The government is exploring the possibility of listing – through an Initial Public Offering - the Kenya Pipeline Company (KPC) at the Nairobi Stock Exchange, National Treasury Cabinet Secretary John Mbadi has said.

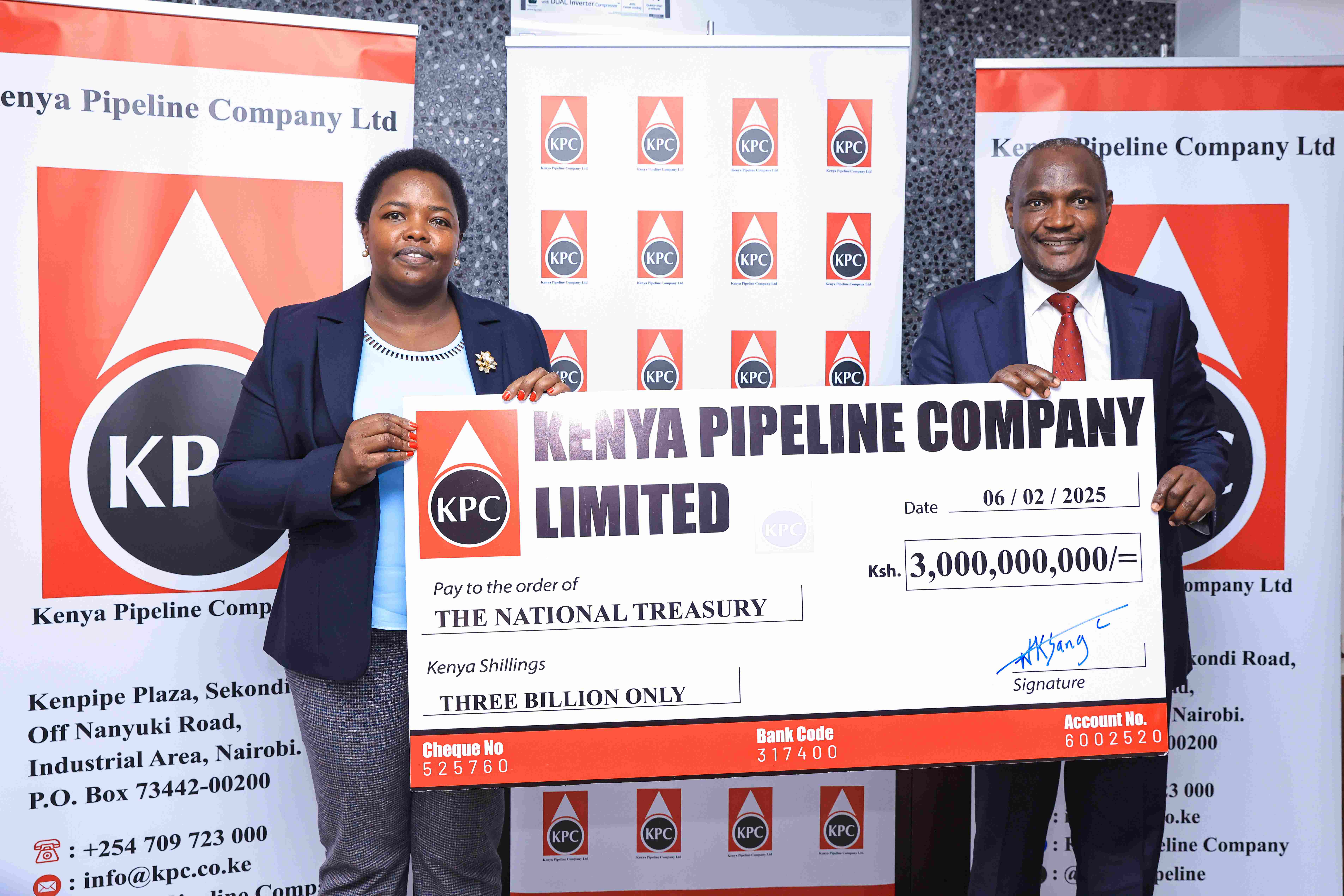

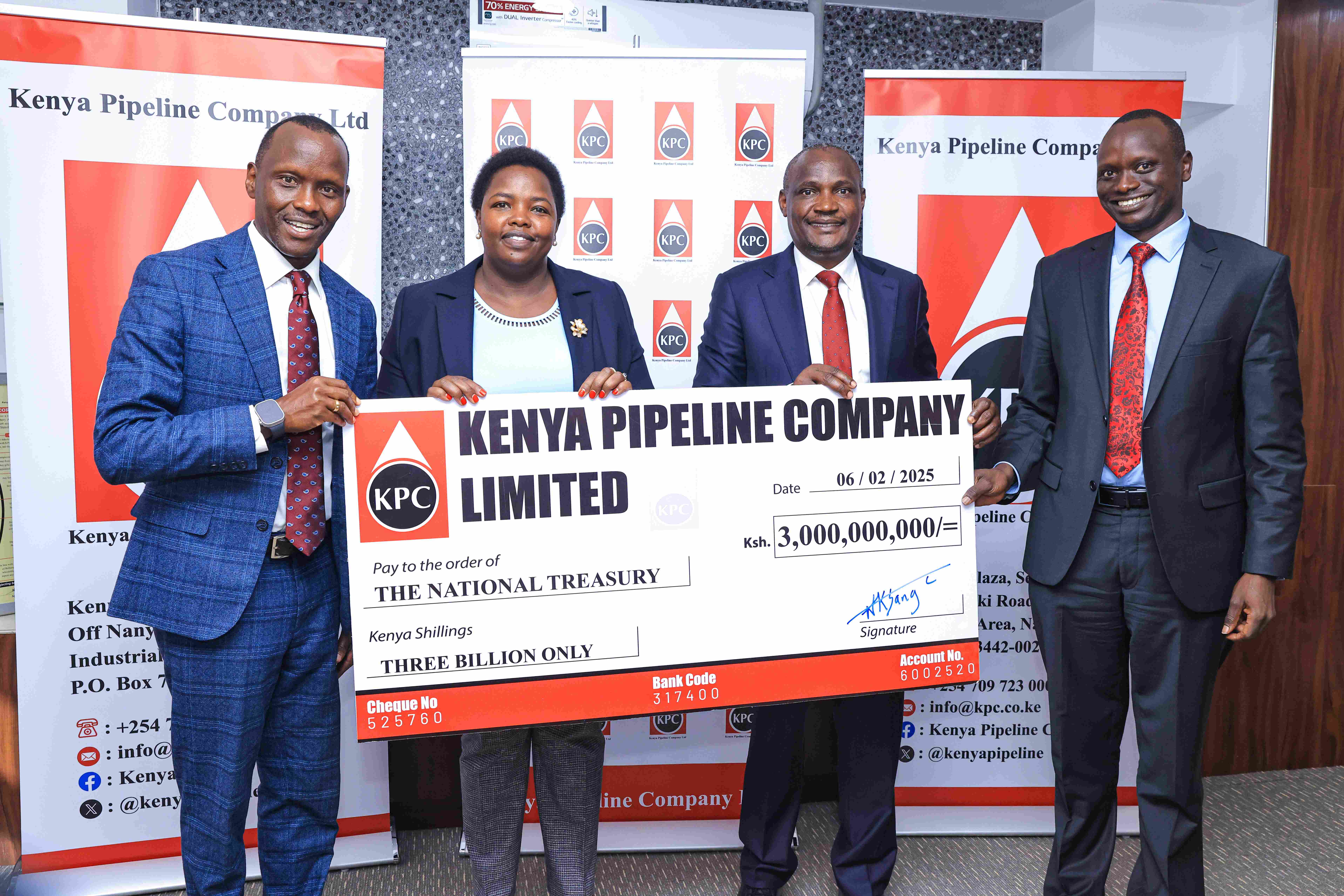

He said this while receiving an interim dividend cheque of Sh3 billion from KPC Board Chair Faith Boinett for the half-year ending December 2024 at the Company’s headquarters in Nairobi.

The dividend payment brings the total dividends paid by KPC to the National Treasury in the last 12 months, to Sh10.5 billion.

“We have this feeling that KPC needs to realise the benefits that will accrue from a listing at the Stock Exchange.” said the CS as he cited Safaricom and KenGen as among the corporates that have reaped huge benefits from listing at the Nairobi Stock Exchange.

“Listing will be a good idea especially as KPC expands into the region because it will provide much-needed liquidity and capital for expansion and diversification into LPG, Kenyans will have a chance to own a piece of KPC.”

As part of its business growth plans and diversification of business streams, KPC is mooting the establishment of a trading hub for receipt, trading and distribution of petroleum and petroleum products in Mombasa which will be a boost to the regional oil and gas industry.

The CS also noted that the National Treasury would support plans to wind down Kenya Petroleum Refinery (KPRL) and onboarding it into KPC.

