His medium-sized iron sheet coop holds about 800 chickens, most of which he expects to sell to the local community.

Being a festive season, he projects he will make a good sale, his confidence showing in his smile. However, it has not been always this rosy.

The story starts 22 years ago, when Mwanyinywa, a father of six, arrived in Nairobi, Kenya as a refugee from the Democratic Republic of Congo, where he abruptly left a well-paying secondary school teacher job in South Kivu.

Fleeing to Kenya in search of safety after insecurity in his country spiraled, he decided to restart his life and explore ways to build a future.

After spending a decade in Nairobi as a French teacher, the 44-yearold had to move to Kakuma refugee camp in 2014.

Upon his arrival at the camp, like many refugees, he had to start anew. He was initially employed as a security guard, later transitioning into a role as a hygiene promoter, and then finding work as a teacher.

Despite his stable job as a teacher, his entrepreneurial spirit led him to start poultry farming as a side hustle. “The salary we were being paid was not enough to sustain my family, and that is why I had to think of another business I would engage in when free,” he says.

HOW HE STARTED

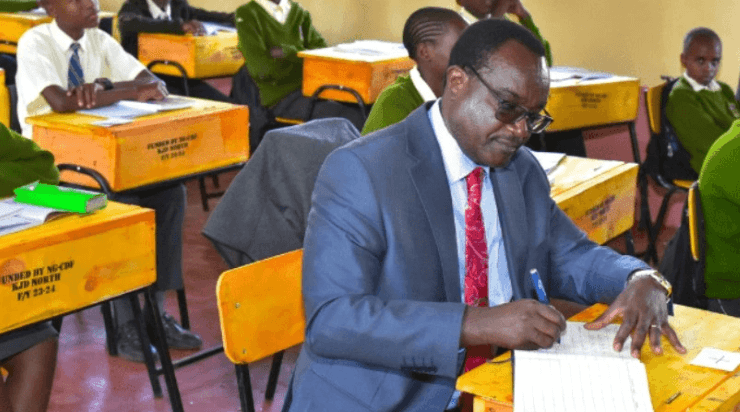

Mwanyinywa, who lives in Kakuma 3 zone1 block 14, began with 30 chicks, which he ordered from Eldoret.

The choice of poultry came after conducting some market research, which revealed a high demand for chicken in the region, especially from local hotels.

“Most hotels in Kakuma were ordering chicken from distant areas. This presented me an opportunity to raise them here,” Mwanyinywa says.

In 2018, he quit his teaching job to focus entirely on the business. “Combining the two was not viable at all. I used to wake up at 6am to go to school, leaving the poultry with no one to take care of them,” he says.

However, within the same year, they were informed of a planned repatriation from Kakuma, which forced him to sell all his chicken and farming equipment.

Luckily, the repatriation did not happen and Mwanyinywa decided to go restart his chicken business from scratch. With support from KCB, which provided him with a loan to relaunch the project, Mwanyinywa set about rebuilding his business to what it currently is.

He attributes his success to the support, which he says was what he needed for him to continue taking care of his family.

“If it was not for KCB, I would not have been able to reach the number of chickens I have today. When we were informed of the repatriation, I lost hope. I was at the lowest point of my life, I didn’t know where to start from,” he says.

With hard work and dedication, his farm has grown to house 800 chickens this year, and he employs three other workers, who are all refugees. He now supplies big hotels in Kakuma town.

SUPPORT SYSTEM

Mwanyinywa is one of the beneficiaries onboarded to the KCB guarantee programme, launched in partnership with the Swedish International Development Agency (Sida) through the Swedish Embassy in Kenya last year.

Prior to being considered as a beneficiary, he underwent a verification process conducted by the Danish Refugee Council in partnership with the Department of Refugee Services.

The support has seen him grow and thrive in the business, making him one of the leading suppliers of chickens in Kakuma.

He ordered new chicks and feeds slowly to rebuild what he had lost. Looking ahead, he is planning to scale up his poultry farm with a goal of raising 2,000 chickens next year and reaching 5,000 by 2026.

He explains that he is left with only two months to finish repaying the loan so he can borrow another one to expand the project.

His business has also benefited local farmers. He has more than 60 other farmers he is training and who have been buying chicks from him.

They buy them when they are two weeks old. A one-month chick goes for Sh400, while a three-month old is Sh900.

EASING LOAN ACCESS

As of August 2024, Kenya was hosting about 796, 331 refugees and asylum seekers, half of them living in Dadaab, 37 per cent in Kakuma and 13 per cent in urban areas.

With at least 25 of them having received Sh30 million loans so far out of the Sh1 billion set aside, the bank hopes to make more disbursements next year.

“We looked at 2024 as a year that we were putting in place structures,” KCB head of micro banking Zacharia Cheruiyot says in an interview.

“In the coming year, we hope to onboard more customers and have good amounts of disbursements.” Cheruiyot says they have addressed all the challenges refugees have been facing, especially in terms of documentation to be used at the bank.

“We are looking at them as a segment that needs to be included as part of the categories that we are targeting, and we have looked at the issues that have been a challenge to them for very long,” he says.

“As a bank, we have accepted to use Manifest to onboard these customers as a document to identify them.”

In terms of collateral, they simplified the products and now accept the use of chattels (personal possessions).

Additionally, as a bank, Cheruiyot says through a partnership with DRC, they have managed to bring on board 46 Village Savings Lending Associations (VSLAs) and about 920 individual members. Head of Development Cooperation at the Swedish Embassy in Kenya Annika Otterstedt highlights the role of Swedish Development Cooperation in its partnership with KCB in the initiative.

Otterstedt says they come in to support the bank in terms of “understanding” the specific circumstances and income opportunity challenges the refugees live in.

“Sweden is also decreasing the risks such that when KCB lends money to these refugees but they fail to repay, Sweden guarantees the bank loan and supports the bank in covering the loss,” she says.

KCB group marketing director Rosalind Gichuru says to ensure the right loan is issued to individuals or targeted groups, they have developed their own internal mechanisms to track it.

With this cooperation, the bank has been able to drive financial inclusion, she said, noting the programme is aligned with the UN’s 2030 Sustainable Development Goals.

These are ending poverty, decent work and economic growth, gender equality, reduced inequality and partnerships.

Kakuma branch manager

Frankline Kweyu says their market

presence and the fact that KCB is the

best governed financial institution is

what distinguishes them from other

banks in the area.