High-income earners have resorted to the Hustler Fund to finance their loan needs, the latest data shows, a complete contrast from the low-income earners who are the main target.

New findings by the Central Bank of Kenya and Kenya National Bureau of Statistics show that a massive 35.8 per cent of those who accessed the loans are those categorised under the highest wealth quintile.

Only 18.7 per cent from the lowest wealth quantile used the fund in 2024, the complete opposite from the government’s push to increase access to financing for low-income households.

“Informal group usage remains relatively stable across wealth quintiles, with slight decreases as wealth increases. Hustler Fund is particularly significant among middle- and higher-income groups, reflecting its appeal as an accessible credit option,” the report reads in part.

The 2024 Finaccess Report by KNBS, CBK, and Financial Sector Deepening Trust (FSD Kenya) says that for such funds to match their intended purposes, effective financial inclusion will require financial products and services to match consumer expectations and welfare.

“Improving the terms and conditions of the hustler fund loan facility, especially for youth and lowest wealth quintiles, could accelerate the Bottom-Up Economic Transformation Agenda,” the report noted.

CBK further says that poor customer service discourages usage, particularly among microfinance institutions and insurance account holders, while mobile bank accounts recorded the least complaints.

Overall in 2024, 28.9 per cent of the adult population used the hustler fund, with the mobile money loan facility recorded as having higher popularity in urban areas with higher-income populations who are formally or informally employed.

The survey revealed that 28.9 per cent of Kenya’s adult population— equivalent to 8.1 million people— used Hustler Fund loan services in 2024.

Urban residents were the most active users of Hustler Fund services, with 35.4 per cent of the urban population accessing the loans, compared to 24.2 per cent in rural areas.

The highest wealth quintile dominates usage at 35.8 per cent, whereas the lowest wealth quintile makes up 18.7 per cent of users.

Age also plays a significant role in loan uptake.

The majority of users, 39.4 per cent, are aged between 26 and 35, while those above 55 years represent the smallest segment, at just 11.2 per cent.

In 2024, the daily usage of mobile money increased from 23.6 per cent in 2021 to 50.2 per cent.

This indicates that the users rely on mobile money and mobile banks to undertake transactions and manage liquidity.

The report further revealed a marginal increase in formal financial access in Kenya, alongside persistent challenges in financial inclusion for certain groups. Formal financial access rose to 84.8 per cent in 2024, up from 83.7 per cent in 2021.

The improvement is largely attributed to advancements in digital technology, which have nearly eliminated the gender gap in access to financial services.

Despite progress, 9.9 per cent of Kenyan adults remain financially excluded. Rural youth make up a significant portion of this group, accounting for 45.5 per cent.

Barriers to inclusion include a lack of mobile phones ( 64.1 per cent) and national identification cards ( 51.5 per cent).Counties like Kiambu, Nairobi, Kirinyaga, Nyeri, Isiolo, and Mandera lead in financial inclusion, while Turkana, West Pokot, Elgeyo Marakwet, Trans-Nzoia, Migori, and Narok face the highest levels of financial exclusion.

Brick-and-mortar bank accounts and SACCOs have recorded increased uptake, while digital financial services showed mixed trends. Growth in mobile money, mobile banking, and overdraft services like Fuliza has moderated.

However, digital microfinance institutions, including “buy now, pay later” schemes, have experienced a boost following the regulation of Digital Credit Providers.

However, despite the uptake, the repayment has not been growing at the same rate, prompting the government to revise loan terms.

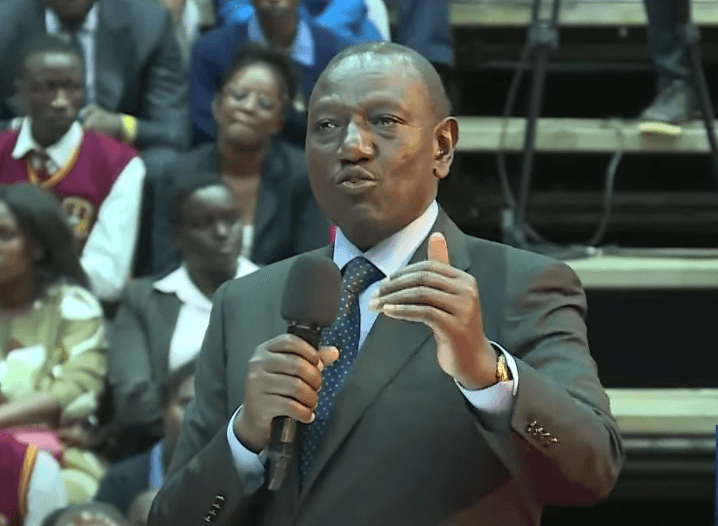

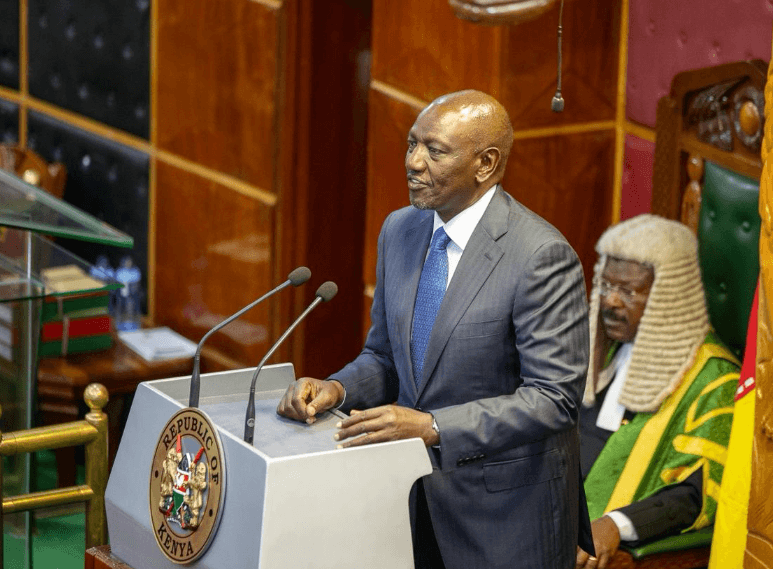

President William Ruto last week

said that more than two million borrowers under the state-run fund will

soon enjoy increased borrowing limits and extended repayment periods