As the new NSSF rates come into effect, both employer and employee contributions will increase, resulting in reduced take-home pay for salaried Kenyans.

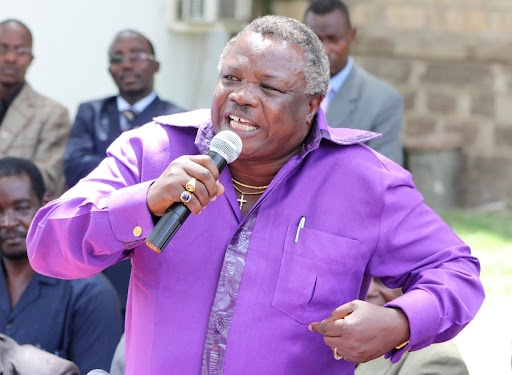

Amid public uproar over the changes, COTU Secretary-General Francis Atwoli reaffirmed that the deductions are not only necessary but also crucial for ensuring workers' financial security in retirement.

"As the voice of Kenyan workers, we affirm that the full implementation of this Act is essential for securing workers' financial futures," Atwoli stated.

He emphasized that NSSF is not a tax but a structured, mandatory savings scheme designed to help workers retire with dignity.

"Unfortunately, many of those politicizing NSSF contributions enjoy superior pension benefits or have assured income streams through their business ventures," Atwoli said on Tuesday.

"Any attempts to misrepresent or politicize the revised NSSF rates—legally enacted in 2013—only serve to mislead the public, hinder compliance, and jeopardize workers' long-term financial security."

The COTU boss stressed that social security is a fundamental human right meant to protect individuals from uncertainties such as old-age poverty.

He cited International Labour Organization (ILO) Convention

No. 102 (1952), which sets global minimum standards for social security, and

Kenya’s Constitution (2010), which explicitly guarantees every citizen the

right to pension and social security under Article 43.

"It is, therefore, the responsibility of the government, employers, and all stakeholders to uphold and strengthen social security measures, including NSSF," he said.

"At COTU (K), we firmly believe that anyone who genuinely cares about workers should fully support NSSF’s mission to eliminate old-age poverty by ensuring that every Kenyan saves for retirement."

Atwoli highlighted that a well-structured pension system provides both a lump sum payout and a monthly pension, allowing retirees to maintain a decent standard of living.

"The ILO recommends that retirees receive at least 40-60% of their pre-retirement income, underscoring the need to strengthen NSSF as a mandatory savings scheme," he added.

COTU urged Kenyan workers to disregard anyone opposing the

full implementation of the NSSF Act (2013), warning that such opposition threatens

their retirement security.

"Kenyan workers must recognize that true allies are those advocating for a better future, particularly their social protection after retirement," COTU stated.

Atwoli also noted that Kenya lags behind its East African

Community (EAC) counterparts in social security contributions.

He pointed out that while Kenya’s NSSF rates are set at 12%

(6% employer, 6% employee), Uganda mandates a 15% contribution (10% employer,

5% employee), and Tanzania requires an even higher rate of 20% (10% employer,

10% employee).