He said the dissolution of KPRL had taken long unnecessarily and said the National Treasury would work with the Ministry of Energy to effect the transition, smoothly within this financial year.

Lawrence Kibet, the Director General, Public Investments and Portfolio Management said the Government Owned Enterprises (GOE) Bill 2024 had been passed by the Cabinet and was being reviewed by the Attorney General.

The Bill among others spells the “commercial principles and the procedure for establishing a Government Owned Enterprise” and establishes the governance structures.

Kibet said the Bill aims to ensure that the public gets a worthy ROI (Return On Investment) from public-owned institutions by granting them autonomy to State firms, rid them of needless redtape and bureaucracy thereby afford them a competitive edge in the marketplace while weaning them of State funding.

Mbadi congratulated the KPC Board and Management for a stellar financial performance for the year ended June 2024.

Speaking on KPC's financial performance, the CS noted that “Recording a Sh10.5 billion profit is no small feat. It speaks volumes about the company's operational efficiency, sound management, and dedication to delivering value to its stakeholders”.

“Today, as I receive this dividends cheque of Sh 3 billion from the KPC Board, I am reminded of the critical role State corporations play in driving our economic growth and supporting national development goals," he said.

"I would like to emphasize that such achievements must be anchored on robust corporate governance structures. Strong governance is essential for ensuring transparency, accountability, and sustainable financial performance. I urge all State corporations to tighten their corporate governance frameworks to not only enhance their profitability but also safeguard public resources and build stakeholder confidence."

Mbadi said the National Treasury remains committed to supporting KPC and other State corporations in their efforts to contribute meaningfully to Kenya’s fiscal sustainability and economic prosperity.

KPC has paid a total of Sh63 billion in tax and dividends over the last 10 years.

In 2023-24, KPC posted a Sh10.1 billion Profit Before Tax (PBT) an increase from the Sh7.6 billion recorded the prior year.

Boinett said KPC’s strong financial performance is anchored on efficient operations and diversification into new revenue streams such as Fiber Optic Cables (FOC) and LPG.

“KPC remains steadfast in its commitment to regional competitiveness. We are proud to hold a 90 per cent stake in fuel transportation to Uganda and are on the brink of securing a similar share in Rwanda," he said.

"This demonstrates our strategic efforts to cement our leadership in the regional energy and logistics sector. I extend our gratitude to the National Treasury for their efficiency and collaboration, which have been instrumental in driving KPC’s success.”

Also present at the ceremony was Joe Sang, the Managing Director, KPC, KPC Board Members and senior management.

KPC received its audited results in November 2024 with a clean audit opinion.

This is a testament to the company’s robust business processes and operations and a culture of transparency and accountability.

The business has grown and the focus for the future indicates that things are looking up. This is an assurance of financial stability despite the volatile operating environment.

The change of operating philosophy has increased the flow rate on the Mombasa – Nairobi and Nairobi – Western Kenya lines by 37 per cent and 20 per cent respectively, without additional CAPEX.

To ensure continued supply of products in the country and the region, the business has optimized the Kisumu Oil Jetty (KOJ). As a result, more than 320 million litres have been loaded to date.

In operation, the pipeline takes out about 22,100 trucks off the road from Mombasa to Nairobi monthly equating to about 4,479,493.2 tCO2 annual emission offset.

To further demonstrate its commitment to conservation credentials and dedication to environmental sustainability and responsible business operations, KPC has engaged in various greening initiatives.

Since 2017, KPC, in partnership with various organizations, has planted approximately 600,000 tree seedlings across the country.

Notably, KPC’s mangrove reforestation programme at Jomvu Kuu Creek in Mombasa County, in collaboration with Community Forest Associations, the Kenya Forest Service, and the Mombasa County Government, has seen over 440,000 seedlings planted.

The gazettement of Morendat Institute of Oil and Gas as a National Polytechnic not only enhances our petroleum and gas sectors, it also plays a crucial role as the region’s centre of excellence on matters oil and gas.

Additionally, KPC is lighting its extensive fibre optic network, a strategic move aimed at enhancing revenue and promoting sustainability.

The business aims to tap into the growing demand for data and high-speed internet, providing reliable connectivity to various sectors.

This initiative aligns with Kenya's Vision 2030; supporting digital transformation, fostering economic growth, and bridging the digital divide, particularly in areas lacking internet.

![[PHOTOS] Kindiki inspects works at regional centre in Kwale](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F04%2Fc68aa00b-39bc-4214-bafe-80e8e38b1e60.jpg&w=3840&q=100)