State-owned development finance institution, Kenya Development Corporation, is sinking into a Sh33.44 billion hole as Kenyans fail to repay loans.

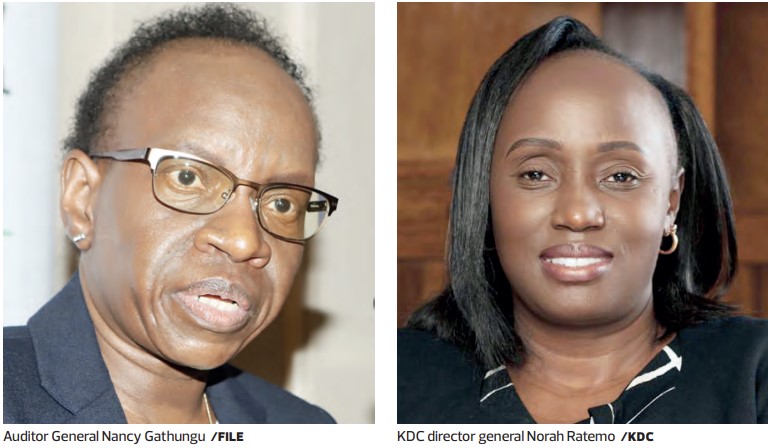

A new report by Auditor General Nancy Gathungu reveals KDC is increasingly failing to recover loans advanced to Kenyans and this has threatened to paralyse its operations.

“The respective loan records indicated that approximately Sh33.44 billion or 86 per cent of the corporation’s total loans portfolio estimated at Sh39.06 billion as at June 30, 2023, was considered by management as non-recoverable,” the report states.

In the report that covers the financial year ending June 2023, the corporation has stopped accrual of interest on the loans – denying itself the much-needed funds – in line with the set rules.

The rule requires that interest accrued should not exceed the principal amount outstanding when the loan becomes non-performing. In addition, the securities-related to some of the old non-performing loans being borrowers’ ancestral lands, were reported to be missing, impaired or irredeemable.

“The board of directors has approved the full provision for the losses totalling Sh33.44 billion against the corporation’s reserves as required by International Financial Reporting Standard No 9,” the report says.

The high ratio of non-performing loans portfolio, Gathungu said, indicates the corporation is unable to recover money owed by its customers.

“As a result, the corporation’s capacity to lend to new borrowers and eventually attain its purpose and mandate may be constrained,” the auditor said in the report.

Kenya Development Corporation Ltd is a development finance institution that was established on November 27, 2020.

KDC merges the operations of the Industrial and Commercial Development Corporation, Tourism Finance Corporation and IDB Capital Limited.

It provides long-term financing and other financial, investment and business advisory services to Kenyans.

In the report, Gathungu raised concerns over the unsold 35 housing units, some completed in 2015, valued at Sh490.50 million developed by the corporation as part of its investment.

The unsold houses have continued to attract a service charge of Sh10,000 per unit paid to the apartment management companies.

“The number of unsold apartments

was 11 (out of 28 ) and 24 (out of 36

) for the Zamia Heights Apartments

and Oceania Apartments, respectively. This is despite the completion of the apartments in July 2015

(Zamia) and 2018 (Oceania),” the

report says.