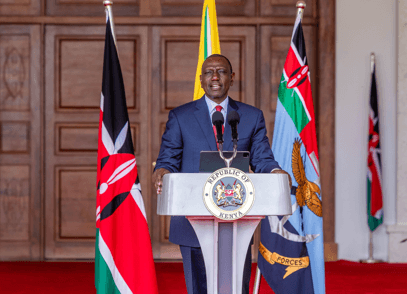

High Court Judge Alfred Mabeya has discharged orders blocking the process of paying out depositors of the collapsed Imperial Bank.

The Judge at the same time disqualified himself from hearing the matter filed by one of the depositors-Ashock Doshi- who was a depositor at the collapsed lender.

He is currently seeking more than Sh 1 billion from it.

"Due to personal reasons, I'm unable to proceed with this case. I, therefore, discharge the order I granted," Mabeya said.

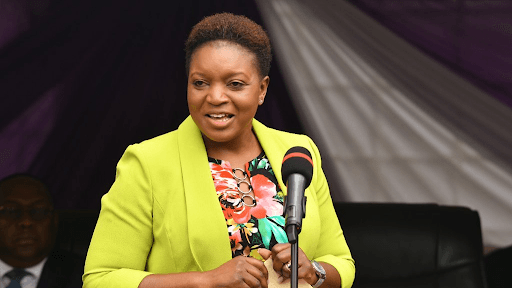

He directed the matter be placed before Justice Josephine Mongare for further directions.

Imperial Bank collapsed six years ago and has been under the receivership of the Kenya Deposit Insurance Protection (KDIP)

The Central Bank of Kenya in 2021 approved the liquidation of the bank which set the stage for the sale of the lenders' remaining assets.

But KDIP in court papers claims that Ashok has constantly frustrated the liquidation process of the Bank and has been forum shopping for a favourable outcome before the courts.

"Ashok, a sole depositor of the Bank, has exploited judicial processes and frustrated the liquidation process sod the Bank for approximately seven years to the detriment of other depositors," KDIP says.

"Ashok actions are not only a course for alarm to the mandate of the corporation but also a concern to the financial stability in Kenya."

KDIP also says once appointed as the liquidator, it is an agent of the Bank and cannot be sued or held liable for actions of the institution.

The Insurance was responding to the suit filed by Ashok which Mabeya has now recused himself.

Ashok in his court papers sought to stop KDIPs from paying out protected deposits to depositors of IBL before the conclusion of the liquidation process and the publication of the final statement of account.

He said the decision requiring depositors to commit in writing that they will not pursue future claims will deprive depositors of the right to pursue any future claims that go beyond the protected deposit of Sh 500,000.

He argued that intense document as commenced by the Insurance is illegal and unconstitutional.

His recent case comes after the Insurance placed an advertisement in the local dailies on June 7.

The ad invited depositors of the collapsed lender to continue lodging their claims for payment.

![[PHOTOS] Three dead, 15 injured in Mombasa Rd crash](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2Fa5ff4cf9-c4a2-4fd2-b64c-6cabbbf63010.jpeg&w=3840&q=100)