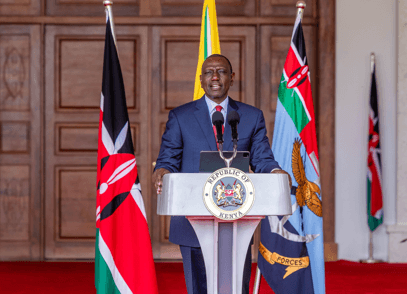

On Monday, President William Ruto signed into law the Finance Bill 2023 after it sailed through in Parliament.

It will now be a requirement to pay 1.5 per cent of gross salary towards the contribution of the Affordable Housing Project.

This will be a new deduction on Kenyans payslips as of July 1, 2023.

The Head of State had said through the affordable housing project more jobs will be created and in the long term eradicate slums in the country.

"We are going to restore the dignity of our people living in the slums, at the same time create more than 1 million jobs for our youth. Singapore decide to make difficult decisions, that's why they are where they are," he said.

On petroleum products, Kenyans will now have to pay double from 8 per cent to 16 per cent. Ruto defended this move saying he intends to raise Sh50 billion from the enhanced VAT.

"The 8 per cent extra will give us Sh50 billion to deal with roads across the country," he said during an interview.

In the new law, digital content creators will part with 5 per cent of their earnings, down from the 15 per cent proposed before the amendment of the Bill.

“A person who is required to deduct the digital asset tax shall, within 24 hours after making the deduction, remit the amount so deducted to the Commissioner together with a return of the amount of the payment, the amount of tax deducted, and such other information as the Commissioner may require,” the law now states.

Speaking during the Kenya National Drama Festival at State House, Nairobi three weeks ago, the President said he had told the ICT and Finance committee to work on amendment of the percentage.

“I know there is a proposal in this year’s budget on digital content and creators… I have told the ICT and Finance committee to work on it. Let’s them give a bit more space, let us allow them wajipange alafu baadaye si sisi wote tutalipa ushuru,” he said.

Others are the betting and insurance withholding tax, which will be charged at 12.5 per cent and 16 per cent respectively.

This means if you bet with Sh100, some Sh12.50 of your primary stake will go to the tax man.

The five per cent tax on wigs, fake beards and eyebrows and other beauty products was done away with.

At least 184 MPs largely from Kenya Kwanza supported the bill whereas 88 MPs opposed the amendment.

![[PHOTOS] Three dead, 15 injured in Mombasa Rd crash](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2Fa5ff4cf9-c4a2-4fd2-b64c-6cabbbf63010.jpeg&w=3840&q=100)