The UK government has announced a new fund of Sh667 million (USD 5.2 million) to support Micro, Small to Medium Enterprises (SMEs) in Kenya.

The fund aims to mobilise upto Sh38.85 billion of sustainable finance to provide affordable credit to Micro, Small and medium-sized enterprises.

The ‘Listed SME Debt Fund’, sponsored by Financial Sector Deepening Africa (FSD Africa).

The fund will offer affordable credit to over 10,000 MSMEs and support 50,000 households, creating or preserving more than 89,000 jobs.

The UK also aims to improve access to basic services for over 200,000 people across sectors, from local artisans to farmers, by lowering borrowing costs.

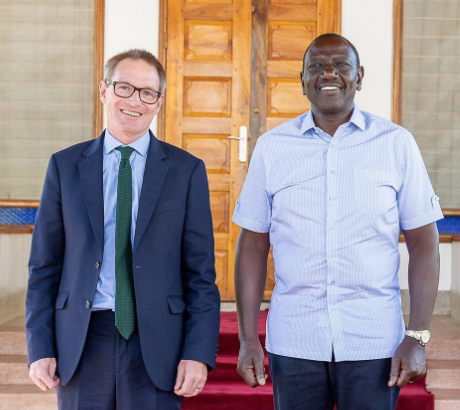

British High Commissioner to Kenya, Neil Wigan, emphasised the UK's commitment to lowering borrowing costs and creating economic opportunities, especially for marginalised groups.

"This fund strengthens the UK’s support for job creation and economic growth in Kenya. It will deliver for the hardworking hustlers of this country especially women, young people, and persons with disabilities who often struggle in the economy’s margins," Wigan said.

This initiative underlines the strategic partnership between the UK and Kenya, focusing on long-term growth and development.

FSD Africa CEO Mark Napier praised the initiative’s potential for transforming Kenya's economy.

“The SME sector is pivotal to Kenya’s socio-economic development, comprising nearly all businesses and generating many jobs. FSD Africa is thrilled to launch this fund to empower MSMEs with affordable credit, helping them overcome financing obstacles,” Napier said.

Wigan said SMEs are crucial to Kenya’s economic growth as they account for 98 per cent of businesses and about 24 per cent of Kenya’s Gross Domestic Product.

He went further to say that the fund will drive cross-border growth for Kenyan MSMEs and contribute to employment and economic expansion.

Currently, Kenyan SMEs face borrowing rates as high as 40 per cent, which restricts growth.

By offering an attractive, lower-risk investment for domestic investors, this fund aims to draw capital from Kenyan institutional investors, including pension funds, which currently have limited participation in alternative assets.

This initiative aligns with FSD Africa's mission to enhance and diversify capital markets, ultimately creating a sustainable path for economic progress in Kenya.