reports that pending bills remain high (at Sh379 billion as of June 30, 2024), including contractor fees of Sh160 billion, land compensation (Sh41.4 billion), supplies (Sh37.8 billion), and unremitted employee deductions of Sh24 billion.

State corporations generated about Sh1.14 trillion, which accounted for 75 per cent of the total revenue. The rest was from government grants.