The National Assembly’s Finance Committee retreated on Wednesday to write a report on the Finance Bill, 2024 ahead of its tabling in the Parliament next week.

The committee chaired by Molo MP Kuria Kimani wrapped up public hearings on Tuesday.

The committee on Tuesday held engagements with the various government agencies on a raft of proposals made by the public.

This was in a bid to get their perspectives on the particular issues that emerged during the public engagements on the Bill and how they would impact on the economy if enacted.

During the two-week period, the committee conducted public hearings in some selected counties across the country with a final one at KICC in Nairobi.

At the conclusion of the session, Kimani was confident that the views from all stakeholders had been factored in ahead of the tabling of the report.

“We have come to the end of the public participation exercise on the Finance Bill and we are now set to retreat to develop our report,” he said.

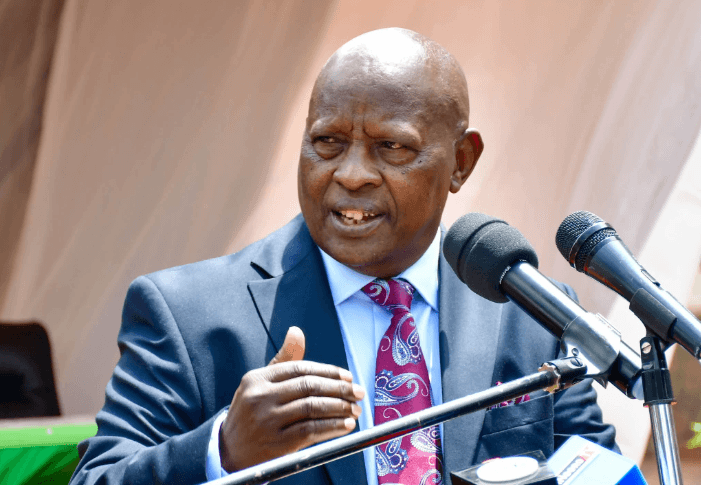

Among those who appeared during the session is Environment Principal Secretary Festus Ngeno who gave his views with regard to the imposition of the proposed Eco-levy, given its projected impact on the manufacturing sector.

Ngeno submitted that the introduction of the levy is part of the series of initiatives being undertaken by countries in the acknowledgment of the scale of proliferation of problematic waste streams in recent decades.

“Hon. Members, the revenue generated from the levy is earmarked for such initiatives as putting up enhanced waste management systems, creating public awareness and education through nationwide campaigns, to support innovation and enhanced research and development in green technologies,” he explained.

Committee Members David Mboni (Kitui Rural) Julius Rutto (Kesses) and Joseph Munyoro ( Kigumo), however, raised concerns that without ring-fencing the fund, the envisaged initiatives would come cropper due to delays in funds’ disbursement.

