Patients might from next week Thursday be forced to pay for healthcare services from their pockets in a select number of hospitals.

This is after the Kenya Healthcare Federation (KHF) threatened to instruct its affiliate members to opt for the cash-only mode of payment for NHIF clients in the next seven days.

According to the federation, the facilities are owed more than Sh20 billion in NHIF claims for the services rendered, with those in rural areas being the worst affected.

The federation has raised concern that the delay in disbursements has resulted in the affected health facilities defaulting on supplier credit, payroll, rent and other essential obligations hence pushing many providers to the brink of insolvency.

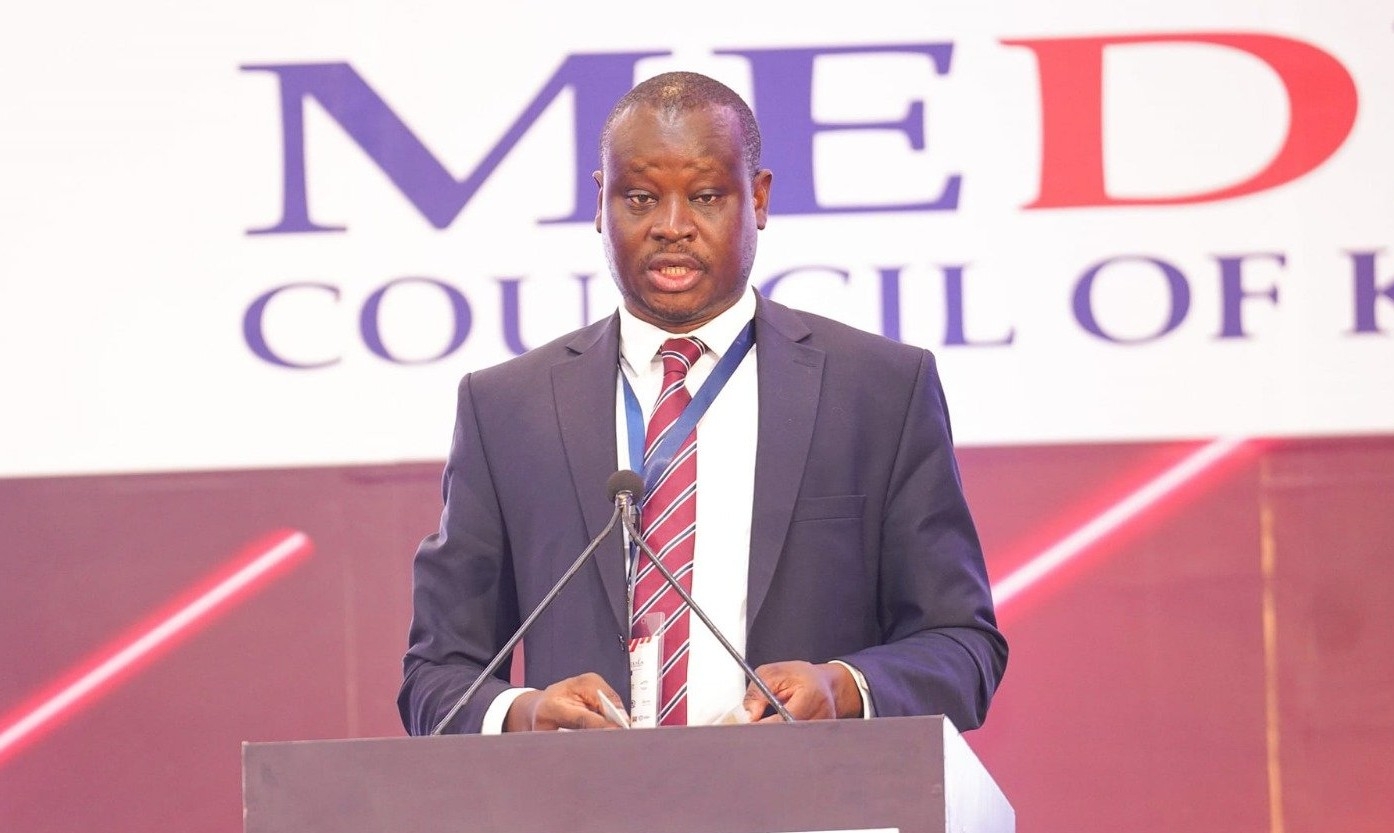

“To this end, our members have advised that they will adopt a cash-only basis for all NHIF clients within seven days,” KHF CEO Tim Theuri said.

“Providers will furnish all clients with a duly filled claim reimbursement form in the standard format as provided by the fund. This is the only survival tool they have left within the existing structures,” he added.

According to Theuri, the delay in NHIF reimbursements poses an existential threat to the quality of healthcare especially in critical areas such as dialysis.

Theuri has further noted that the situation has been worsened by the significant depreciation of the Kenyan Shilling against the dollar since the current NHIF contracts were signed.

He noted that this has increased the cost-of-service delivery due to reliance on imported medical supplies yet NHIF reimbursement rates remain fixed, creating a growing financial strain on providers.

“The current reimbursement rates, often ranging between five to 13 per cent of monthly billing, are insufficient to cover fixed overheads like rent and staff salaries,” Theuri said.

“This undermines the quality of care as providers struggle to afford essential supplies and equipment,” he noted.

This comes even as the Kenya Association of Private Hospitals (KAPH) wrote to NHIF with similar concerns and demands.

KAPH in a letter dated March 12 and addressed to NHIF CEO Elijah Wachira said despite having several engagements with NHIF on the delayed payments of member hospitals, the problem persists.

KAPH Chair Eric Musau said the payments from the fund have been minimal making the affected hospitals unable to continue with their operations.

As a result, the hospitals have been forced to take expensive credit to continue offering care to NHIF beneficiaries.

“We hereby demand the NHIF/Social Health Authority to release all funds owed to members as per our contractual agreements which is 60 days after service offering,” Musau said.

He added:

“We further issue a seven-day notice of withdrawal of services should the fund not honour the payments as stipulated in hospital contracts.”

Last week, the Ministry of Health called on health facilities to continue providing services as the issue of outstanding debt is addressed.

Health CS Susan Nakhumicha said she was in touch with the National Treasury to ensure funds are released.

The CS said the committee tasked with ensuring a smooth transition from NHIF to the Social Health Authority will ensure that no outstanding debt is left unpaid.

The CS on Thursday told MPs that NHIF had disbursed more than Sh13 billion to health facilities between October and December 2023.

Nakhumicha said that currently, NHIF reimburses claims based on the availability of funds received from statutory deductions from the formal sector, revenues from the informal sector, government remittances for sponsored programmes and enhanced schemes premiums.

"Reimbursement of claims to Hospitals is therefore fully dependent on the availability of funds," she said.

"Nevertheless, NHIF has continued to ensure a good balance in payouts to government, faith-based and private Health Care Providers," the CS added.