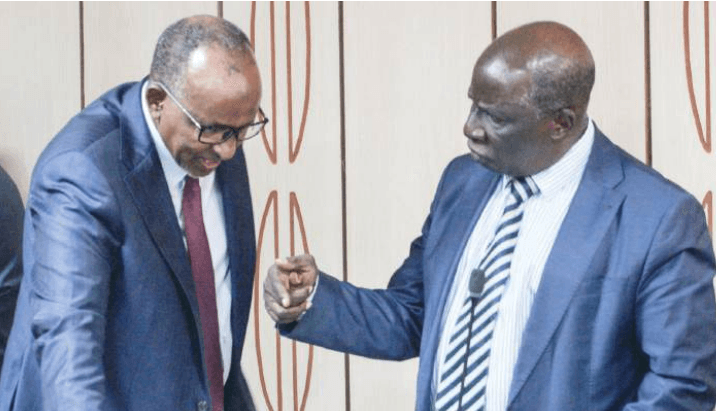

Kenya will host International Monetary Fund’s Deputy

Managing Director Nigel Clarke in December as the government explores options

of managing her ballooning debt burden.

Kenya is currently dealing with a complex balancing act between meeting pressing

spending needs and boosting domestic revenues from an increasingly despondent

public.

IMF Director of the Communications Department Julie Kozack said

Clarke’s visit will touch on ongoing talks regarding Kenya’s desire to borrow

more in efforts to bridge revenue deficit in the face of constrained revenue

base.

"During his visit, DMD Clarke will meet with the authorities and other key stakeholders, and we'll provide more updates on this trip as they become available,” Kozack said.

She said Clarke will travel to Nairobi on December 9 for a two-day engagement as part of ongoing engagements with Kenya.

Kozack confirmed that Kenya is in talks with the UEA over a

loan facility of about $1.5 billion but added that "we're not going to comment

on the specific discussions that the authorities are having with their

bilateral creditors".

She, however, revealed that currently, Kenya has a high risk of debt distress and any borrowing should be carefully thought out.

Kenya is grappling with a Sh10.6 trillion public date as of

July, 2024, comprising domestic debt stock was Sh5.41 trillion as of the end of

June 2024,

The country’s total debt service obligation for the 2024-25

financial year is Sh1.85 trillion.

To safeguard against unstrategic borrowing that might plunge

the country into debt distress, IMF has conditioned Kenya’s borrowing on

several conditions, including increasing tax revenues, reducing subsidies and

cutting government wastage.

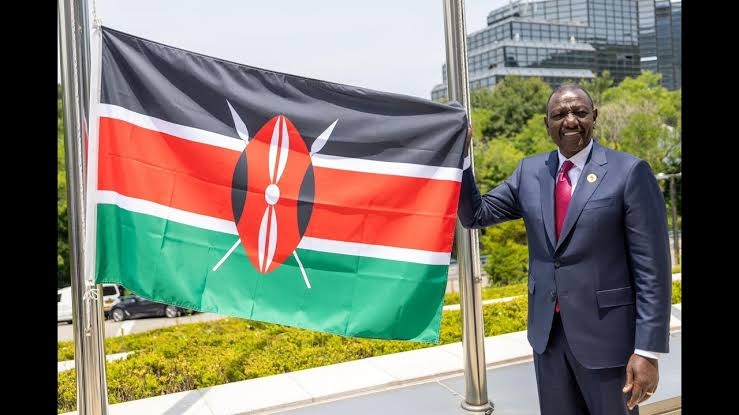

President William Ruto has in recent months effected some of

the measures, including introducing austerity measures in ministries, merging

nonperforming corporations and introducing new tax measures to boost domestic

revenue collection.

However, the President suffered a blow after widespread street protests forced him to withdraw the unpopular Finance Bill, 2024, which sought to introduce new taxes projected to raise Sh340 billion to finance his Sh3.9 trillion budget.

Total 2024-25 expenditure is projected at Sh3,920.7

billion, which comprise Sh2,781.7 billion recurrent and Sh687.9 billion

development.

To finance the above budget, total revenue collection, including grants, is Sh3.4 trillion, with the deficit of Sh597 billion expected to be financed by domestic and external borrowing.