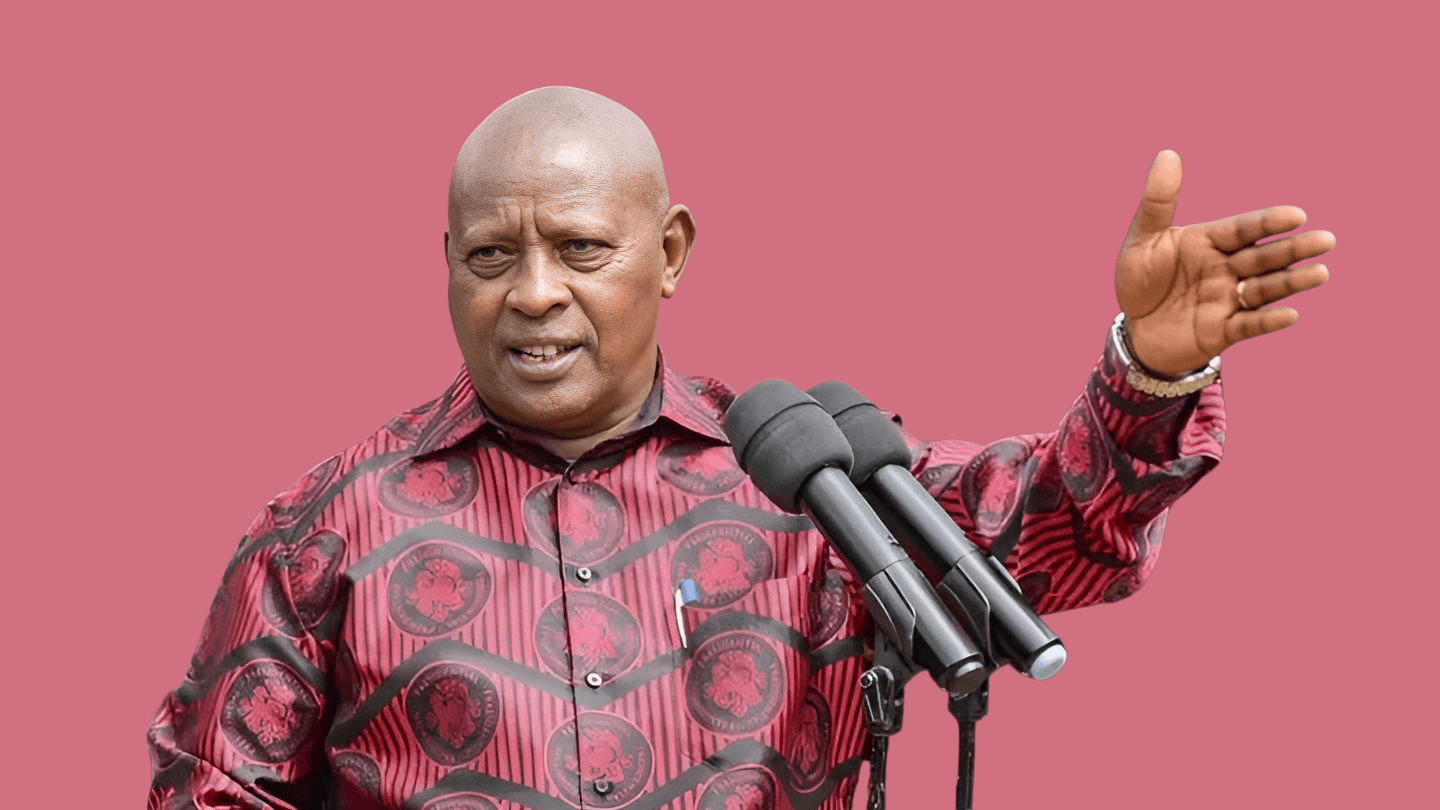

The Committee also met the Transport Cabinet Secretary Kipchumba Murkomen and deliberated on the projected impact of the proposed increase of the Fuel Levy charge from Sh18 to Sh25 per litre.

Though he put a strong case for increased revenue to facilitate the roads’ maintenance backlog, the potential impacts of e-mobility and growth in the size and quality of the road network, members emphasised the need for the ministry to demonstrate that their budgetary allocation was being put to good use.

Treasury Principal Secretary Chris Kiptoo also met the Committee to justify the revenue raising proposals in the Bill.

He told the Committee that the Finance Bill, 2024 is broadly aimed at reforming the tax system, enhancing efficiency in tax administration and improving tax compliance.

Noting that the country was taking the trajectory of fiscal consolidation, he emphasized the need to mobilize sufficient revenue to support government programs while living within the country’s means.

“Mr. Chairman, considering the need to mobilize sufficient revenue to stabilize our debt, I urge the Committee Members to favorably consider all the proposed provisions in the Finance Bill, 2024,” he urged.

He further disclosed that the MTRS would be implemented within a three-year period beginning from FY 2024/25 to FY 2026/27.

Earlier on, the Committee received submissions from the Ministry of Defence led by the Principal Secretary Patrick Mariru and Vice Chief of Defence Forces Lt General John Omenda.

During the engagement, Mariru put up a spirited justification for the exemption of excise duty on goods supplied to the Defence Forces Welfare Services.

He noted that the organisation was a not-for-profit which funds the provision of welfare services for the Kenya Defence Forces.