Attorney General Justin Muturi would have directed the taxman to stop collecting the housing levy, but the reprieve would just be for a while, it has emerged.

This is because the Kenya Kwanza administration is still keen to enact a legal framework within the shortest time possible to anchor the controversial tax.

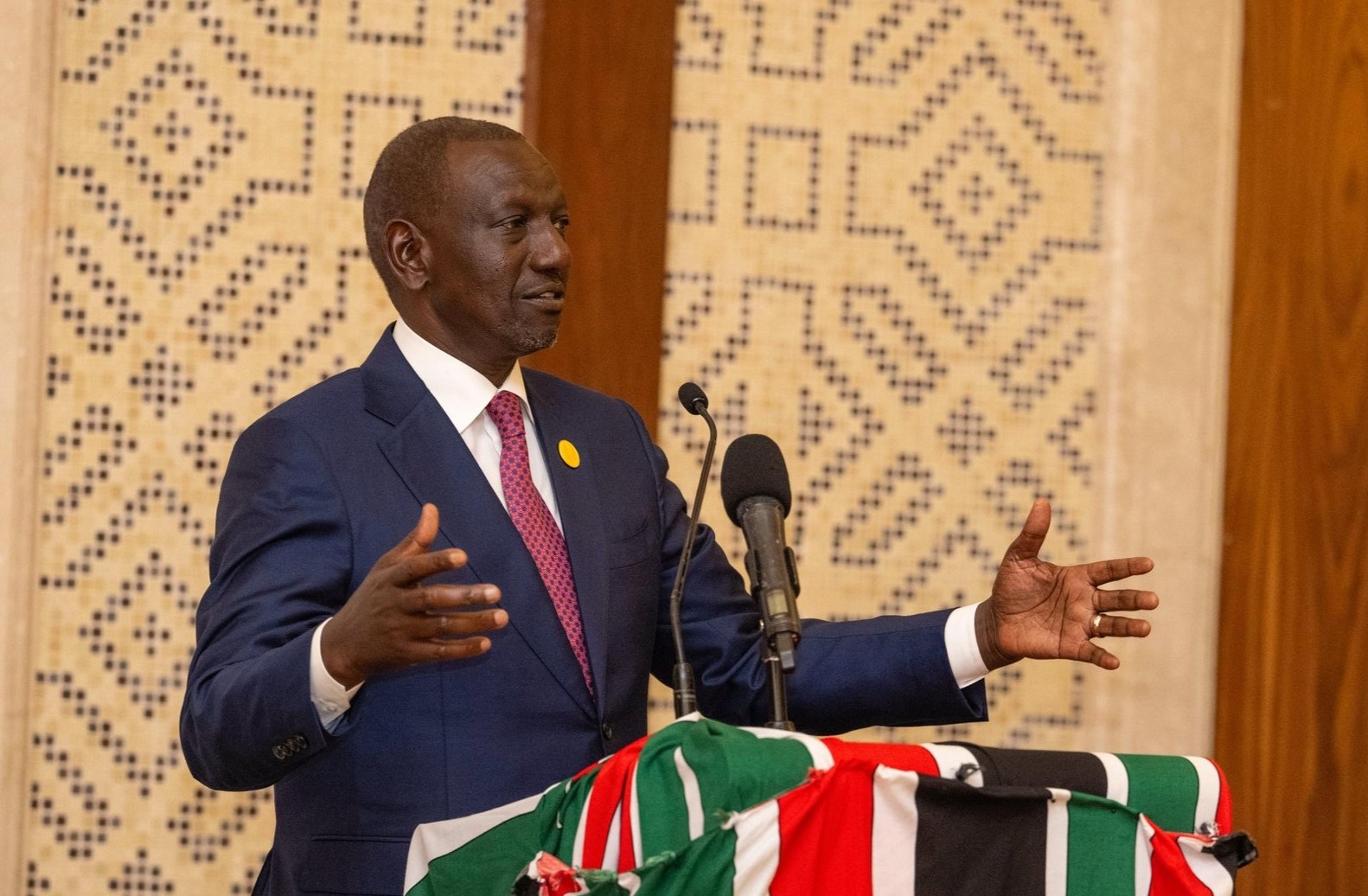

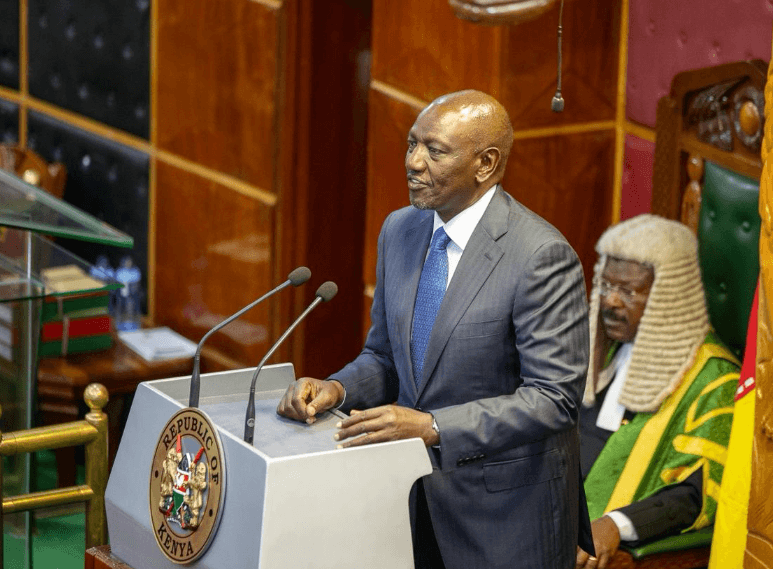

Kenyans will soon be forced to pay the housing levy once the Senate passes the government-backed Affordable Housing Bill, 2023 and President William Ruto assents to it into law.

The Bill passed the third reading on February 21 at the National Assembly amid anger from the opposition Azimio side.

It was subsequently forwarded to the Senate for concurrence, rejection or review.

In his advisory to the Kenya Revenue Authority to stop collecting housing levies from salaried Kenyans saying it lacks legal basis, Muturi did not mention the Affordable Housing Bill, 2023.

Following the court’s decision to declare the housing levy unconstitutional, the government introduced the new Bill in Parliament and amended the impugned sections.

The initial housing levy was anchored in the Finance Act 2023, whose provisions are contested in court including the housing levy.

The proposed law before the Senate is aimed at curing the lacuna anchoring the government’s housing tax in law and aligning the levy with the constitution.

With the government determined to expedite the Affordable Housing Bill, 2023 at the Senate, the reprieve is just for a while.

The Star has established that the grand plan is for the law to be in place within the current financial year.

In a letter to KRA Commissioner General Humphrey Wattanga, the AG said the Court of Appeal’s January 26 decision declining to stay High Court orders that declared the levy unconstitutional still stands.

“The upshot of this is that there is no legal basis on which the Housing Levy as provided in section 84 of the Finance Act, can be implemented,” Muturi said.

He was responding to a letter from Wattanga dated February 12 seeking guidance on the government’s position on the matter.

