The newly rolled out Social Health Authority/FILE

The newly rolled out Social Health Authority/FILE

A central focus of these changes has been addressing longstanding barriers to access to affordable healthcare for millions of Kenyans, particularly those at the bottom of the pyramid.

On health, the National Health Insurance Fund (NHIF) has for 58 years provided health insurance for Kenyans.

It was replaced by the newly established Social Health Authority (SHA).

This new scheme completely overhauls the approach to healthcare financing and delivery.

SHA represents a shift from the outdated NHIF system, which had been limited in scope, covering primarily formal sector employees and offering a narrow range of services.

In contrast, SHA is set to cover all Kenyans, including the informal sector, thus making healthcare more inclusive and accessible.

This new authority officially commenced its operations on October 1, 2024.

According to Ruto, SHA will create a more equitable healthcare system, designed to provide affordable and quality care for all, regardless of income.

Timothy Olweny, the chairman of SHA, emphasised that the reforms are not just about improving the old system, but about transforming the healthcare landscape entirely.

"These reforms will not only fill gaps left by NHIF but also provide better services to all Kenyans," he said in an interview.

He highlighted the government’s determination to realize the long-elusive goal of Universal Health Coverage (UHC).

While the original plan was for SHA to begin in July 2024, a series of setbacks pushed the start date to October.

Despite this, the transition has been largely smooth, with over one million Kenyans already registered on the new platform, and more than 10,000 health facilities, including both public and private institutions, now part of the SHA network.

The transition to SHA is anchored in the introduction of four new laws: the Primary Health Care Act, the Digital Health Act, the Social Health Insurance Act, and the Facility Improvement Financing Act.

These laws form the foundation of a broader strategy that includes the establishment of three major funds: the Primary Health Care Fund, the Social Health Insurance Fund (SHIF), and the Emergency, Chronic, and Critical Illness Fund.

These funds are designed to offer relief to families facing the financial burden of medical expenses, particularly for conditions that require long-term treatment, such as cancer, hypertension, and diabetes.

A key pillar of this reform is the emphasis on Primary Health Care (PHC), which forms the bedrock of Kenya’s healthcare system.

The Primary Health Care Fund covers outpatient services at community facilities classified under Primary Care Networks (PCN), to ensure that 315 PCNs are operational across all counties.

These networks are intended to bring healthcare closer to communities, making essential services more accessible, reducing the reliance on expensive hospital care, and promoting early detection of diseases.

In addition, over 100,000 Community Health Promoters (CHPs) have been recruited to spearhead promotive and preventive healthcare at the grassroots level.

These CHPs are responsible for visiting homes and providing services such as blood pressure checks, malaria testing, and general health advice.

The program is intended to reduce the need for individuals to visit hospitals for routine check-ups, thereby lowering healthcare costs while promoting healthier lifestyles.

Perhaps one of the most significant changes brought about by SHA is the introduction of a digital health platform, which aims to eliminate inefficiencies and fraud that plagued NHIF.

By centralising patient data and linking health facilities through technology, SHA aims to enhance the quality of care while ensuring accountability and transparency.

The new platform will allow healthcare providers to access patient histories securely, reducing the risk of misdiagnoses and unnecessary tests.

Additionally, it will facilitate the transfer of medication and diagnoses between facilities, especially in emergencies or disaster situations.

The government's commitment to reducing the financial burden of healthcare on families is reflected in the structure of the new system.

The minimum monthly premium for SHA coverage has been reduced from Sh500 to Sh300, and the government will subsidise contributions for vulnerable populations who cannot afford even this reduced rate.

The system is designed to ensure that no Kenyan is left behind, even those who are unemployed or in the informal sector.