The High Court on November 28, 2023, declared the Housing Levy illegal citing various reasons including that it was discriminatory as it secluded workers in the informal sector.

The three-judge bench, however, stayed the execution of the orders until January 10, 2024, pending the filing of an application for conservatory orders to stay the decision and allow the government to continue collecting the levy.

But on January 26, the Appellate court dismissed the application and reaffirmed the High Court’s ruling that the 1.5 per cent Housing Levy meant to finance the affordable housing programme is illegal.

“Therefore, our considered opinion is that as of the date of the delivery of the ruling of the Court of Appeal, i.e on January 26, 2024, there is no legal provision that enables the collection and administration of the Housing Levy,” Muturi told Wattanga.

“Kindly be advised.”

The Housing Levy was introduced vide section 84 of the Finance Act, 2023.

With the proposed law, the levy will now be anchored in the Affordable Housing Act 2023, once the Bill at the Senate is signed into law by the president.

The Bill in the Senate was radically amended by the MPs, introducing far-reaching provisions that would further pain taxpayers.

Kenya Kwanza troops at the last minute reintroduced the requirement for persons seeking to occupy a unit in the housing programme to pay a deposit.

While the original legislation proposed a 10 per cent deposit on the unit price, the new provision gives discretion to the Treasury Cabinet Secretary.

Employers and employees who default in remitting the levy would be subject to tax recovery procedures in the current law – court or mediation.

MPs also voted to empower the fund board to allocate money to institutional housing and for off-take of housing projects.

Loans would be paid on reducing interest, with the new dispensation barring buyers from changing units aimlessly.

Crimes committed in the cause of the execution of the affordable housing plan or administration of the levy would attract a mandatory fine.