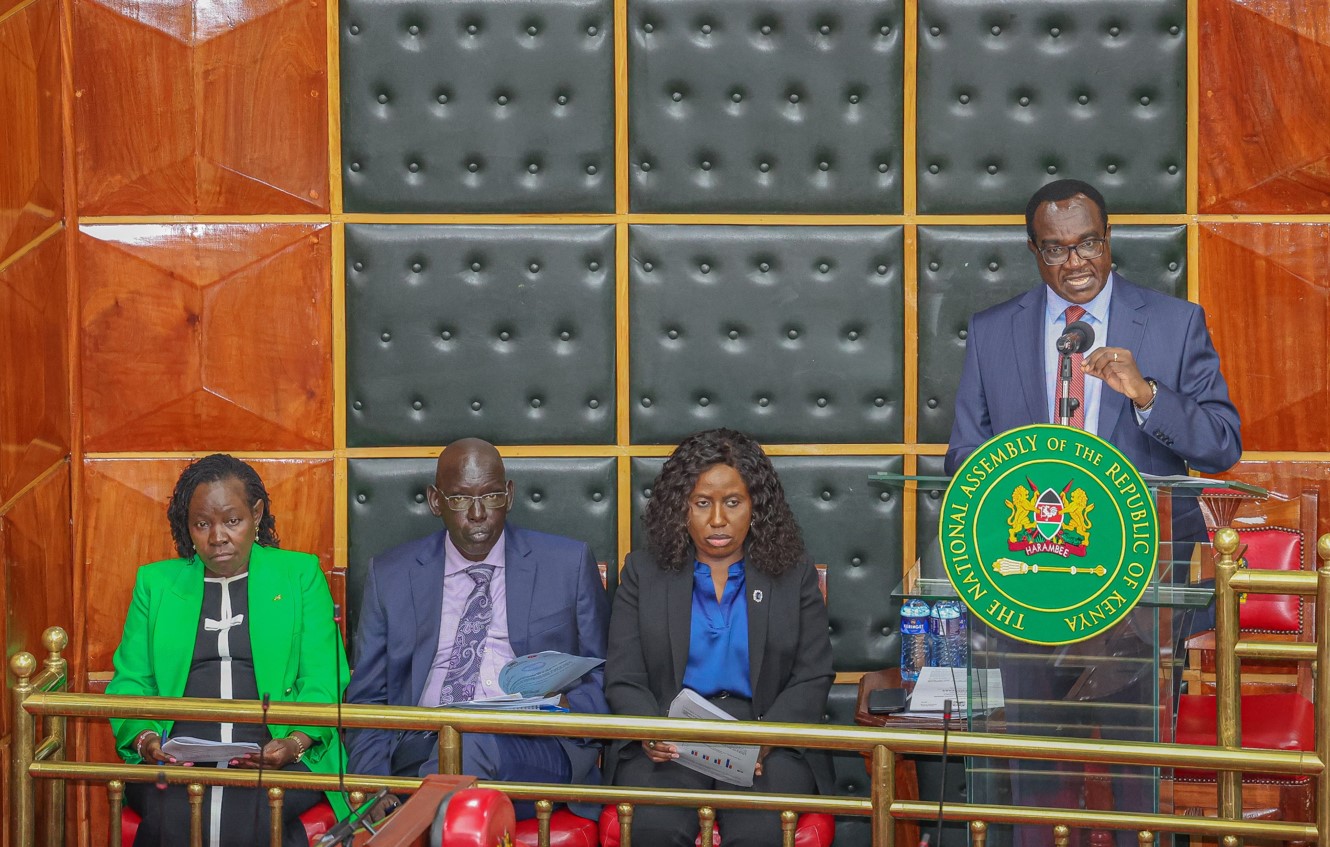

Education CS Julius Ogamba flanked by PS in the ministry when he appeared before National Assembly on September 18, 2024/FILE

Education CS Julius Ogamba flanked by PS in the ministry when he appeared before National Assembly on September 18, 2024/FILE

Unveiled on May 3, the model according to Ruto aims to ensure that all eligible students receive adequate educational financial support.

It promotes the provision and access to quality higher education and ensures that all students are equitably and adequately supported based on their financial needs.

This funding framework replaces the Differentiated Unit Cost (DUC) previously used to finance universities.

Under this model, universities and TVET institutions will no longer receive block funding in the form of capitation but instead funding for students will be provided through scholarships, loans, and household contributions.

Ruto added that the model seeks to address the challenges encountered by public universities and technical and vocational education (TVET) institutions due to massive enrollment and inadequate funding.

It prioritises a student’s financial need and separates placement from funding.

It further ensures timely disbursement of funds to students through their higher education institutions.

Students can apply for scholarships and loans online at www.hef.co.ke.

Alternatively, applications can also be made at www.universitiesfund.go.ke.

Funding models

Band One

This is primarily for the most needy group; a family whose monthly income is not beyond Sh5,995.

Under this category, the government scholarship will cover 70 per cent of the fees while the loan will cover 25 per cent, making the total support 95 per cent.

Here, the family will pay 5 per cent of the fees and the student will receive an upkeep loan from Helb of Sh60,000.

Band Two

This targets families whose monthly income does not surpass Sh23,670 but is above Sh5,995.

In this category, the government scholarship will cover 60 per cent while the loan will cover 30 per cent.

The family will pay 10 per cent of the fees. Under this category, the student will receive an upkeep loan of Sh55,000.

Band Three

This is for families whose family monthly income does not pass Sh70,000 but it is above Sh23,670.

Here, the government scholarship will cover 50 per cent, while the loan will cover 30 per cent.

The family will contribute 20 per cent of the fees supposed to be paid. Students in the category will receive an upkeep loan of Sh50,000.

Band Four

It targets families whose monthly income does not exceed Sh120,000 but is above Sh70,000.

The government scholarship will cover 40 per cent while the loan will cover 30 per cent.

Band Five

It is for families which earn more than Sh120,000 monthly.

In this category, families will pay 30 per cent of fees.

They will receive 30 per cent of the fees as a loan while their families will be required to pay 40 per cent of the fees.